A new tranche of heavily redacted Jeffrey Epstein files has reopened an uncomfortable chapter in crypto history.

Emails attributed to Epstein claim he discussed Sharia-compliant with unnamed Bitcoin founders in 2016, who he said were “very excited.” The assertion is self-reported and unverified.

Yet, Epstein’s personal logs list “satoshi (bitcoin)” as a guest for a UN Climate Week event, alongside heavyweights like Larry Summers and Peter Thiel.

The Timing is Terrifying:

As many as three of five Bitcoin core devs were in contact with Epstein since at least 2015. Here’s who else might be corrupted in crypto:

DISCOVER:

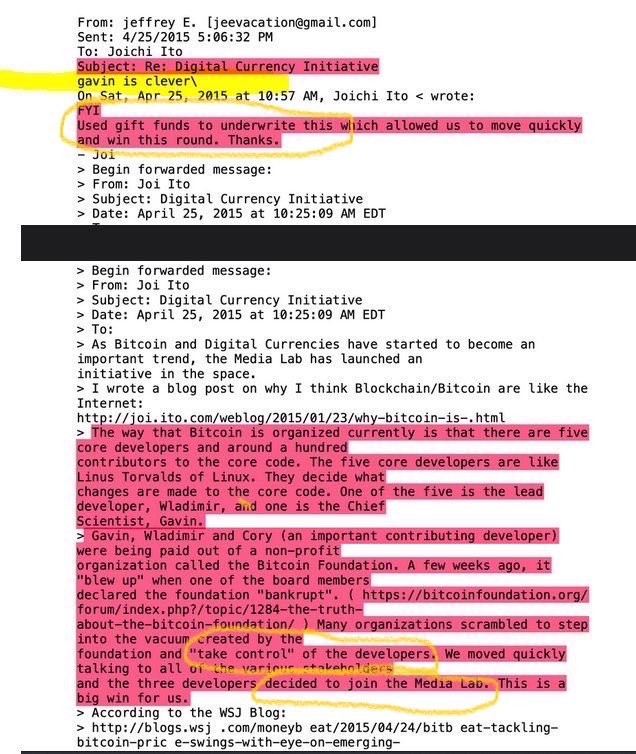

Records show Epstein seeded Blockstream with roughly $500,000 in 2014 via MIT Media Lab director Joi Ito, and later financed Bitcoin Core development during a funding crisis that same year, including support for Gavin Andresen.

But he is also responsible for supporting in its early days.

BREAKING: Jeffrey Epstein invested $3 million in Coinbase in 2014 at a $400 million valuation, emails show. Fred Ehrsam was aware, and the deal was arranged by Brock Pierce and Blockchain Capital.

— SwanDesk (@SwanDesk)

Emails show Epstein invested $3 Mn into Coinbase’s Series C in December 2014 at a $400 Mn valuation, via IGO Company LLC. The same documents indicate Fred Ehrsam was aware the investment was being made on Epstein’s behalf.

“I have a gap between noon and 3pm today… would be nice to meet him if convenient.” – Fred Ehrsam, Coinbase co-founder, email released by DOJ

That $3 Mn stake would be worth orders of magnitude more today. Coinbase now carries a market capitalization near $51 Bn.

DISCOVER:

Separate emails reference Michael Saylor, detailing a $25,000 charity donation that placed him inside Epstein’s social orbit.

The correspondence underscores how Epstein functioned less as an investor and more as a connective hub, leveraging money and access across business, academia, and government. There is no evidence Saylor invested alongside Epstein or coordinated crypto activity with him.

Michael Saylor got cooked by Epstein’s publicist Peggy Siegel who basically said

“He’s so creepy I don’t even know if I can take his money I don’t even know how to blackmail him he has no personality and doesn’t understand social behavior.”

Michael Saylor was saved by his…

— Autism Capital

(@AutismCapital)

Bitcoin hit $78,000 in February 2026 and retail interest is dead. No new buyers, no momentum, just institutional money with $1.7 Bn into US ETFs while 106 million people worldwide hold BTC.

The realization is that institutions are loading up while retail does not care. History suggests this changes when necessity kicks in, not enthusiasm.

DISCOVER:

Importantly, the documents matter for transparency, not price discovery. Who’s corrupted? Who’s not?

Watch for additional unredacted releases clarifying the extent of early funding relationships. And for how exchanges handle historical disclosures amid stricter compliance regimes.

Early crypto capital came from everywhere, and sunlight, however late, is still necessary.

EXPLORE:

Follow 99Bitcoins on For the Latest Market Updates and Subscribe on For Daily Expert Market Analysis

The post appeared first on .