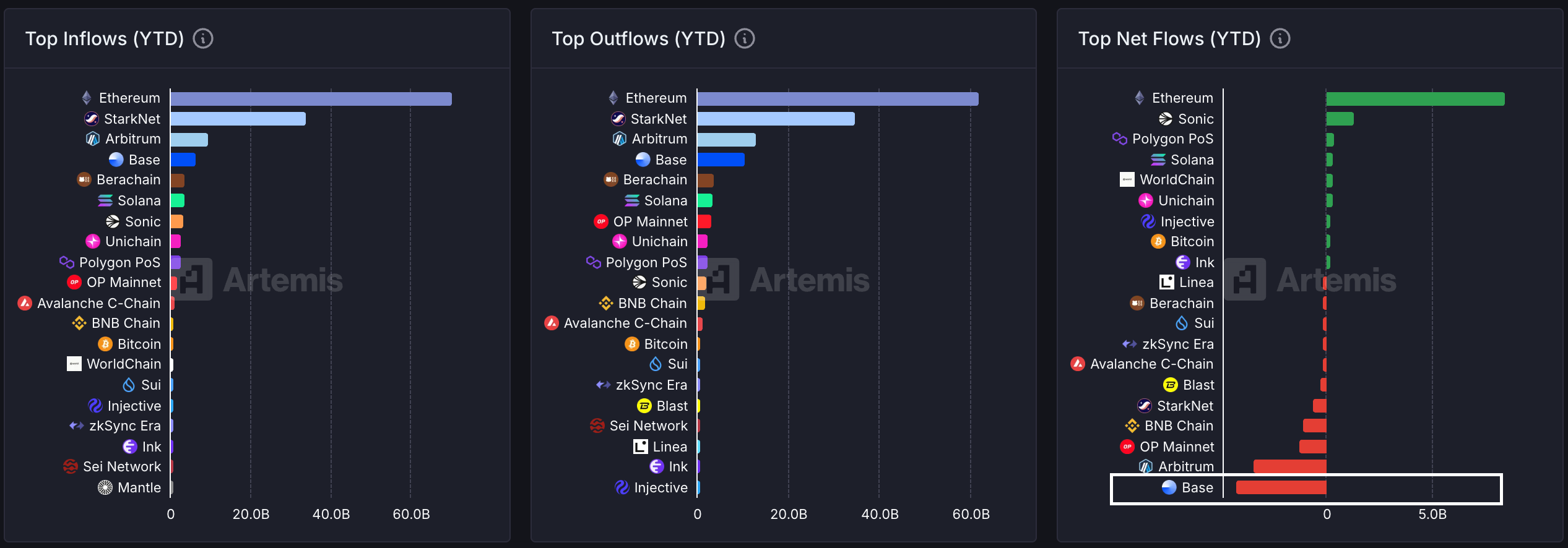

Nasdaq-listed crypto exchange Coinbase's Layer 2 scaling solution, Base, has gone from being the leader in 2024 in terms of capital inflows through cross-chain bridges to the top loser this year.

Data from the shows Base has seen a net outflow of $4.3 billion this year, a the net inflow of $3.8 billion in 2024, which was the highest among the top 20 blockchains.

Meanwhile, Ethereum, the world's largest smart contract blockchain, has registered a net inflow of $8.5 billion this year, of $7.4 billion in the previous year.

The data show the momentum behind the Base chain has decelerated, with Ethereum reclaiming its top spot.

Crypto bridges are protocols that facilitate communication and interaction between different blockchains, enhancing interoperability. Bridging, therefore, refers to the act of moving tokens between different networks.

