Bitcoin reportedly slid deeper into the red this week as examined how far this pullback can realistically go. BTC struggled to defend the mid-$80,000s as sellers stayed active and buyers hesitated. This drop sits within a broader story of post-halving volatility, rising regulatory pressure, and Wall Street’s growing influence.

DISCOVER:

In simple terms, Bitcoin is going through a digestion phase. After strong ETF-driven inflows in 2024, price moved faster than long-term demand could comfortably support.

BREAKING: Kalshi traders forecast Bitcoin to drop as low as $64,000 this year

— Kalshi Ecosystem (@KalshiEco)

Forbes points to prior cycle behavior. After each Bitcoin halving, price swings grow wider before the next sustained move. Think of it like a crowded escalator that suddenly stops. People don’t fall because Bitcoin broke. They fall because momentum vanished.

This helps explain why we keep seeing sharp dips like . When buyers step back, price drops faster than beginners expect.

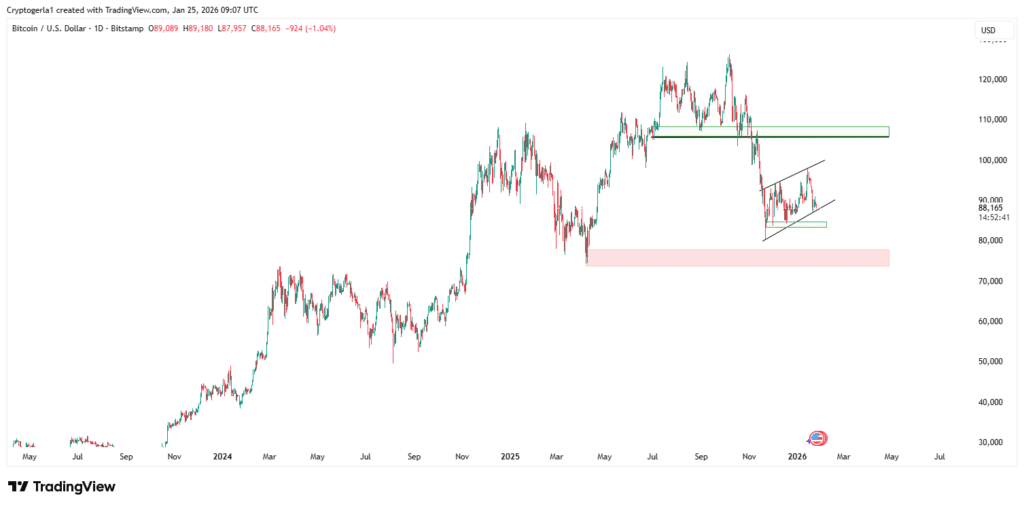

Forbes highlights prior support zones between $72,000 and $78,000. Support means a price area where buyers previously stepped in. Picture it like a floor that has held weight before.

(Source: BTCUSD / )

If Bitcoin slips below that range, fear accelerates. That is why some analysts echo . These levels matter because leveraged traders get forced out fast.

Derivatives activity adds fuel. Bitcoin and Ether futures and options once cleared $3 billion per day in notional volume, showing how much short-term betting amplifies moves. When prices fall, forced selling kicks in.

DISCOVER:

Spot Bitcoin ETFs from BlackRock, Fidelity, and Grayscale changed who controls the flow. ETFs make buying Bitcoin feel like buying a stock. That invites retirement money, but also panic selling during drawdowns.

(Source: Recent Bitcoin etf net flow / )

At the same time, regulators are tightening the screws. With 93% of central banks developing digital currencies, governments want control. That pressure explains why Bitcoin reacts sharply to policy headlines.

Ethereum’s past upgrades, like unstaking after Shanghai, showed how unlock events can move markets. Bitcoin does not unlock supply, but ETF flows act in a similar way. Money in lifts price. Money out hurts fast.

DISCOVER:

Follow For the Latest Market Updates and For Daily Expert Market Analysis

The post appeared first on .