By Omkar Godbole (All times ET unless indicated otherwise)

Markets remain squarely focused on the U.S.-China trade tussle and headlines from both countries.

Bitcoin fell below $75,000 during the Asian morning, with S&P 500 futures nursing a 2% loss after the U.S. . The Australian dollar, a China-sensitive commodity currency, fell to a five-year low of 0.5913 against the greenback and the threatened a USD liquidity squeeze.

Sentiment improved somewhat after China's State Council Information Office on the tensions that said Beijing is willing to communicate on issues and didn't mention fresh retaliatory taxes on U.S. imports. It soured some hours later after the Ministry of Finance from 34%, sending BTC, which had rallied to around $77,000, back below $76,000.

In any case, the sustainability of the recovery was always under question as China's comments beyond the headlines were tough and suggested the government was unlikely to blink any time soon. For instance, the document said China won't be bullied and the U.S. will need to show respect and equality if it wants to resolve the problem. The country will take measures to safeguard its rights and interests, it said.

Besides, persistent volatility in bonds, triggered by the supposed unwinding of carry trades and fears of sticky inflation, could work against a sustained recovery in the risk assets. A growing number of observers, including economist markets are too optimistic in pricing an aggressive Fed easing, and central bank support will come only after President Donald Trump tempers his rhetoric. Meanwhile, Bank of Japan Governor Kazuo Ueda said if the economy improves as expected, adding the need to be alert to trade tensions.

In the broader crypto market, BlocScale, a launchpad to onboard projects and community-driven token introductions to XRP Ledger, continued to make waves, with for the seed sale of its native token BLOC. “With over 35% of the seed sale allocation already claimed, BlocScale Launchpad is gaining significant traction from early-stage investors, developers, and XRP enthusiasts looking to be part of something groundbreaking,” it said.

The TRUMP token, associated with President Trump, traded at record lows near $7.5 in the wake of massive selling by whales early this week. It is now down 90% from its record high, with a $360 million unlock due later this month. Stay Alert!

Crypto:

April 9: The gets applied to the Neutron (NTRN) mainnet, migrating it from Cosmos Hub's Interchain Security to a fully sovereign proof-of-stake network.

April 9, 10 a.m.: U.S. House Financial Services Committee on updating U.S. securities laws to take into account digital assets. .

April 10, 10:30 a.m.: for former Terraform Labs CEO Do Kwon at the U.S. District Court for the Southern District of New York.

April 11, 1 p.m.: U.S. SEC Crypto Task Force Roundtable on "" in Washington.

Macro

April 9, 8:00 a.m.: Mexico's Instituto Nacional de Estadística y Geografía (INEGI) releases March consumer price inflation data.

Core Inflation Rate MoM Prev. 0.48%

Core Inflation Rate YoY Prev. 3.65%

Inflation Rate MoM Prev. 0.28%

Inflation Rate YoY Prev. 3.77%

April 9, 11:30 a.m.: U.S. Senate to for Paul Atkins' nomination as SEC Chair. If invoked, confirmation vote at 7 p.m.

April 9, 12:01 p.m.: on U.S. imports take effect.

April 9, 2:00 p.m.: The Fed releases minutes of the FOMC meeting held March 18-19.

April 9, 9:30 p.m.: China’s National Bureau of Statistics (NBS) releases March’s Consumer Price Index (CPI) report.

Inflation Rate MoM Prev. -0.2%

Inflation Rate YoY Est. 0% vs. Prev. -0.7%

PPI YoY Est. -2.3% vs. Prev. -2.2%

April 10, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases March consumer price inflation data.

Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

Core Inflation Rate YoY Est. 3% vs. Prev. 3.1%

Inflation Rate MoM Est. 0.1% vs. Prev. 0.2%

Inflation Rate YoY Est. 2.6% vs. Prev. 2.8%

April 10, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended April 5.

Initial Jobless Claims Est. 223K vs. Prev. 219K

April 10, 10:00 a.m.: U.S. Senate Banking Committee on the nomination of Michelle Bowman as Federal Reserve Vice Chair for Supervision. .

April 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases March producer price inflation data.

Core PPI MoM Est. 0.3% vs. Prev. -0.1%

Core PPI YoY Est. 3.6% vs. Prev. 3.4%

PPI MoM Est. 0.2% vs. Prev. 0%

PPI YoY Est. 3.3% vs. Prev. 3.2%

April 14: Salvadoran President Nayib Bukele will join U.S. President Donald Trump at the White House for an .

Earnings (Estimates based on FactSet data)

No earnings scheduled.

Governance votes & calls

Bancor DAO is discussing the e on stable-to-stable trades on Sei v2 to make Carbon DeFi more competitive.

