The Bitcoin price rally extended to over the weekend, with Ethereum and Dogecoin posting double-digit gains. Did you get that? Altcoin season confirmed.

The surge followed President Trump’s announcement of a “total reset” in U.S.-China trade relations after high-level talks in Geneva.

China bent the knee. They will buy the next year.

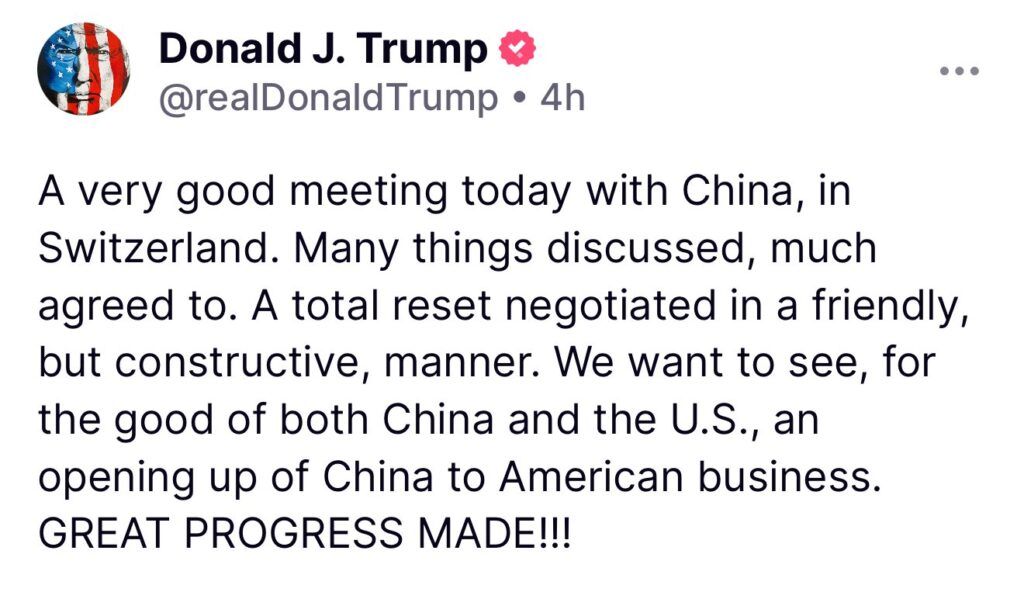

High-level trade discussions between the U.S. and China marked a significant step in de-escalating heightened economic tensions. President Trump remarked positively on the talks, saying, “A very good meeting today with China, in Switzerland. Many things discussed, much agreed to. A total reset negotiated in a friendly, but constructive, manner.”

The comments fueled optimism in global markets, .

Alongside Bitcoin, altcoins rallied hard. Ethereum recorded a 10% price jump to $2,600, while Dogecoin surged over 21% to near $0.25.

After months of gridlock and secondhand anxiety over U.S.-China relations, signs of progress have reset investor expectations. The result: a sharp return to risk-on sentiment across global assets.

Bitcoin responded the way it usually does when the fear index drops: with a bullish leap to $104,000. Even a wasn’t enough to knock down the price.

Bitcoin isn’t the only one catching tailwinds. Ethereum is surprisingly back in the spotlight after many wrote it off thanks tobelief in its DeFi ecosystem and smart contract utility, while Dogecoin—still absurd, still adored—rides the momentum with its loyal following and cultural cachet.

Crypto’s days of being insulated from the outside world are over. When Trump talks trade, coins jump—meme or not.

That reflexivity is a sign of maturity. Hedge funds, asset managers, and even pension funds are watching these updates to pump their crypto bags as well.

Bitcoin’s once again over the $104K line, but momentum is a fickle thing. If confidence slips, corrections come quick—and altcoins will feel it too.

Behind the optimism, regulatory clarity and the still looms

EXPLORE:

The post appeared first on .