took a tough hit today, sliding down to around $82,000 after hovering near $92,000 just yesterday. The drop wiped out more than $120 billion from the overall crypto market, bringing its total value below $2.8 trillion. For traders still searching for the best crypto to buy during this volatility, the sharp move is a reminder of how quickly things can shift in this space, especially with big leveraged bets in play.

Market Cap

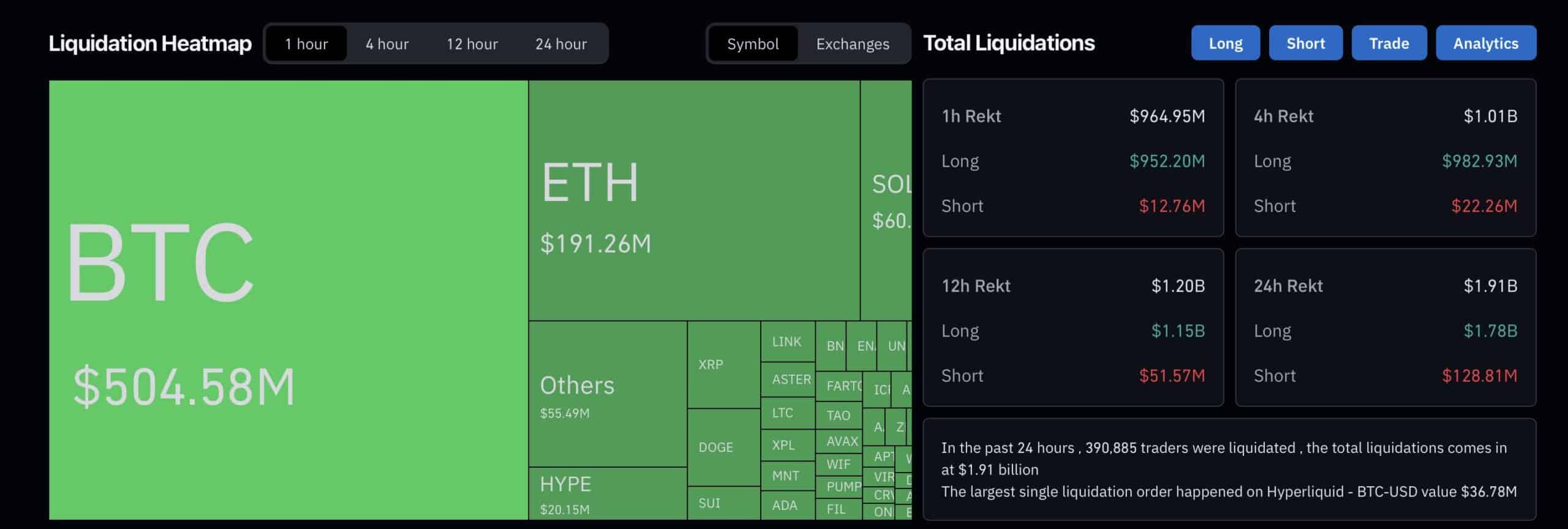

The numbers tell the story: in the last four hours, liquidators closed out over $1.9 billion in positions, with $1.78 billion coming from long trades—bulls lost this battle again. More than $1 billion was liquidated in just four hours. It’s the kind of chain reaction that happens when prices move fast and margin calls kick in.

EXPLORE:

Most altcoins joined the slide, losing 5–10% or more. fell to $2,717, down 10.44% on the day and 15.79% for the week. Solana dropped to $127.53 (-11.11%), XRP to $1.92 (-9.85%), and Dogecoin to $0.1401 (-11.22%). BNB sat at $835.64 (-7.82%), Cardano at $0.4091 (-12.79%), and Hyperliquid at $34.48 (-12.15%).

Stablecoins like USDT ($0.9989) and USDC ($0.9997) held steady, as expected.

Is everything red, down, and hope completely lost? Not really. In crypto, there is always something moving against the grain. One coin that stood out today was Cheems (CHEEMS), up 13.79%. In a sea of red, it’s the kind of spark that keeps traders scanning for hidden gems.

