continues to defend the $100,000 level after a volatile week shaped by U.S. government shutdown risks and broader macro uncertainty. The chart shows signs of consolidation, with higher lows forming, a setup many traders view as a bullish sign when searching for the best crypto to buy this week. Analysts suggest that a potential rally could follow once political uncertainty clears.

This would be nice from . higher lows, lower highs consolidation and then a breakout when government shutdown ends. Yes.

— VikingXBT (@VikingXBT)

Meanwhile, Tether_to has increased its Bitcoin holdings by 961 BTC, worth around $97.3 million, reinforcing institutional confidence in Bitcoin as a reserve asset.

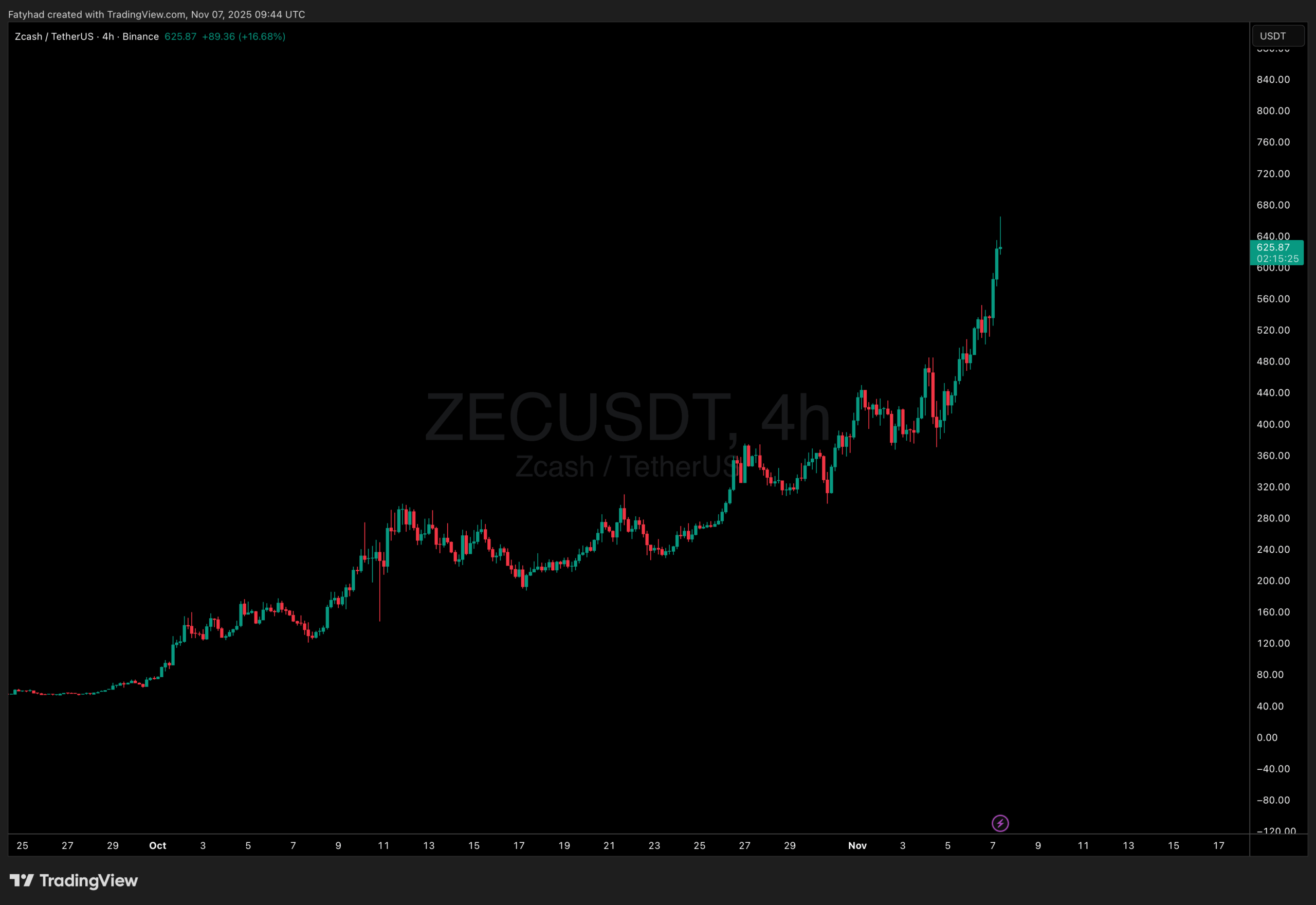

At the same time, privacy-focused cryptocurrencies are outperforming the market. Zcash has surged to $618, up 20% in the last 24 hours, while gained 2% daily and 12% over the past week.

(Source: )

Traders are increasingly rotating toward privacy coins such as ZEC, XMR, and Decred (DCR), which prioritize selective transparency rather than full on-chain visibility. These tokens act as the “digital equivalent” of off-chain self-custody, giving users control over what they share while maintaining decentralization.

Another strong mover is ICP , which has jumped 45% in a day to $8, breaking out from a multiyear downtrend that began in 2021.

After hitting an all-time low in October 2025, ICP is now returning to 2024 price levels — a sign of renewed market interest in “dino” coins (old bottomed ones).

EXPLORE:

Beyond price rallies, a major story this week is the USDX depeg. The $680 million synthetic stablecoin, issued by Stableslabs, fell as low as $0.40 after losing $1 million in the Balancer V2 exploit. The incident sparked liquidity withdrawals across platforms like Euler and Lista DAO, with borrow rates skyrocketing up to 800% and triggering cascading liquidations.

USDX has since recovered to about $0.60, but uncertainty remains over whether the peg will fully restore, as Stableslabs has yet to confirm redemption status.

In this environment, assets with proven resilience — Bitcoin, Monero, Zcash, and ICP — are standing out as the best crypto to buy, offering stronger fundamentals and market trust amid growing volatility.

As we enter the heart of altcoin season, savvy investors are narrowing in on what they believe are the best altcoins to buy right now. Major whales and institutional players appear to be positioning themselves around three tokens with very different core narratives. AIA (DeAgentAI), DASH, and HYPER (Bitcoin Hyper) are all primed for aggressive upside in Upvember. With narratives revolving around AI-infrastructure, privacy revival, and Bitcoin layer-2 infrastructure, this trifecta may encapsulate the current rotation in crypto markets. AIA managed to break out of resistance and is already on the move to the moon mission. The native token of the DeAgentAI protocol is at the forefront of the AI wave, targeting core challenges such as identity, continuity, and consensus, while operating reliably on chains like Sui, BNB, and Bitcoin. Over the past 48 hours, this coin managed to break through the $1Bn market capitalization. Currently, the price is set at around $12.50, but it remains volatile, so approach with caution. The previous resistance at $3.7 has now become support, as we stated in our recent article. Since then, the price has increased by over 800%, reaching $14.80. The RSI indicator indicates that we are currently in overbought territory, and the MACD is heavily positive.

Whales Target AIA, DASH, HYPER As Best Altcoins For November

Market Cap

AIA Frontrunning Upvember Szn: Why is DeAgentAI Dominating Market?

(Source – )

The post appeared first on .