Fundstrat co-founder Tom Lee said gold’s explosive 2025 rally is pulling investor attention away from Bitcoin and Ethereum. The comment landed as gold pushed above $2,800 per ounce while Bitcoin and Ethereum chopped sideways after months of ETF hype. Zoom out, and this fits a familiar pattern: when fear rises, money parks in assets that feel boring but safe.

For everyday investors, this explains why crypto prices feel stuck even with big-name firms offering ETFs. Capital has not vanished. It has moved.

DISCOVER:

Gold acts like a financial bunker. When inflation stays sticky or wars dominate headlines, investors buy gold because it has held value for thousands of years. That instinct kicked in hard this year, with gold ETFs pulling in more than $10 billion in the first half of 2025.

GOLD JUST NEW HIT ALL TIME HIGH OF $5,150

— Ash Crypto (@AshCrypto)

Bitcoin often gets called “digital gold,” but it still trades like a risk asset in tense moments. When fear spikes, large funds trim crypto first and add gold. That shift helps explain why has lined up with Bitcoin struggling to gain traction.

Tom Lee co-founded Fundstrat Global Advisors and built a reputation for calling Bitcoin’s 2021 bull run early. He also backed the idea that spot Bitcoin ETFs would get approved, long before regulators agreed. Personally, though, I don’t listen to him as he sometimes gives unrealistic targets.

Tom Lee was way wrong about price.

in Interview w/ He said $7000-$9000 by end of January 2026.

Current @ ~$2900 (He was off by $4000-$6000)

— Dhaval (@iDhavalDP)

Though that track record gives his macro views weight. When Lee says gold is “sucking the oxygen out of the room,” he means big institutions have limited cash. They choose one trade at a time.

DISCOVER:

In the short term, gold’s strength can cap crypto upside. Money sitting in gold ETFs is money not chasing Bitcoin or Ethereum breakouts. That pressure shows up as slow price action and sharp pullbacks on bad news.

Longer term, the picture looks different. Bitcoin and Ethereum now sit inside regulated ETFs from firms like BlackRock and Fidelity. The launch of products such as the made crypto easier to buy than ever, even after Ethereum’s Shanghai upgrade unlocked staked coins.

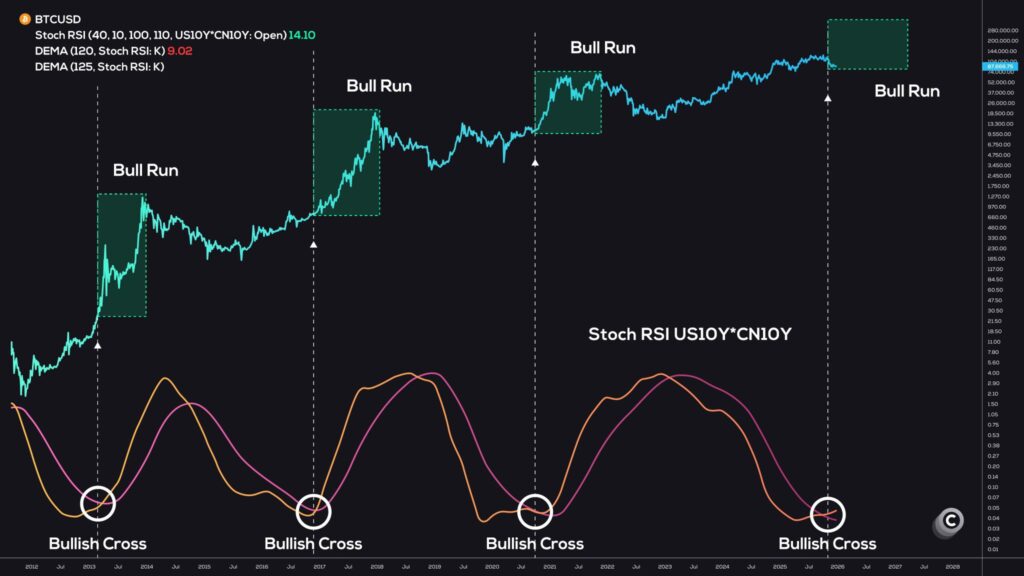

This setup matters. When fear cools, capital often rotates back into assets with higher upside. That rotation fueled past crypto rallies after gold-led risk-off phases.

(Source: BTCUSD / )

Gold winning today does not mean Bitcoin failed. It means investors want stability right now. Crypto still swings harder, and that volatility cuts both ways.

DISCOVER:

Follow For the Latest Market Updates and For Daily Expert Market Analysis

The post appeared first on .