XRP just blew past its 2018 high, hitting $3.70 as daily transaction volume on the surged 50% to $1.4 billion. This is a full ecosystem breakout. Activity across the XRPL is accelerating at a record pace, drawing fresh attention from both institutions and retail traders.

Can XRP this year? Here’s our prediction below:

“We’re witnessing an unprecedented spike in XRPL activity, marking renewed confidence from both the developer ecosystem and institutional players.” – David Schwartz, CTO at Ripple

DISCOVER:

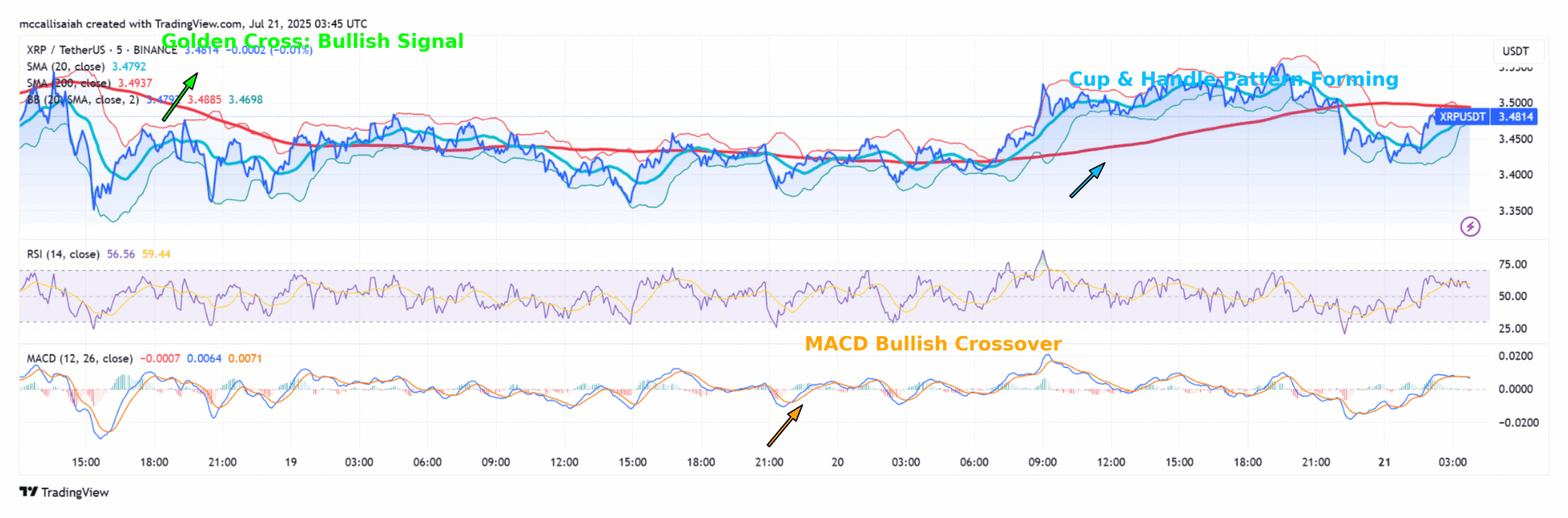

Open interest in XRP derivatives is climbing alongside spot activity. We’ve got a textbook on the chart: the 20-day SMA has just crossed above the 200-day SMA, signaling bullish momentum.

That’s already attracting short-term attention and could signal a broader trend reversal if volume follows through.

With the MACD and signal line now both above zero, XRP has locked in a bullish crossover that strengthens the case for continued upside. On the policy front, the token’s perceived acceptability in Washington could give it the kind of regulatory breathing room other projects lack.

JUST IN:

White House to release its first crypto policy report this week on July 22 as required by EO 14178.

Bullish

— Amonyx (@amonbuy)

Most importantly, we’re seeing what looks like a cup and handle pattern forming. If XRP can break above the $3.52 level with strong volume, that would likely confirm the breakout.

Key support levels to watch:

$3.44: Local support near Bollinger Band midline

$3.35: Handle bottom and psychological level

$3.28: 200-day SMA, strong longer-term base

DISCOVER:

XRP is currently hovering around $3.54, just shy of its $3.66 all-time high. If it maintains support above $3.38, a retest—and potential break—of those highs is likely.

Meanwhile, XRP dominance () is approaching 5.75%, a key resistance level untouched in over 2,200 days. If this level is cleared, XRP could be poised for explosive price action toward the $7–$10 range, according to multiple 99Bitcoins analysts.

XRP is flashing all the classic signs of a top-performing altcoin entering the next bullish phase: high transaction activity, surging price, rising derivatives interest, , and institutional ETF rumors. That said, warning signs from new wallet data and HODLer behavior suggest a short-term pullback or consolidation could be next.

Watch the 0.038 BTC resistance on the XRP/BTC chart and the 5.75% mark on XRP.D for the next signal. If history repeats, XRP’s biggest run might still be ahead.

EXPLORE:

The post appeared first on .