Solana’s price action has shown some sort of resilience in the past few days while much of the cryptocurrency market turned red. After surging past $210 to reach as high as $218 on August 29, SOL briefly dipped below $200 but quickly stabilized, outperforming major large-cap assets such as Bitcoin, since August 14.

This has put Solana in an interesting position, and technical analysis shows its correction phase is constructive and could prepare the token for another breakout.

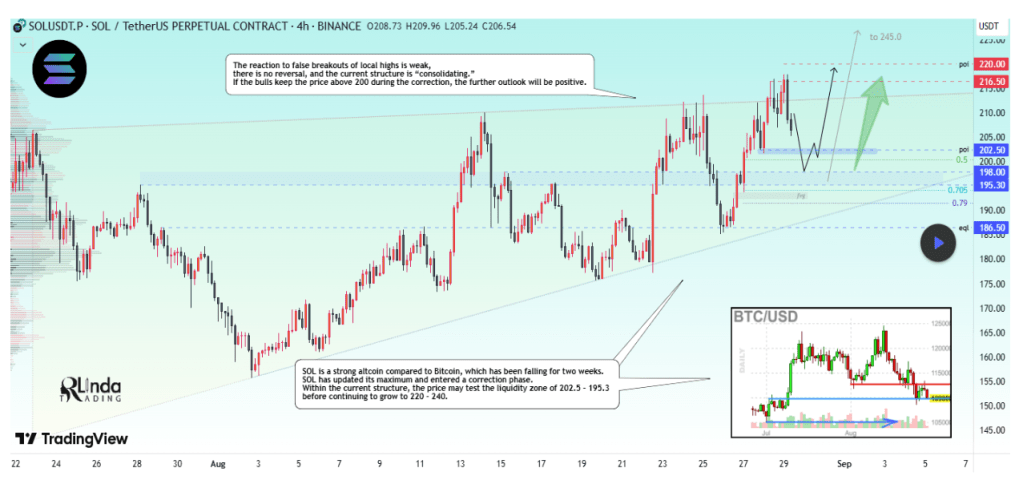

Crypto analyst RLinda on the TradingView platform stronger than the market. According to the analyst, Solana’s recent price behavior, where it even after pulling back from a new multi-month high of $218, its highest price point since February.

Although the multi-month high ultimately resulted in rejection and a downward move, Solana is doing much better than Bitcoin. According to on-chain analyst Ali Martinez, Solana investors immediately after the cryptocurrency broke past $210 before eventually reaching $218. Particularly, data from Glassnode shows realized profits spiking to over $911 million after Solana broke above this level.

According to RLinda’s analysis, the ongoing correction is not a reversal but rather a consolidation stage and there’s likely going to be a liquidity test between $202.5 and $195.3. However, the analyst noted that the outlook will remain positive as long as buyers can defend the $200 level during this corrective move. This, in turn, will pave the way for a breakout from $200 up to $240.

The last two times Solana broke above $200 this month, it entered into an ensuing correction that brought its price action below $180. However, the most recent break, which led to a peak at $218, has managed to hold above $200. The formation of higher highs and higher lows shows that and are now unable to force the token back under $200. Therefore, the bullish outlook from here is with RLinda pointing to $240 as the next target.

Reaching $240 would translate to a new peak since January. However, RLinda also highlighted resistance levels at $216.5 and $220 before reaching this target, and then a final resistance at $244 should the

On the other hand, the analyst also noted support levels at $202.5, $198, and $195.3. The overall expectation is that Solana could resume its bullish trading trajectory once the correction slows down and bounces at either of these levels.

At the time of writing, Solana is trading at $205, up by 1.6% in the past 24 hours.

Featured image from Getty Images, chart from TradingView