Rumors about MicroStrategy’s finances added fuel to the fire, given their massive Bitcoin stack. But stepped in on X to set things straight. He said the company

would only go bankrupt if an asteroid hits Earth.

Ju also explained that CEO Michael Saylor couldn’t sell Bitcoin without shareholder approval—and doing so would tank their reputation. On debt delays, he pointed to options like refinancing or BTC-backed loans; even a drop to $10,000 per Bitcoin would mean restructuring, not collapse.

It’s a vote of confidence that could help steady nerves.

DISCOVER:

So, is this the setup to start picking up cheap altcoins? History says yes. After big liquidations, markets often bounce as weak hands are flushed out. With Bitcoin finding some footing at $82,000, eyes are on U.S. jobs data later today for clues on the next move. ETF inflows could pick up too, drawing fresh money back in.

is already showing why meme coins can shine in tough times, up double digits while everything else dips. For a balanced approach, Bitcoin itself looks tempting here, backed by firms like MicroStrategy that aren’t flinching. More volatility is expected: don’t FOMO or panic—follow the market and the latest news to position yourself accordingly.

In crypto, dips like this are where patient plays pay off. What’s on your radar?

According to OKLink, the OKX Boost claim contract appears to have malfunctioned, allowing 32 addresses to claim 623 million PYBOBO tokens in just four seconds. The exploit drained nearly the entire 625 million PYBOBO reward pool, accounting for 99.68% of the total allocation. The largest single claim came from address 2zAnVa…VvCd2h, which collected 37.847 million PYBOBO—worth roughly $18,600. In response, OKX Wallet has paused PYBOBO reward claims while the issue is investigated. The team says updates will be provided once the problem is resolved. There’s a new meme coin in town, and it’s making all the right noises. ETHDAY is a fresh new meme coin centered around the Ethereum Day, a one-day event that the Ethereum Foundation hosts to celebrate the progress of its ecosystem. Currently, ETHDAY is gaining the attention of degens through viral marketing, community giveaways, and DeFi tie-ins, in an effort to capitalize on the Ethereum popularity wave. — PinkPunk Robot The major sites, such as CoinMarketCap or CoinGecko, have not listed the coin yet, suggesting that the coin is still in its early phase. At the moment, there is not a lot known about the coin other than rumours that its total supply is around 1 billion tokens, with half of them possibly locked into liquidity pools.

The question on every investor’s mind right now is simple: if BTC USD keeps dropping, does Strategy get kicked out of major stock indices? With Bitcoin sliding from six-figure euphoria to the high-$80Ks, and Michael Saylor’s Bitcoin-heavy corporate strategy under pressure, the debate has exploded across financial media. And it’s a fair concern – MSTR has become a leveraged proxy for BTC price action, rising faster than Bitcoin on the way up and bleeding harder on the way down. However, despite market fears, a Bitcoin move to $75K wouldn’t automatically trigger index removal. The reality is more nuanced, tied to market-cap rankings, premium collapse, and looming index-provider reviews rather than a single Bitcoin price threshold.

OKX Boost Contract Glitch Drains 99.68% of PYBOBO Reward Pool in Seconds

ETHDAY Meme Coin Goes Wild Before Zurich Event: Is Ethereum Day New Memecoin To Buy?

Token – Ethereum Meme Update!

Token – Ethereum Meme Update! Found Potential Gem: ( MC: 48.1M )

Found Potential Gem: ( MC: 48.1M ) Contract Address: 0xb35832e4556598ac92c6b2c7a8292f2dd92d7914

Contract Address: 0xb35832e4556598ac92c6b2c7a8292f2dd92d7914 Holders: 416

Holders: 416 Txs: 61 Buys | 61 Sells

Txs: 61 Buys | 61 Sells

(@PinkPunkRobot)

(@PinkPunkRobot)

Will MicroStrategy Get Removed From Stock Indices if BTC USD Hits $75K?

Market Cap

The post appeared first on .