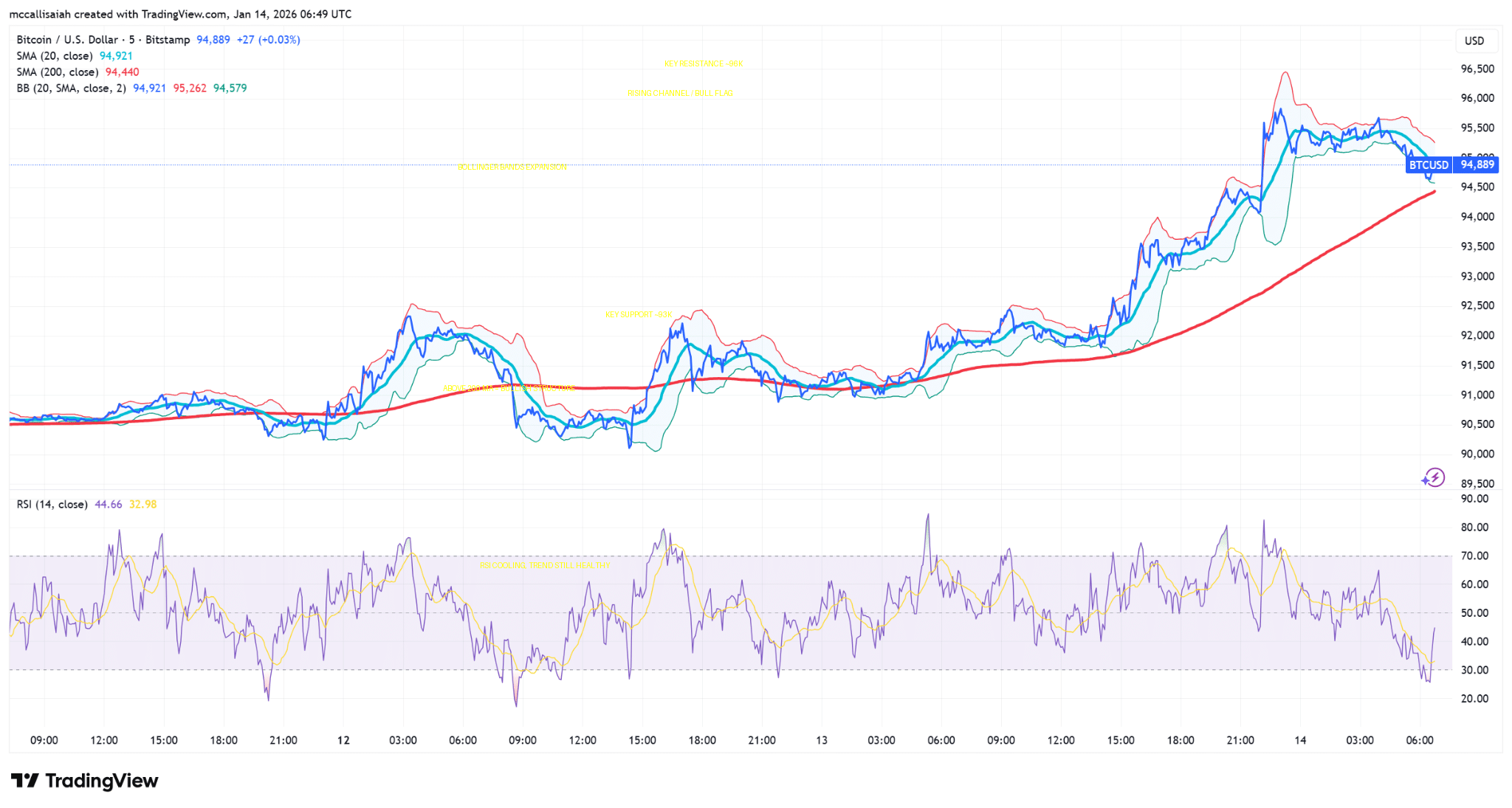

Why is Bitcoin up today? Spoiler alert, 94k was a pretty significant resistance aaaaaand acccsshhhualllyyyy, despite what bears tell you, the higher low certified bull status a month back.

That’s the good news. Here’s the even better news: ‘s recent break triggered over in a matter of hours and forcing short sellers to cover.

BTC pushed to a two-month high near $96,240 before cooling, but the damage to bearish positioning was already done.

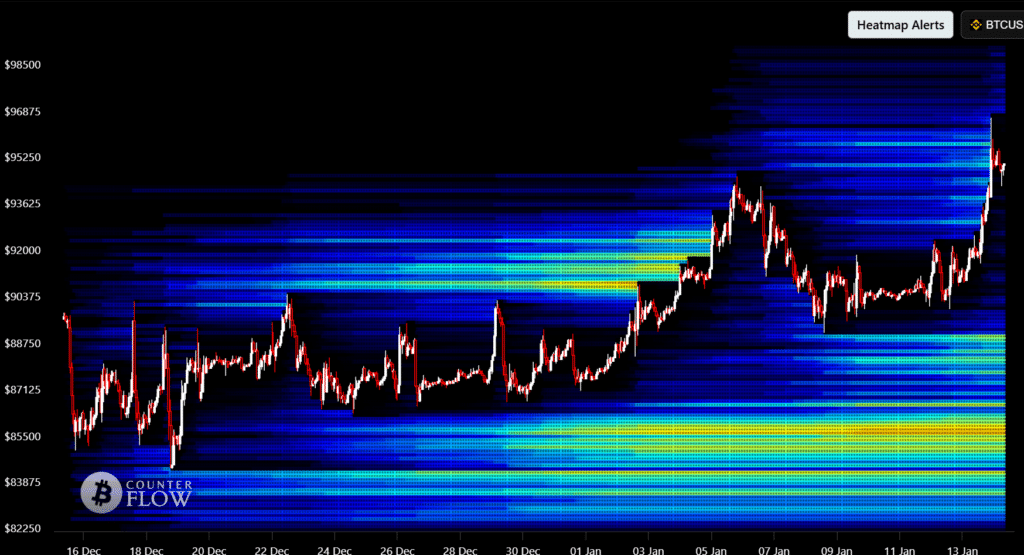

Open interest fell from roughly $31.5 Bn to $30.6 Bn as price rose, a classic tell that this was not leverage chasing upside but . Spot buyers stepped in while derivatives traders scrambled. Here’s everything we know and if this will likely continue.

DISCOVER:

This was not a Bitcoin-only breakout. Altcoins led aggressively. DASH printed its highest level since 2021 on strong volume, while OP, TIA, and all posted double-digit gains in 24 hours. Bitcoin dominance slipped from 59.3% in late December to about 58.6%, confirming risk appetite rotating outward.

We also saw nearly double its price and break new ATHs in less than a week. A lot of the speculation for the price has been that Monero and Bitcoin are thriving from revolutions in Iran and Venezuela.

The October liquidation cascade left the market fragile and under-positioned.

shows this breakout punished complacency in the market. Shorts leaned too heavily on the idea that Bitcoin lacked 2026 catalysts. Instead, price moved first and narratives followed, as they usually do.

DISCOVER:

From a technical standpoint, $94,500 is now the level that cannot fail. Holding above the low-$93K region keeps structure intact and opens a path toward $99K. Lose it, and this turns into another range fakeout.

For now, this appears to be consolidation after a period of strength, and we may have a new floor. Bitcoin broke the door down once again, like a raid. The market responded exactly how it does when too many traders were leaning the wrong way.

EXPLORE:

Follow 99Bitcoins on For the Latest Market Updates and Subscribe on For Daily Expert Market Analysis

The post appeared first on .