Charles Schwab plans, the latest twist in US-China trade talks, and the surge tied to the Ethereum Fusaka upgrade all hit the crypto market at the same time today, and the overlap is bullish. These three themes keep showing up today because they’re likely driving most of the movement we’re seeing right now.

Fusaka has been the biggest catalyst for Ethereum this week. ETH punched through $3,200 after a fast 4% climb, and the upgrade is now getting credit for the bump. Ethereum Fusaka expanded blob capacity sharply through ; users are already seeing cheaper L2 activity and smoother network performance.

It’s the first time in months we feel that improvements are translating into actual price action, and Fusaka, or any Ethereum upgrade, seems to be giving the market a narrative it can stick to, as usual.

There’s also the massive $5.8 billion in short positions hanging over the Ethereum chart. If ETH tags $3,500, these shorts get squeezed, and probably violently. After reclaiming $3,100, the technicals lean bullish. People can see in the chart that the pressure is building.

(source – )

Bitcoin, on the other hand, is basically parked between $92,000 and $94,000 after an upward move earlier in the week. The 50-week EMA still acts as support, which is exactly what we want for a move higher. Bitcoin’s volume patterns are still in a consolidation mode, despite the move.

If BTC finally breaks above $94,000 with conviction, the path to $100,000 opens up quickly, and we might see it soon, hopefully.

(source – )

The Charles Schwab move, which is aimed to start next year, might be one of the biggest institutional headlines for crypto of the month. Once Charles Schwab starts its crypto access, it puts one of the largest US brokerages directly in competition with Coinbase.

With more than $12 trillion under management, this Charles Schwab crypto integration could drag a lot of hesitant traditional investors into the space, whether they planned on entering or not.

JUST IN: $12 trillion Charles Schwab says it will offer Bitcoin & Ethereum trading in early 2026.

— Watcher.Guru (@WatcherGuru)

Institutional behavior is shifting elsewhere, too. Tom Lee’s BitMine scooped up another $265 million in ETH last week, lifting holdings beyond 3.7 million ETH. And BlackRock CEO Larry Fink now openly admits he was wrong about crypto. He says Bitcoin and digital assets are being adopted faster than the early internet, and BlackRock’s ETF flows support the claim.

I have very strong views, but that doesn’t mean I’m not wrong. But by having strong views, you have to test yourself and ask yourself. You know, in my role, I see thousands of clients a year… governmental leaders. And we had these conversations that my thought process always evolves. This is a very glaring, public example of a big shift in my opinions. – Larry Fink, answering Andrew Ross’s question about his views of Bitcoin and crypto.

DISCOVER:

Regulation is also moving faster. SEC Chair Paul Atkins said the agency doesn’t need extra authority from Congress to keep building crypto rules and expects to roll out an “innovation exemption” within a month, something crypto builders have been asking for.

The US-China trade situation eased slightly as Washington chose not to sanction Beijing’s security ministry, maintaining a fragile truce. The quieter US-China trade backdrop helped risk markets stabilize, which is bullish for crypto.

US halted plans to sanction Chinese spy agency to maintain trade truce, FT says

— The Straits Times (@straits_times)

With Ethereum Fusaka still pushing ETH upward and Charles Schwab plans enforcing a deeper shift in adoption, the crypto market enters December with more strength than many expected, especially with the help of a rare moment of calm in US-China trade relations.

DISCOVER:

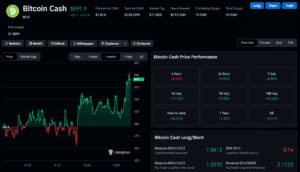

Bitcoin Cash (BCH) is having a moment. In the last 24 hours, BCH saw its price action go vertical, pumping from $580 to breach the $600 level, approaching its one-year high. However, it could not maintain its momentum above $600, and its price has since then come down to $592. The move followed Bitcoin’s push towards $94,000, which made investors across the crypto space more confident.

Even with the overall crypto market sentiment improving, investors are holding off from parking all their funds in privacy coins. They picked out assets with stronger momentum, better liquidity, and a clearer narrative, which, in this case, happened to be . A quick look at CoinGlass’s data reveals that BCH is trading in the green across the majority of the timeframes.

(Source: )

It is up by +8.80% in the weekly charts and by +17.12% on the monthly charts, with its YTD (Year to Date) numbers sitting at an impressive +36.47% highlighting an accumulation trend that has been ongoing for weeks rather than a reaction to BTC’s recent rebound.

's hashrate has surpassed 2017 levels.

— CW (@CW8900)

One major reason for this momentum is Grayscale’s plan to turn its BTC Cash Trust into a spot ETF, for which the digital asset management company with the US Securities and Exchange Commission (SEC) on 9 September 2025. If approved, BCH could see more upside to its price action as more institutional investors park their funds in it.

Read the full story .

In Federal Reserve news, today, the long-running Trump-Powell tension is back at center stage as fresh FOMC clues hint at a potentially decisive December meeting. The mix of weaker labor readings, uneven PMI data, and a Fed shifting away from quantitative tightening has turned routine updates into political fuel.

LMFAO! President Trump is nuking Jerome Powell right now in the Cabinet meeting

"We have a guy that's a stubborn OX who probably doesn't like your president, your favorite president!"

"We have an incompetent Fed Chair, a real DOPE. Who should reduce rates!"

"Well be…

— Eric Daugherty (@EricLDaugh)

The Federal Reserve officially ended QT on December 1, and we can see the move as the first clear step toward a more accommodative stance, or something Trump has been demanding for years. This overlap between policy shifts and Trump-Powell criticism is noticeable, especially as markets now lean heavily toward a December rate cut.

Read the full story .

The market is going into frenzy once again as Ethena pumps and FTN explodes in a spectacular rebound rally, igniting a new wave of momentum across altcoins. After the sharp December correction, sentiment shifted almost overnight, with several high-beta tokens outperforming large caps by wide margins.

And while FTN is stealing the spotlight with a triple-digit surge, smart money is rotating into three other breakout plays. Analysts say those plays may deliver even more substantial upside into mid-December, driven by technical setups, aggressive accumulation, and strong community narratives.

Market Cap

Read the full story .

The return of Polymarket to the United States marks one of the most significant regulatory moments of late 2025. With crypto markets seeking new catalysts after months of volatility, the CFTC’s greenlight has opened the door to a prediction-market boom in the world’s largest financial economy.

After years of regulatory tension, Polymarket is finally rolling out its US-compliant platform – starting with sports events and soon expanding to politics, finance, crypto, and global risk markets. With more than $3 billion in monthly volume globally, the reopening positions Polymarket as one of the most influential on-chain platforms heading into 2026.

Read the full story .

The post appeared first on .