Derivatives traders took on more exposure to Bitcoin and Ethereum on December 22 as new money flowed back into crypto futures.

Both assets posted small but steady gains over the past 24 hours. Price moves, trading volume, and derivatives activity all rose together across major exchanges.

That alignment suggests positioning built gradually, not through forced liquidations.

Bitcoin traded near $89,700, while Ethereum hovered around $3,050, each up about +2% on the day, based on data from CoinGecko.

Bitcoin saw steady follow-through on Monday as spot and derivatives data moved in the same direction.

CoinGecko shows Bitcoin spot volume near $32.5Bn over the past 24 hours, alongside a price gain of about +2.1%.

Risk appetite stayed focused in futures markets. Coinglass reported roughly $65.6Bn in 24-hour BTC futures volume, with open interest close to $59.7Bn.

That points to heavy positioning, but not the kind of leverage that usually triggers forced liquidations.

DISCOVER:

DeFiLlama shows Bitcoin-linked perpetual DEX volume at around $16.5M over the same period, suggesting most risk is still concentrated on centralized venues.

From a technical angle, Bitcoin is starting to show early breakout signals. A 4-hour chart shared by Ash Crypto shows BTC pushing above a long-term descending trendline that had capped rebounds since early November.

Price had been compressing inside a symmetrical triangle, with lower highs meeting steady demand near the $85,000–$86,000 area.

The recent push higher suggests buyers are regaining control as volatility expands near the pattern’s apex. Short-term momentum has improved, with higher lows forming into the breakout attempt.

Separately, Ted noted that Bitcoin’s 3-day chart is stabilizing after a sharp pullback.

Price continues to hold a clear demand zone near recent lows, while RSI is printing a confirmed bullish divergence, pointing to fading downside pressure rather than renewed selling.

DISCOVER:

Ethereum’s setup looks similar to Bitcoin’s, but activity is more concentrated on-chain. ETH near $3,050, up just over +2% in the past 24 hours.

Futures data from shows Ethereum futures volume around $55–56Bn over the past day. Open interest sits near $39Bn as traders rebuild positions after the recent pullback.

