The crypto market opened December under heavy selling pressure. slipped below $86,000, touched $85,618 at the intraday low, and is now trading near $86,476, a decline of almost 5% on the day. The drop erased more than $200 billion from the total market valuation, bringing it back toward the $3 trillion level.

Altcoins moved in the same direction: fell 5.6% to $2,839, XRP dropped 6.6% to $2.05, Solana slid 6.8% to $127, while Dogecoin and Cardano declined 7.9% and 7.6% respectively. Stablecoins stayed anchored around $1.

Not everything was red, though. continued its erratic price action and climbed more than 20% in the past 24 hours, raising the question of whether it’s becoming one of the best crypto to buy as the broader market pulls back.

DISCOVER:

Compounding the issue was a global liquidity squeeze tied to Japan’s bond market. Yields on 10-year Japanese Government Bonds climbed to 1.84%, the highest since 2008, signaling the potential end of the yen carry trade. For years, investors borrowed cheaply in yen to fund purchases of high-yield assets like Bitcoin. Rising borrowing costs now force rapid unwinding, prompting sales across risk assets. The yen’s surge added to the pressure, as positions in equities and crypto were liquidated to cover exposures.

Japan sneezed at the open and crypto puked.

Arigatou gozaimashita

— Alex Krüger (@krugermacro)

Markets assigned an 87% probability to a Federal Reserve rate cut by December 10, per CME FedWatch, but delayed U.S. jobs and inflation reports bred doubt. The Nasdaq 100’s correlation with crypto stayed elevated at +0.85, linking digital assets to broader equity swings.

Ahead of the ISM Manufacturing PMI release today and September PCE inflation data on December 5, investors trimmed risk, reducing exposure to volatile holdings.

EXPLORE:

Geopolitical tensions provided another layer of caution. Reports highlighted escalating U.S. rhetoric toward Venezuela, with President Trump warning of imminent action against drug networks and declaring the country’s airspace off-limits.

An armada led by the USS Gerald R. Ford positioned in the Caribbean, while legal debates over strikes on trafficking vessels intensified congressional scrutiny. Trump’s Thanksgiving pardon offer to a jailed Honduran ex-president further muddied the narrative, raising fears of regional instability that could spill into oil markets and global sentiment.

Tell Me Venezuela isn’t about drugs without telling me Venezuela isn’t about drugs:

Trump pardons Former Honduran President Hernandez- who was convicted of drug trafficking (400 TONS of cocaine) and sentenced to the 45 years in the United States.

— Maine (@TheMaineWonk)

Despite the red day, not everything is bleeding.

EXPLORE:

(Source: )

