Leading crypto exchange Kraken has reported $472 million in revenue for Q1 2025. Amazingly, it is up 19% from the previous year despite a volatile Q1 that saw BTC drop below $65,000.

In a positive sign for the anticipated bull market, Kraken’s trading volume on the platform rose 29% year-over-year, and funded accounts grew by 26%. However, assets on the platform dropped 2% to $34.9 billion. Kraken attributed the drop to the market crash that saw many tokens falling 70% and then some.

Q1 results are in for !

$472 million gross revenue

Adjusted EBITDA of $187 million (+19% YoY)

Funded accounts growing by 26% YoYcheck out the rest here –

and much more on the way for Q2!

— Dave Ripley (@DavidLRipley)

One tell-tale sign to look for when trying to speculate on bull market timing in crypto is liquidity and volume. A leading platform such as Kraken exchange reporting a near 30% volume increase year-on-year is extremely bullish.

Especially when taking into account that crypto had a mostly horrendous Q1, which saw BTC tank around 30%, from $106,000 to briefly going under $78,700 on March 11.

All previous bull runs have begun once ‘retail’ enters the market. Retail being non-crypto individuals that normally enter when Bitcoin has just hit a significant landmark. For this to happen, BTC will likely need to climb above $110,000, marking a new all-time high whilst analysts will begin calling for $200,000 next.

DISCOVER:

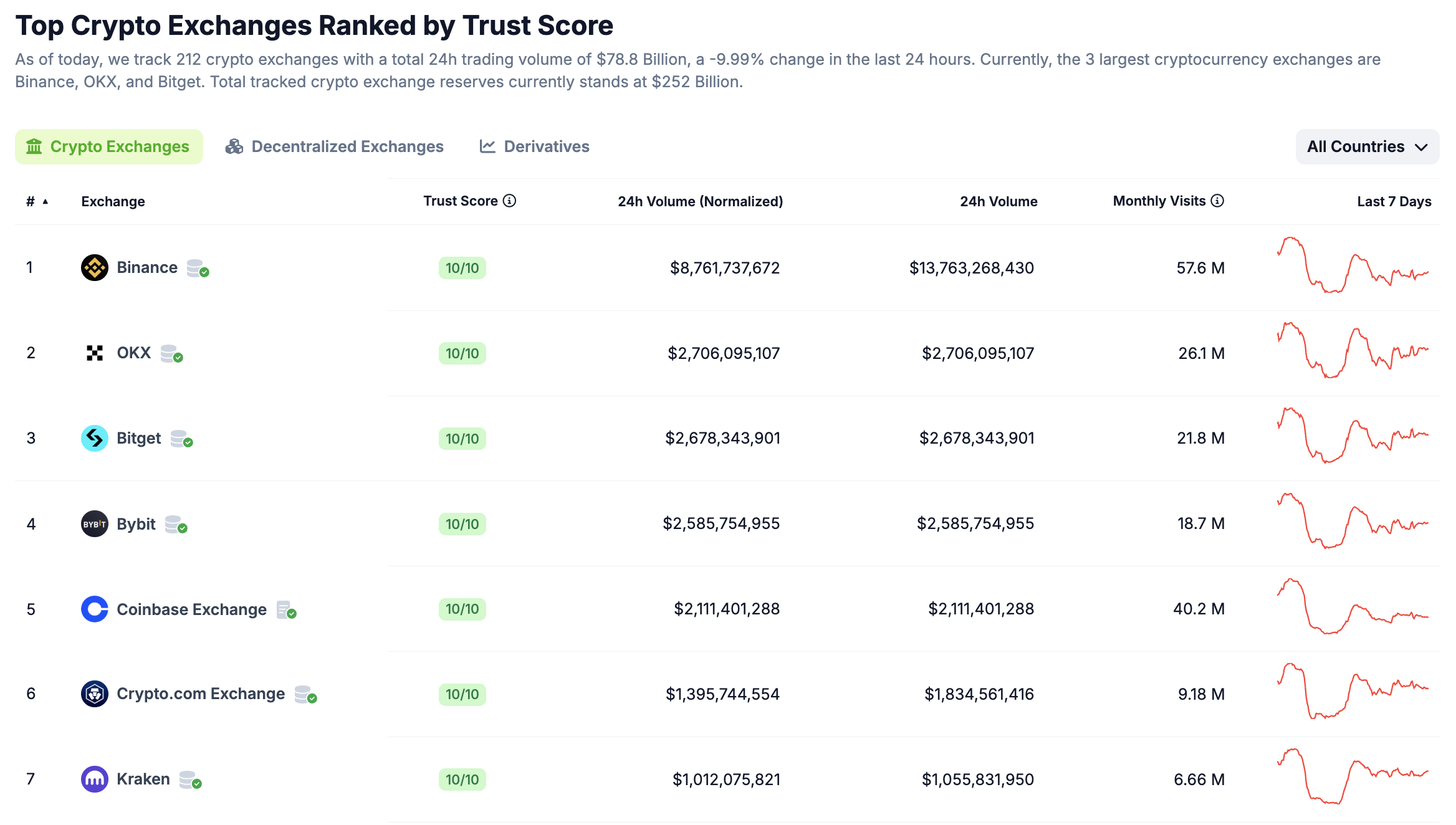

CoinGecko data shows that 24 hour trading volume for all major centralized exchanges stands at $78 billion. Kraken itself accounts for $1 billion of that figure while Binance leads the way with $13.7 billion.

No other major exchange has posted their quarterly reports as of yet but it will be interesting to see if the likes of Binance and Coinbase have experienced similar upticks in activity and volume.

()

The headline of the quarter, however, was Kraken’s completed acquisition of NinjaTrader, a retail-focused futures and derivatives trading platform.

“This transaction marks the largest-ever deal combining traditional finance (TradFi) and crypto. More than an expansion of our business, this strategic acquisition strengthens our position in derivatives for both TradFi services and crypto,” the exchange wrote in a report.

The deal positions the platform to serve traders looking to access both asset classes all in one place. It will allow for crypto traders to access traditional futures contracts, while the reported 800,000 NinjaTrader users will gain access to the crypto market.

This is an exciting day in NinjaTrader’s journey to redefine retail futures trading as we have entered into an agreement to join forces with .

We’ll continue to operate as a standalone platform while we work with Kraken to unlock new opportunities for all our…

— NinjaTrader (@NinjaTrader)

The move puts Kraken’s one step closer to fulfilling its ambition to become a multi-asset platform. The purchase of NinjaTrader came during the same quarter Kraken launched a feature allowing for cross-border payments, Kraken Pay. It will be boosted with the introduction of crypto debit cards, in partnership with Mastercard.

Kraken also completed a Proof of Reserves attestation for the cryptocurrencies custodian by the exchange as of March 31. The firm, which allows users to verify their assets independently on-chain through a Merkle tree proof, said it plans on publishing these proofs quarterly.

DISCOVER:

The post appeared first on .