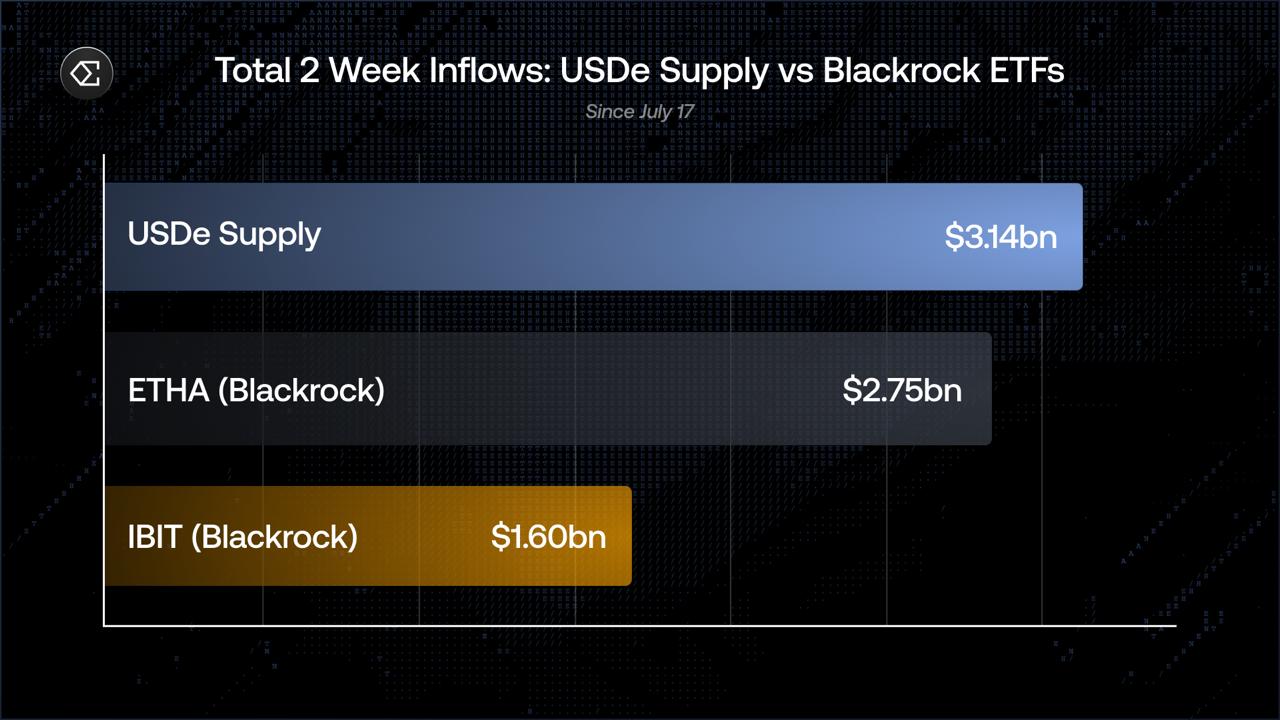

synthetic stablecoin, USDe, has crossed $8.4 billion in supply, adding more than $3.14 billion over 20 days in a surge that outpaced flows into BlackRock’s (BLK) flagship bitcoin and ether exchange-traded funds.

According to on-chain data curated by the Ethena community, the supply increase since July 17 is the fastest period of growth since the protocol's inception in February 2024.

Inflow into the yield-bearing stablecoin exceeds the $2.75 billion added to BlackRock’s ether ETF (ETHA) and the $1.60 billion into its bitcoin ETF (IBIT) in the same period, making the DeFi-native stablecoin the biggest magnet for capital across both on- and off-chain markets in recent weeks.

The rally has spilled over into , which in the past month, though it is down 12% in the past 24 hours as traders hope the long-awaited fee switch will soon activate.

The protocol has already surpassed most of the thresholds required to distribute revenue to staked ENA holders, with the final benchmark, a favorable yield spread versus rivals, expected to be met soon.

USDe's reflexive loop

USDe’s recent growth reflects a powerful reflexive loop built into its core design, as in a recent research report on the Ethena ecosystem.

As bitcoin and ether prices rally, perpetual funding rates in turn increasingly positive. , and distributes it as real-time yield to sUSDe holders.

That higher yield then draws in more users, leading to greater USDe issuance, more hedging, and more protocol revenue.

In the last month, Ethena has brought in nearly $50 million in feed and $10 million in revenue, . This makes it the sixth best-performing protocol for monthly fee revenue according to the data aggregator.

ENA is currently trading for $0.58.