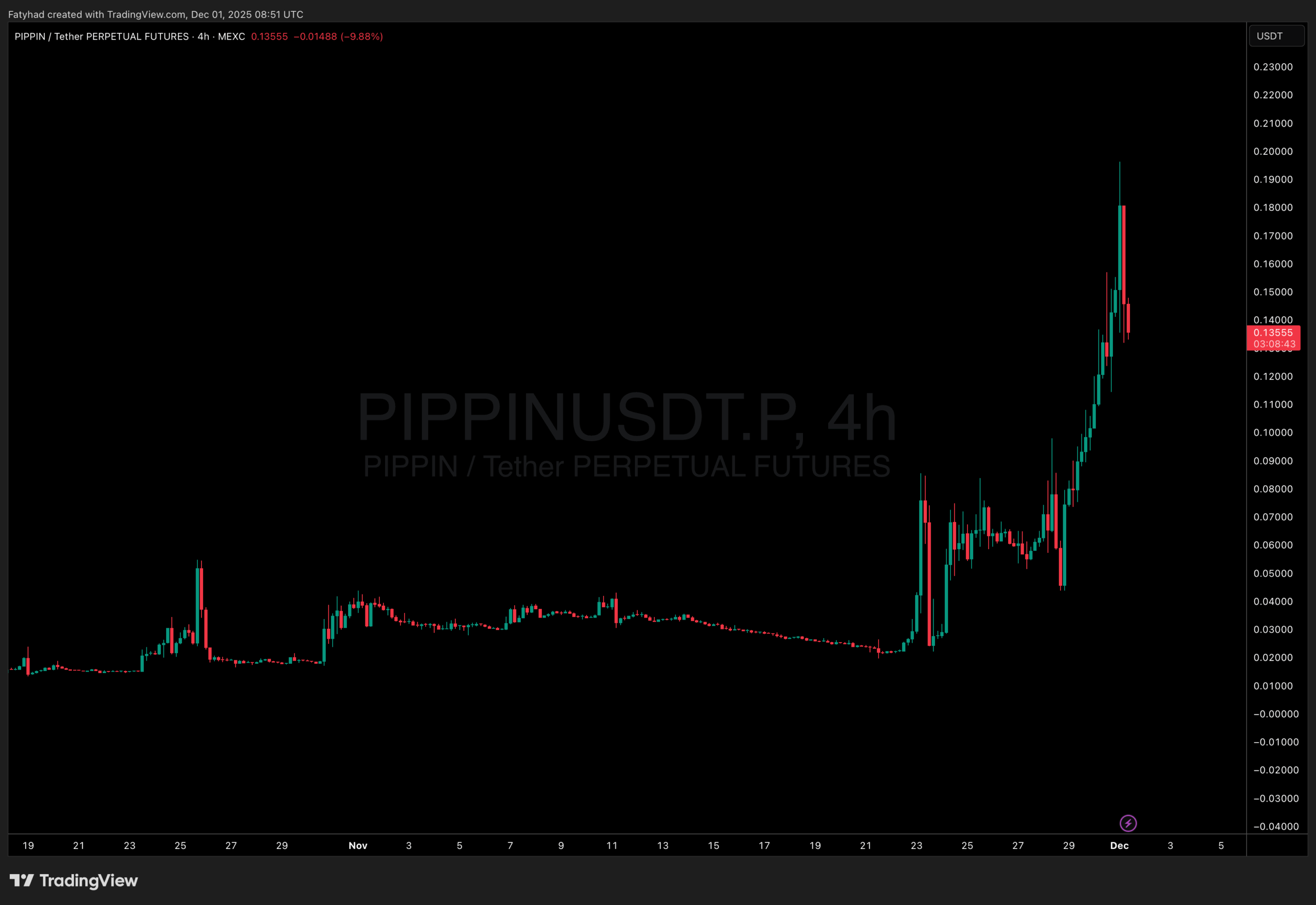

While almost every major coin is down 5–8%, the Solana-based AI-meme token PIPPIN is up +20.07% in the last 24 hours and currently trades at $0.1355. Over the past two weeks it has rallied more than 460%, pushing its market cap to around $124 million. Created by AI builder Yohei Nakajima, $PIPPIN combines meme appeal with on-chain AI agents and has seen heavy whale accumulation and $117 million in daily volume.

Fixed 1 billion token supply, strong community, and the broader AI narrative are keeping buyers active even as Bitcoin dumps. High-risk, high-reward play, but it’s one of the few green charts today.

Institutional inflows into Bitcoin ETFs continue, whales are accumulating BTC at lower levels, and many analysts see the current shake-out as a healthy flush of leverage before year-end.

Volatility is likely to stay elevated this week, but dips have historically been buying opportunities in bull cycles.

The question on every trader’s mind right now is simple: why did crypto crash while silver and gold launched into fresh territory? As Bitcoin price plunged from $92K range to the mid $80Ks, precious metals ripped to new all-time highs – triggering a wave of fear, forced liquidations, and talk of a looming recession. With Bitcoin experiencing a sharp decline and Silver printing levels not seen in modern history, markets are clearly shifting. But is this a structural rotation, a temporary panic, or a macro warning shot? Michael Saylor said that MicroStrategy’s potential inclusion in the S&P 500 is ultimately insignificant. He explained that Bitcoin and digital assets were once dismissed by rating agencies and regulators, with Basel rules even assigning Bitcoin a value of zero. Today, those same institutions are gradually accepting it. If Bitcoin is truly superior digital capital, Saylor argued, market forces will direct capital toward it regardless of short-term decisions by index managers, insurers, or banks. Those delays, he added, simply create larger opportunities for investors who recognize the trend early.

Silver Slams New ATH, Gold Fires Up as BTC Price Dumps: Why Did Crypto Crash? Is a Recession Here?

Michael Saylor: In the Long Run, S&P 500 Inclusion Doesn’t Really Matter

The post appeared first on .