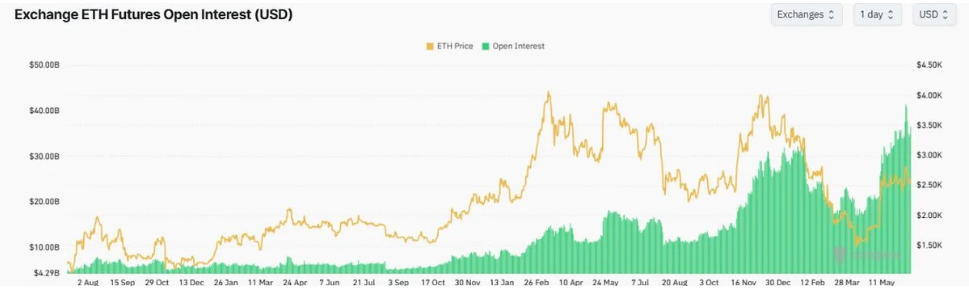

Ethereum (ETH) grabbed fresh attention on June 16 as futures open interest climbed to a yearly high of $36.56 billion. Prices bounced back above $2,600 and hovered near a key resistance level that has held for months. Traders piled into new positions, setting the stage for a big move in either direction.

According to , open interest in ETH futures jumped sharply over three days, hitting $36.56 billion on Monday. That number marks the highest level since last year. It shows that many traders are using borrowed funds to bet on where Ethereum will go next.

ETH rose about 4.5% in a single session. Based on technical charts, that rally pushed ETH right up to a long‑standing descending trendline. Investors have watched that line for over a year.

It sits just above the 50‑week moving average, while the 200‑week average lies just below. If ETH can clear and hold above these levels, it may signal room to run. But weak trading volume could mean bulls need more firepower before taking charge.

US spot funds tied to Ethereum saw a small outflow of $2.18 million on the same day, marking the first net withdrawal in 19 days. Yet weekly inflows still totaled $528.12 million, pushing total assets under management in these beyond $10 billion.

Institutional Backing Expands ETH ReachMajor asset managers are also getting more creative with Ethereum. Companies such as and Fidelity have begun rolling out tokenized treasury products and stablecoin‑backed funds that link directly to ETH.

Based on statements by those firms, these latest products are intended to expand access for large institutions that have avoided so far. They support the notion that Ethereum is not only capable of fueling DeFi tests, but also applications in the real world.

Ethereum Drift Remains Steady Before Potential RipplesMeanwhile, market statistics shows Ethereum traded calmly at $2,630 on June 16, showing a 4% increase in the last 24 hours. Futures markets are warming up, with volumes rising steeply as large players pour into ETH-based contracts.

Speculative positions usually foretell choppy action. As increasing amounts of money move into leveraged positions, even modest moves in price can cause forced liquidations—sometimes on both the long and short sides. When that occurs, volatility increases. That is to say, today’s tranquil chart can become jagged quickly once those mammoth bets begin to be unravel.

Featured image from Unsplash, chart from TradingView