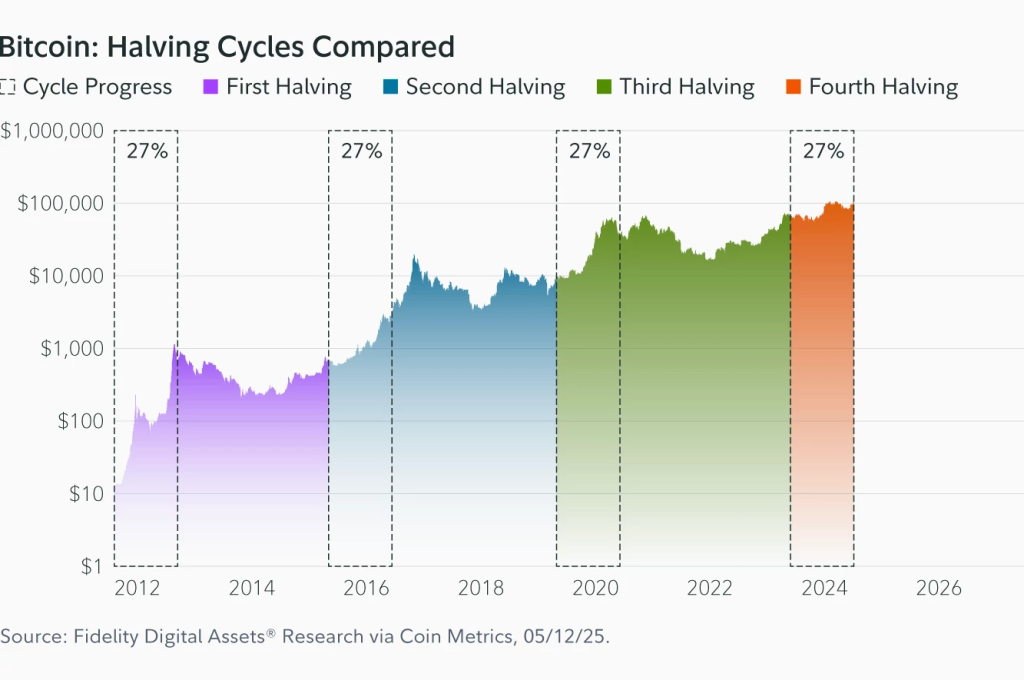

Fidelity Digital Assets chose a single post on X to frame its latest research note: “Bitcoin is up ~63 % from its 2024 halving price with 27 % of this halving epoch completed. While past epochs saw triple-digit rallies, a new story may be unfolding: one of rising maturity, deeper adoption, and network resilience.” The tweet landed minutes after the firm released “2024 Bitcoin Halving: One Year Later,” by senior analyst Daniel Gray, who contends that the apparent lull in price action masks “a strengthening foundation.”

“Bitcoin presents a nuanced narrative a year after its fourth halving, with signs pointing toward consolidation, network resilience, and growing institutional adoption,” Gray writes, adding that structural indicators “suggest a strengthening foundation.”

While previous cycles delivered triple- and even quadruple-digit percentage gains by this stage, Gray argues the softer trajectory signals maturation: “History suggests that we would be well into the bull run at this point in the fifth epoch — but this cycle may be unfolding more cautiously.”

From a market-share perspective the data are unequivocal. “Bitcoin’s market dominance excluding stablecoins has risen to just over 72.4% as of 11 May, a new eight-year high,” Gray notes, pointing out that Ether and Solana have surrendered ground even as “fragmentation on the long tail of assets has failed to produce a clear alternative leader.”

On-chain security metrics tell a similar story: “Bitcoin’s daily rose above one zetta hash per second twice in April, reflecting continued investment in mining infrastructure despite a 60 percent collapse in hash price since the halving,” he observes.

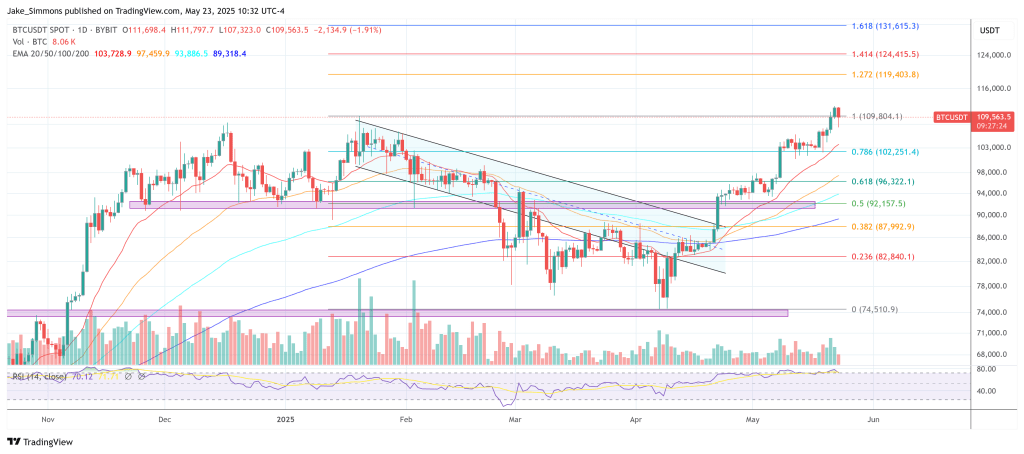

Spot-market behaviour has begun to echo those fundamentals. Bitcoin printed a record intraday high of $109,486 on 21 May before extending above $111,000 on so-called , holding near $110,600 at press time.

The move has been underwritten by renewed demand from US spot ETFs, which drew $934.8 million of net subscriptions yesterday, May 22— the heaviest single-day haul in almost four weeks. Derivatives activity mirrors the trend: aggregate futures reached a record $80 billion on May 23, up roughly 30% since the start of the month, according to CoinGlass data.

Meanwhile, funding rates in most crypto exchanges are at the baseline or below it. “This is the least euphoric new all-time highs in the history of Bitcoin,” crypto analyst Alex Krüger (@krugermacro) via X.

Gray cautions that investors should focus less on headline returns and more on the architecture taking shape beneath them. “Although returns have been more measured compared to previous cycles, structural metrics suggest a strengthening foundation. Overall, it appears Bitcoin is potentially maturing—something investors may find more notable than short-term price movement,” he writes.

His closing assessment is blunt: “One year post-halving, Bitcoin’s price performance may seem muted, but its fundamentals appear stronger than ever … this may be a cycle that redefines Bitcoin’s role in a modern portfolio.”

In other words, Fidelity’s message for would-be spectators is as clear as its headline: do not blink.

At press time, BTC traded at $109,563.