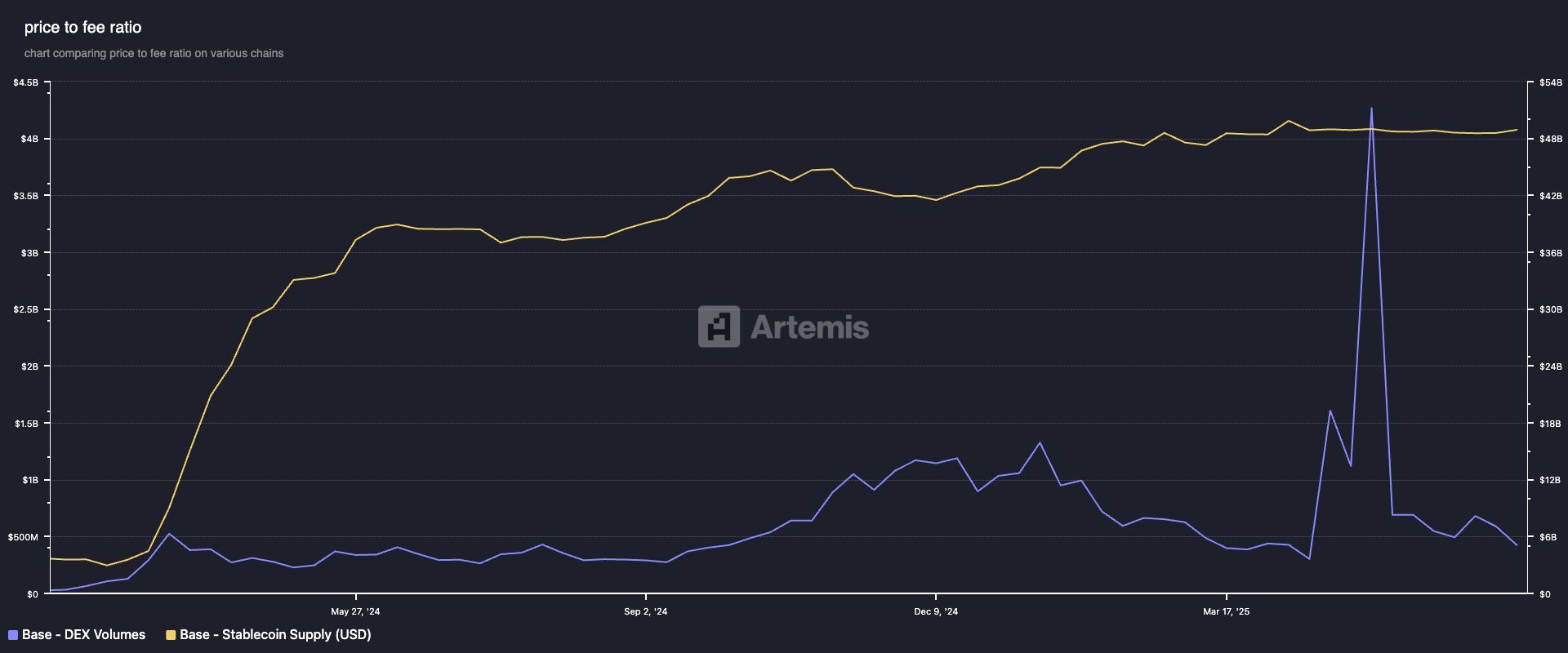

The cumulative supply of stablecoins on Base has also flattened above $4 billion since mid-May alongside slower trading volumes, as the chart below shows.

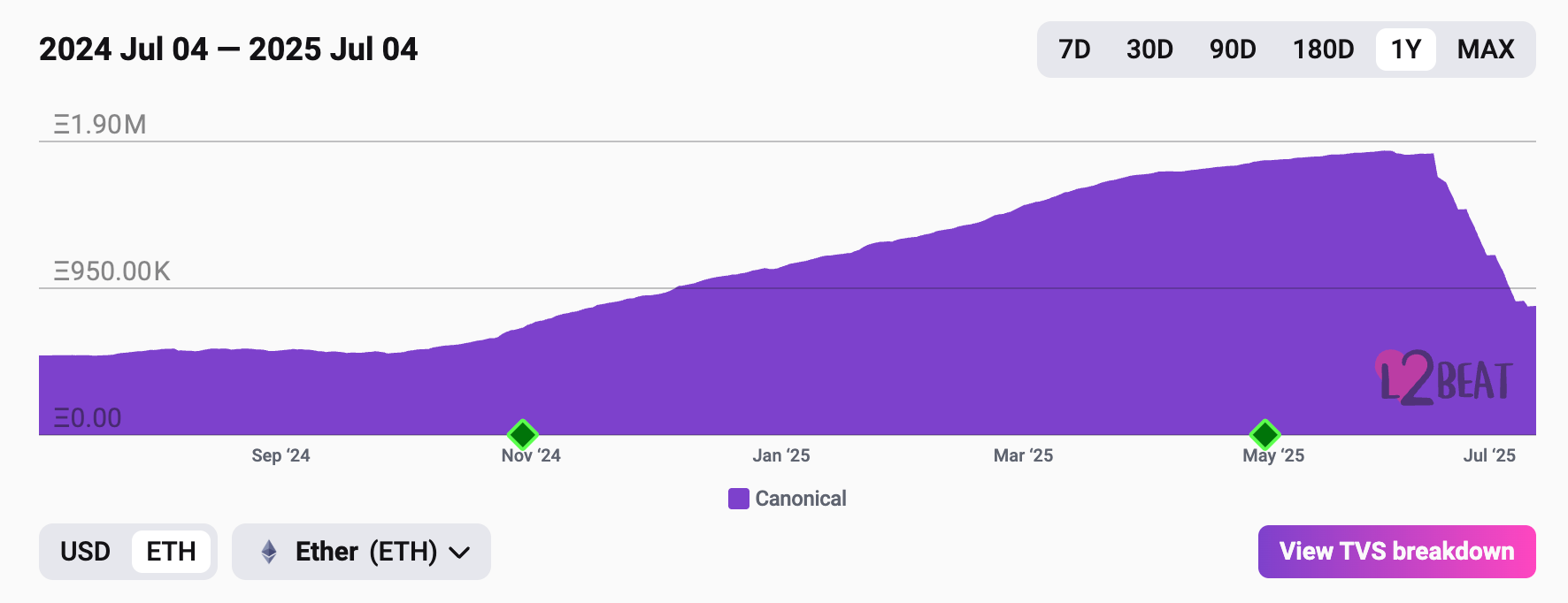

According to the data source , the total number of ether (ETH) deposited on BASE has crashed from 1.82 million ETH to just over 835,000 ETH in four weeks.

The trend is consistent with other Layer 2 solutions, which have seen notable ETH outflows in recent weeks, Michael Nadeau of The DeFi Report on X.

According to Coinbase's Protocol Specialist Viktor Bunin, the outflows are likely due to Binance withdrawing capital to the Layer 1.

"The vast majority is just Binance withdrawing to L1. They kept an ungodly amount on the L2s. Unclear if they were getting incentives to keep it there or just didn't balance across their supported chains," .