April 9, 12 p.m.: Vana to host an X Spacesand the future of decentralized data markets.

April 10, 10 a.m.: Hedera to discussing the HBR Foundation joining ERC3643, the non-profit’s standards, and the Header Asset Tokenization Studio.

April 11, 3 p.m.: Zcash to host a town hall on .

April 14, 10 a.m.: Stacks to with recent announcements from the project.

Unlocks

April 9: Movement (MOVE) to unlock 2.04% of its circulating supply worth $15.25 million.

April 12: Aptos (APT) to unlock 1.87% of its circulating supply worth $49.08 million.

April 12: Axie Infinity (AXS) to unlock 5.68% of its circulating supply worth $20.73 million.

April 15: Starknet (STRK) to unlock 4.37% of its circulating supply worth $15.71 million.

April 16: Arbitrum (ARB) to unlock 2.01% of its circulating supply worth $25.31 million.

Token Listings

April 9: IOST airdrop for a roughly 1.7 billion IOST token airdrop to open.

April 10: Stacks (STX) to be listed on Bitfinex.

April 10: Ren (REN), KonPay (KON), and Symbol (XYM) to be

April 22: Hyperlane to

CoinDesk's Consensus is taking place in . Use code DAYBOOK and save 15% on passes.

Day 2 of 2: (Paris)

Day 2 of 3:

Day 1 of 2:

Day 1 of 2: (Mexico City)

Day 1 of 2: (Abu Dhabi)

April 9: (Paris)

April 9: (Bogota)

April 10: (Nashville)

April 10: (Kuala Lumpur)

April 10: (New York)

April 10: (Seoul)

April 10-11: (Miami)

April 10-11: (Philadelphia)

April 11-12: Strategy's (Tysons, Va.)

April 12: (Córdoba)

April 12-13:

By Shaurya Malwa

Confidential Balances, a that lets people send and manage tokens privately, went active late Tuesday.

It uses zero-knowledge proofs (ZKPs), as a way to prove something is true — like you have enough money to pay — without needing to say exactly how much you have. It’s like showing a locked box and proving the cash is inside without opening it.

When tokens are sent, the amount stays secret. Normally, on blockchains, everyone can see how much is being transferred. Here, only the sender and receiver know the details.

The token balance (how much you own) is also kept private. Think of it like a bank account where nobody but the owner can peek at the total, unlike most blockchains where balances are public.

This means the creation or destruction of tokens (minting and burning) can take place without everyone knowing the numbers. For example, a company could issue new tokens or remove some quietly, keeping the total supply under wraps.

The feature is built for privacy-focused financial apps, like payroll systems or business payments, where participants don’t want the amounts to be made public. It’s a big deal for institutions that want privacy but still need to follow rules.

BTC futures open interest on offshore exchanges increased as prices dropped during Asian hours, validating the downtrend. The level held steady during the subsequent recovery, suggesting a spot-led move or absence of bullishness among derivative traders. The same can be said about the ETH market.

The open interest-adjusted cumulative volume delta for the top 25 coins, except BNB, SHIB, BCH and HBAR, is negative for the past 24 hours, a sign of net selling pressure in these markets.

BTC options flow on Deribit has been mixed with puts lifted along with put spreads and a notable block trade involving a long position in the $84K call expiring on April 25.

BTC is up 0.24% from 4 p.m. ET Tuesday at $77,232.03 (24hrs: -1.81%)

ETH is down 0.36% at $1,475.05 (24hrs: -5.66%)

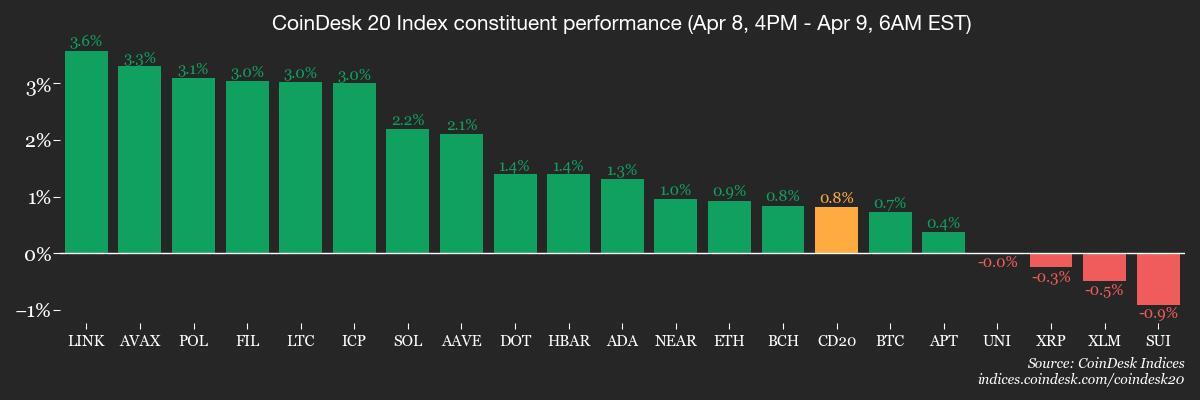

CoinDesk 20 is up 0.95% at 2,203.46 (24hrs: -3.04%)