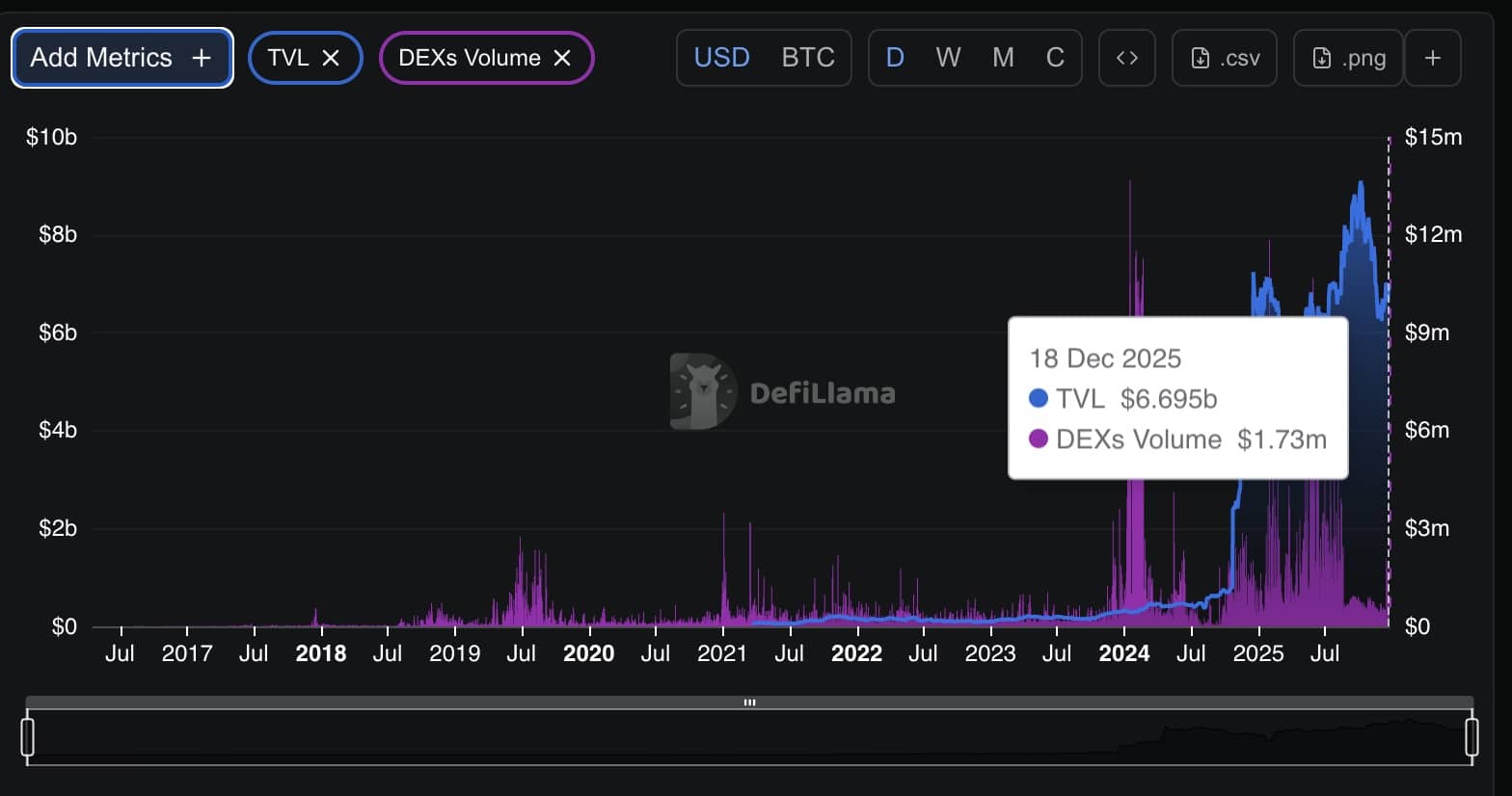

On-chain derivatives tell a tighter story. DeFiLlama data shows roughly $1.7Bn in 24-hour perpetual volume on Ethereum-based protocols, with open interest near $270M.

That sits against a broader DeFi perp market doing about $20.9Bn in daily volume.

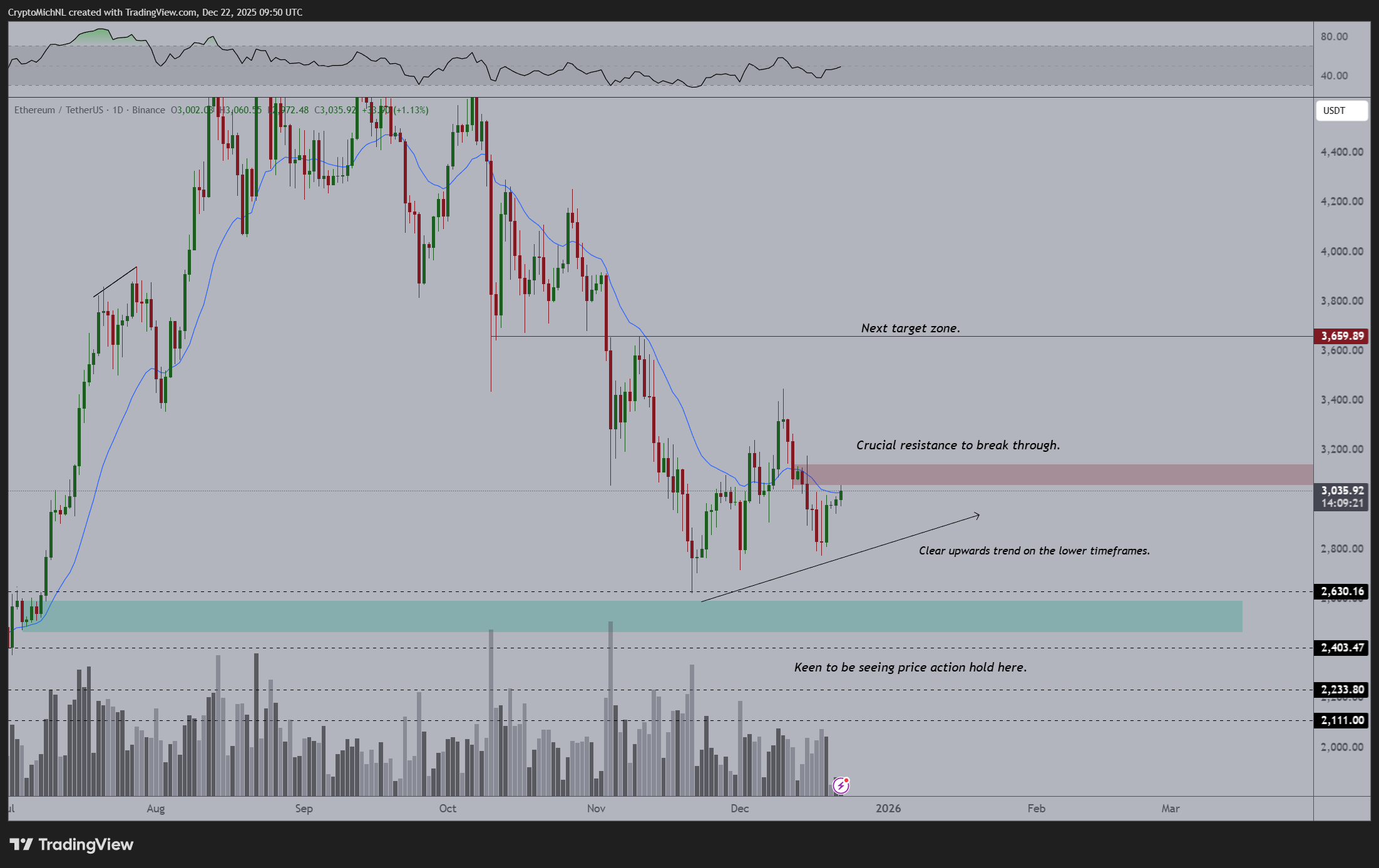

According to the analysis by Michaël van de Poppe, Ethereum is pressing against a clear resistance zone just above $3,000.

Price has tested this level several times. Each rejection has been shallow, which suggests sellers are losing control.

On higher timeframes, the downtrend is starting to flatten. On lower timeframes, ETH continues to print higher lows. That mix points to steady accumulation rather than aggressive selling.

If Ethereum breaks above this resistance with conviction, the chart leaves room for a move toward the next major supply zone.

DISCOVER:

The post appeared first on .