What to Know:

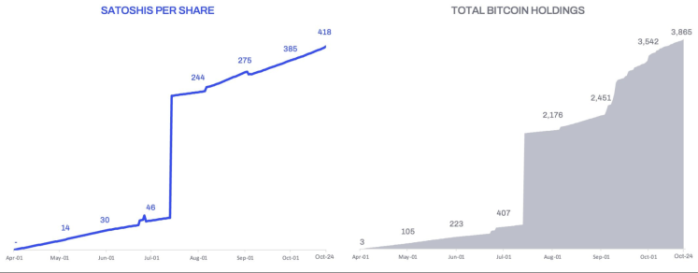

The Trump family has made another bold move in the corporate crypto world as the publicly listed treasury and mining firm American Bitcoin (ABTC) announced a 1,414 Bitcoin addition to its holdings.

That’s roughly $163M at current prices and brings $ABTC’s total stash to about 3,865 BTC – approximately $446M.

Backed by Donald Trump Jr and Eric Trump, American Bitcoin is the public-facing vehicle formed after a merger between Canadian miner Hut 8 Corp and Gryphon Digital Mining.

, American Bitcoin emphasized that its business model goes beyond simply buying $BTC; it also mines the cryptocurrency directly, which the company says gives it a cost advantage over peers that purely purchase from the market.

To drive the point home, ABTC relies on a metric called ‘Satoshis per share,’ or SPS. With 100M Satoshis per Bitcoin, ‘sats’ are the . By dividing the number of shares by the total number of sats in the Bitcoin it holds, ABTC can tell shareholders exactly how much $BTC their holdings represent.

Following the announcement, ABTC’s stock rose by more than , as the news resonated with investors hungry for exposure to public company-level crypto strategies.

Bitcoin is up by around 4.7% in the past week, and sits just under $115K, near a two-week high.

ABTC forms part of the growing push for crypto treasuries, and signals confidence in Bitcoin’s near-term trajectory. That trajectory bodes well for key altcoins as well. Even as ABTC amasses Bitcoin, tokens like , , and $WLFI are emerging as the .plans to introduce a next-gen Layer-2 ecosystem that will address Bitcoin’s biggest pain points – slow speeds, high costs, and smart-contract compatibility.

And the project will do this by merging Bitcoin’s monetary dominance with Solana’s high-performance virtual machine (SVM) environment.

The Hyper Layer-2 will use a Canonical Bridge architecture on the SVM that allows native $BTC to be minted, wrapped, and deployed across a fast, low-fee ecosystem. And with zero-knowledge proofs and final settlement on the original Bitcoin Layer-1, it will all be executed without compromising Bitcoin’s top-tier security model.

Bitcoin Hyper enables real-time payments, DeFi participation, and on-chain micro-transactions that unlock Bitcoin’s liquidity for practical utility.The project’s hybrid framework positions it as a natural upgrade to Bitcoin, capable of scaling transaction speeds from Bitcoin’s current seven transactions per second to multiple thousands, courtesy of the SVM. Meanwhile, its native token, $HYPER, will power validator staking, bridge operations, and ecosystem governance.

Discover more about this exciting Layer-2 project in our detailed.

Discover more about this exciting Layer-2 project in our detailed.

The combination of new utility and proven reliability bode well for $HYPER’s performance, which is why it’s no surprise that the Bitcoin Hyper surpassed the $25M milestone yesterday.

It’s also part of the reason shows that the token could potentially increase from its current price of $0.013185 to $0.08625 by the end of 2026 – for 554% gains. To get in now, check out our step-by-step .

Being a presale, though, its price rises in stages, while the staking APY decreases as more holders stake their tokens. With little over one day left before the next price increase – and staking APY currently at 47% – there’s no time like the present to join the presale at its early-bird price.

Ready to jump in?

deploys an innovative ‘mine-to-earn’ infrastructure play that transforms how meme coin culture and the blockchain intersect.

With a virtual server-room model, you’ll be able to use your $PEPENODE tokens to buy mining rigs and nodes to outfit your server rooms. And the more nodes you have, the more $PEPENODE you’ll mine.

Rewards are also up for grabs courtesy of this gamified project – and they’re not limited to $PEPENODE. Rewards include other popular meme coins like $PEPE and $FARTCOIN.

This novel platform brings together the fun of blockchain gaming and the raw potential of meme coins. For PepeNode investors, mine-to-earn opens the door for several ways to earn from the project:

Discover in our easy-to-follow guide.

Discover in our easy-to-follow guide.

Fancy being a virtual crypto miner? .

– like all Trump projects – is as politically charged as it is business-motivated. Launched in parallel with Donald Trump’s pro-crypto policies, World Liberty Financial includes the $WLFI token as well as stablecoins like $USD1.

$WLFI blends meme-coin energy with a treasury-backed investment protocol tied to the Trump movement’s populist narrative. Its mission is to empower holders through decentralized finance, tokenized assets, and a particular brand identity.

$WLFI recently gained viral traction after a White House-themed tweet referenced GameStop and crypto freedom and sent trading volume surging past $220M in a single day.

Currently trading at $0.1465, $WLFI is up by more than 14% in the past week, reflecting an appeal that lies partly in its growing ecosystem and partly in political mood affiliation.

and other leading platforms.

To recap: American Bitcoin’s $163M bet on Bitcoin highlights just how much institutional corporate interest there is in the crypto space. Projects like show how that interest bridges from corporate projects to leading altcoins, and and stand to benefit.Always do your own research; this isn’t financial advice.

Authored by Aaron Walker, NewsBTC –