Ether CESR Composite Staking Rate is unchanged at 3.69%

BTC funding rate is at -0.0018% (-1.9392% annualized) on Binance

DXY is down 0.68% at 102.25

Gold is up 3.19% at $3,063.20/oz

Silver is up 2.53% at $30.34/oz

Nikkei 225 closed -3.93% at 31,714.03

Hang Seng closed +0.68% at 20,264.49

FTSE is down 2.01% at 7,751.59

Euro Stoxx 50 is down 2.11% at 4,673.14

DJIA closed on Tuesday -0.84% at 37,645.59

S&P 500 closed -1.57% at 4,982.77

Nasdaq closed -2.15% at 15,267.91

S&P/TSX Composite Index closed -1.54% at 22,506.90

S&P 40 Latin America closed -2.24% at 2,177.30

U.S. 10-year Treasury rate is up 8 bps at 4.38%

E-mini S&P 500 futures are down 0.21% at 5,031.00

E-mini Nasdaq-100 futures are up 0.63% at 17,352.00

E-mini Dow Jones Industrial Average Index futures are unchanged at 37,857.00

BTC Dominance: 63.40 (0.08%)

Ethereum to bitcoin ratio: 0.01916 (-0.73%)

Hashrate (seven-day moving average): 925 EH/s

Hashprice (spot): $42.03

Total Fees: 7.88BTC / $622,998

CME Futures Open Interest: 429,112 BTC

BTC priced in gold: 25.3 oz

BTC vs gold market cap: 7.25%

BTC’s monthly candlesticks chart shows the cryptocurrency has almost retraced to the former resistance-turned-support level at $73,757 (March 2024 high) in a classic throwback pattern observed after bullish breakouts.

A bounce from that level would signal a resumption of the broader uptrend.

Strategy (MSTR): closed on Tuesday at $237.95 (-11.26%), up 2.14% at $243.05 in pre-market

Coinbase Global (COIN): closed at $151.47 (-3.69%), up 0.45% at $152.15

Galaxy Digital Holdings (GLXY): closed at C$13.22 (+7.13%)

MARA Holdings (MARA): closed at $10.52 (-6.57%), up 0.67% at $10.59

Riot Platforms (RIOT): closed at $6.54 (-8.02%), up 1.22% at $6.62

Core Scientific (CORZ): closed at $6.51 (-7.26%), down 1.54% at $6.14

CleanSpark (CLSK): closed at $6.74 (-9.29%), up 0.89% at $6.80

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $11.49 (-7.41%), up 10.1% at $12.65

Semler Scientific (SMLR): closed at $31.97 (-6.38%), down 1.02% at $33.80

Exodus Movement (EXOD): closed at $40.14 (-4.06%)

Spot BTC ETFs:

Daily net flow: -$326.3 million

Cumulative net flows: $35.74 billion

Total BTC holdings ~ 1.11 million.

Spot ETH ETFs

Daily net flow: -$3.3

Cumulative net flows: $2.37 billion

Total ETH holdings ~ 3.38 million.

Source:

The chart shows gyrations in the U.S. 10-year yield and the Nasdaq futures this month.

Since Friday, the 10-year yield has surged over 50 basis points despite the continued weakness in Nasdaq.

The rising yield presents a challenge to the Trump administration which wants to lower it to help manage its debt load.

(Reuters): Policymakers are expected to weigh export tax breaks, market support and steps to lift consumption as Beijing responds to the 104% U.S. tariff on Chinese imports.

(CoinDesk): Argentina’s lower house approved measures to investigate the LIBRA token, which caused turmoil after being promoted by President Javier Milei earlier this year.

(CoinDesk): As Trump's higher individual tariffs took effect, the sell-off in major crypto tokens resumed, reversing gains from Tuesday’s relief rally.

(Bloomberg): U.S. 30-year Treasury yields jumped 25 basis points as the tariffs sparked a global bond sell-off and an unexpected drop in the dollar, fueling concerns of waning foreign demand.

(The Wall Street Journal): The IMF said the deal, pending board approval, aims to stabilize Argentina’s economy and support long-term growth amid a volatile global backdrop.

UPDATE (April 9, 11:38 UTC): Adds China's tariff retaliation in third paragraph.