AAVE crypto is surging, fueled by the Bitcoin rally, a $50M buyback program, and GHO stablecoin growth. Will AAVE/USDT reach $400? Bulls are stepping in after prices dropped sharply in Q1 2025, forcing the DeFi token to as low as $110 in April 2025.

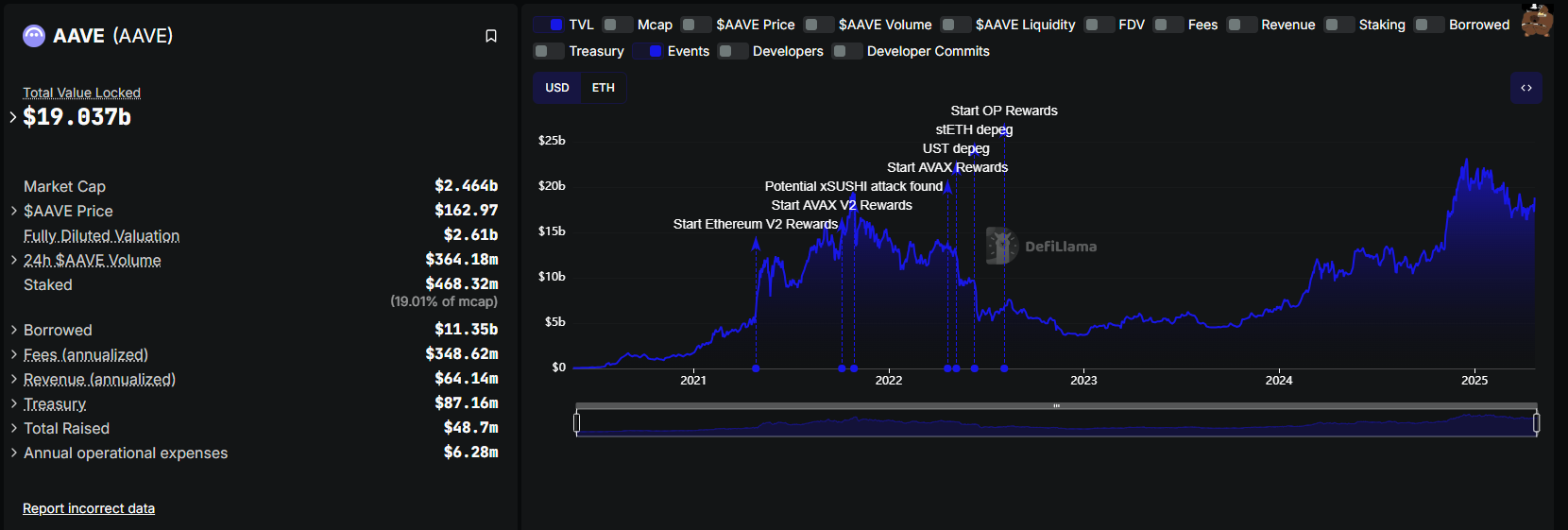

Aave is a decentralized protocol primarily active on Ethereum, enabling users to lend and borrow select tokens. This decentralized money market has grown rapidly, becoming the largest DeFi platform by total value locked (TVL) in just but a few years. As of April 23, 2025, Aave manages over $19 billion, adding 7% in the past week alone, according to DeFiLlama .

()

Reflecting this uptick in demand, AAVE, the governance token, is up in the last trading day, extending gains and attracting more capital. At this pace, AAVE is clearly one of the , with a high likelihood of leading the altcoin rally in H1 2025.

EXPLORE:

The rebound in AAVE coincides with a resurgence in Bitcoin prices, reigniting investor interest in DeFi and altcoins and providing tailwinds for this top crypto coin.

Technically, bears are still in charge after AAVE posted losses in Q1 2025.

After peaking at nearly $400 in December 2024, prices dropped sharply through January and March, hitting $110 in early April.

()

Since then, AAVE/USDT has recovered, gaining 42% from April’s swing lows.

As AAVE crypto breaks higher, reversing losses from April 6 and 7, bulls will likely push prices toward $200 in the coming sessions.

However, the pace of this growth depends on the Bitcoin price rally and other Aave-related developments.

The biggest driver in the past few days is the announcement of the Aave buyback program.

The community approved repurchasing $1 million worth of AAVE weekly, with plans to redistribute tokens to stakers. This repurchase, part of a broader “fee switch” initiative, redirects protocol revenue into the token economy.

If the six-month trial continues at this pace, by this time next year, over $50 million worth of AAVE could be purchased annually.

This demand represents a major structural shift in how Aave rewards stakers. With hopes high, will AAVE outpace some of the ?

Further fueling demand is their of Chainlink’s Smart Vault Revenue (SVR).

SVR will generate millions of dollars for the platform by monetizing liquidations that would otherwise go to MEV bots.

Smart Value Recapture (SVR) Monitoring Platform dropped for 's current application!

since april 3rd, SVR on AAVE has resulted in

– 63 SVR Liquidations

– Seizing $1.48M of Collateral

– To pay $1.39M of Debt

– $10.7k profit for

– $5.7k profit foraverage…

— wahndo (@Wahndo_)

As more revenue is sought to be unlocked, their native stablecoin, GHO, is gaining traction. Supply growth is up 400% in one year.

What a year can do. is 4x bigger than it was last April.

Higher

— Aave (@aave)

GHO is expected to drive revenue and profits for the DAO.

Aave v3 also supports RLUSD, a stablecoin designed for institutions minted on the XRP Ledger and Ethereum.

Users can now supply and borrow RLUSD, 's enterprise-grade stablecoin, on the Aave V3 Ethereum Core market.

— Aave (@aave)

Though its market cap is small, its full fiat backing, including treasuries, strengthens its potential.

DISCOVER:

The post appeared first on .