Not even one week into 2026, and we have already witnessed a regime change in South America… This might just be the beginning as Trump threatens Colombia and Mexico.

Donald Trump warned of new U.S. military operations in Colombia and hinted at action in Mexico and Cuba after the capture of Venezuela’s Nicolás Maduro, raising fresh geopolitical tension across Latin America. But, weirdly enough, barely flinched, climbing about 3.3% from roughly $89,990 to near $93,000 during the same window.

Market Cap

Today’s steady Bitcoin price shouldn’t be mistaken for immunity, as deeper geopolitical escalation could still hit crypto hard, making risk management more important than ever.

EXPLORE:

Trump said a new military operation in Colombia “sounds good to me” and warned that “something is going to have to be done” in Mexico, while also taking aim at Cuba after the Venezuela strike. Of course, Colombia, Mexico, and Cuba condemned the U.S. action and said it destabilises regional security. Tensions remain elevated, with Trump refusing to soften his inflammatory rhetoric and also doubling down on Greenland.

President Trump has declared that America needs Greenland for “national security.”

Follow:

— AF Post (@AFpost)

So why did Bitcoin rise instead of dropping on the Venezuela news? One explanation is that the situation developed too fast for markets to panic, with early announcements limiting uncertainty before traders could react. Basically, we just had no time to panic.

History still matters, and there is no guarantee that would unfold as quickly or smoothly. For Venezuela, this remains an especially fragile moment, far from a simple or peaceful transfer of power.

Not to mention trade policy uncertainty that shadowed much of 2024 and carried into 2025: a messy tariff battle, particularly with China, kept markets on edge. Every round of tariff announcements sparked risk-off moves and steep swings in crypto prices, making 2025 an emotional roller coaster for traders.

EXPLORE:

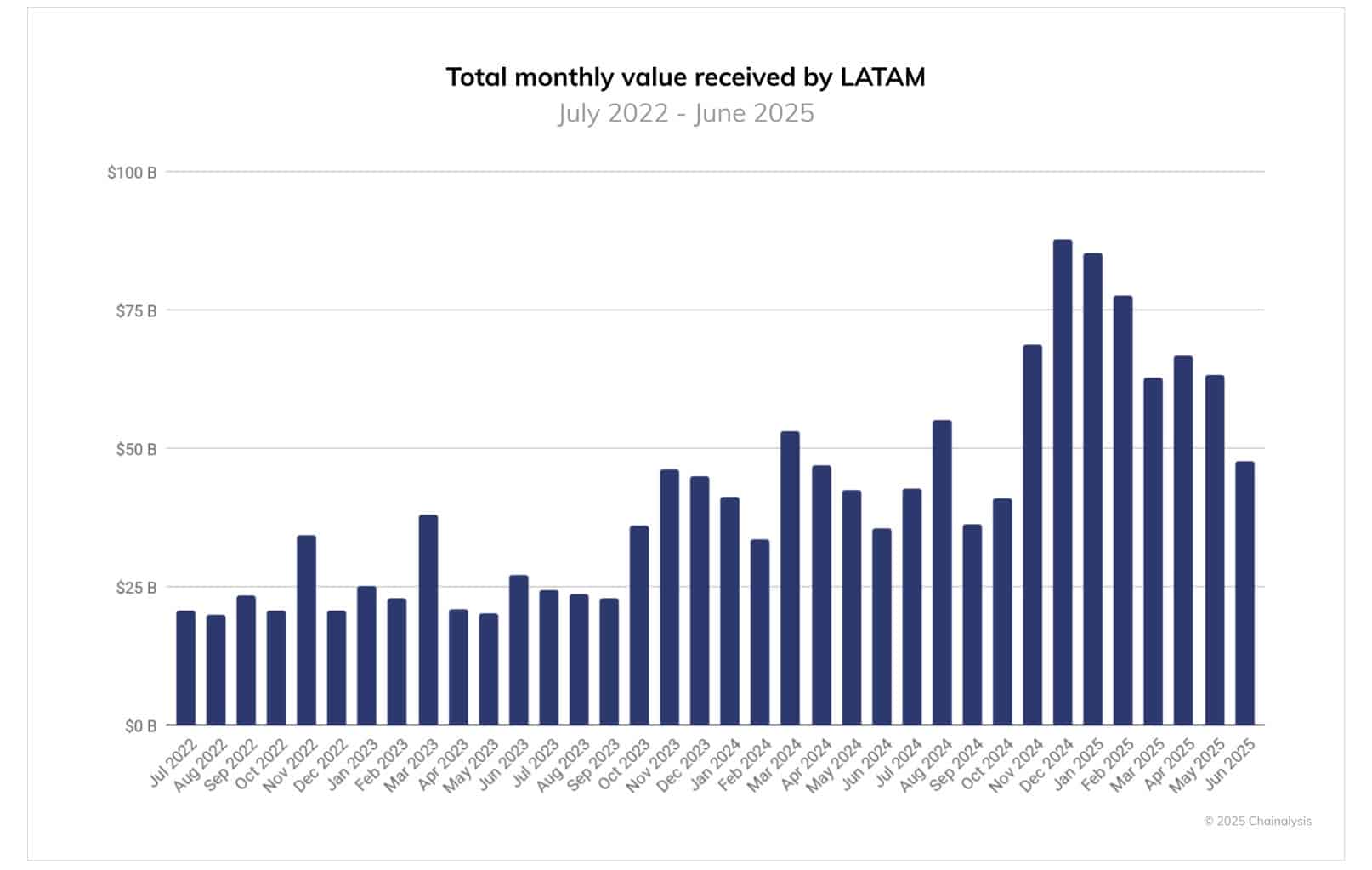

Latin America already relies heavily on crypto in places like Venezuela and Argentina, where people use stablecoins and BTC as escape hatches from broken local currencies. If tension spreads to Colombia or Mexico, local demand for crypto as an alternative money system can actually grow, similar to past safe‑haven narratives around Bitcoin. But higher demand inside one region does not always translate into a straight up-only BTC chart for everyone.

On global markets, war talk often pushes big funds and traders to de‑risk short term. That can mean selling crypto, rotating into cash, and then coming back later at lower prices. Historical data shows that these geopolitical “shocks” often line up with sharp down days in BTC, even when the long‑term story remains bullish.

You also have an extra political twist: Trump loves to use economic threats, sanctions, and tariffs as tools. We already saw crypto react to and to . If his team ties crypto or cross‑border payments into future sanctions or capital controls, that adds another layer of risk for exchanges and users in the region.

First, zoom out. A move from $90K to $93K is loud on social media, but it sits inside Bitcoin’s normal volatility range. For a large asset that still behaves like a tech stock on steroids, 3–4% daily swings are standard. If you invest, size your positions as if a 20–30% drop tomorrow is always on the table.

Second, separate story from strategy. Tension in Latin America fits a growing pattern where global crises and crypto prices interact more often. That does not mean “war = Bitcoin always goes up.” It means your plan needs rules for when Bitcoin dumps hard on scary headlines, not just when it grinds higher.

Practical steps help. Keep only trading money on exchanges, and store long‑term holdings in wallets you control. Consider watching tools like volatility indexes and BTC dominance charts, which many traders use to gauge fear and risk appetite, similar to how stock traders watch the VIX. Our guide on walks through these basics.

Geopolitics will keep bumping into Bitcoin’s story whether we like it or not. If you build a calm, rules‑based approach now, the next headline shock becomes background noise instead of a portfolio‑killing surprise.

DISCOVER:

For the Latest Market Updates and Subscribe on For Daily Expert Market Analysis.

The post appeared first on .