In crypto market news today, the Bitcoin price is giving away a classic shakeout, plunging under 90K overnight before snapping back with a reversal to 92K, almost mechanical. Anyone who has lived through multiple cycles has seen this same movie before, a violent nuke, followed by an equally violent rebound.

The structure of the move looked weirdly similar to 2020 and 2021 flash-sell events, where liquidity hunts cleared out overleveraged longs before the trend marched upward again. For now, the market is treating the 89k region as a line in the sand.

While continues dragging its feet, something that has practically become a meme at this point, and are just kind of existing in Bitcoin’s shadow. The outlier is , which notched an impressive 3% overnight push, outpacing Bitcoin price, and showing that selective strength still exists even in shaky conditions.

If we’re reading the tape correctly, this is usually how early alt momentum starts forming. But, are we ready?

DISCOVER:

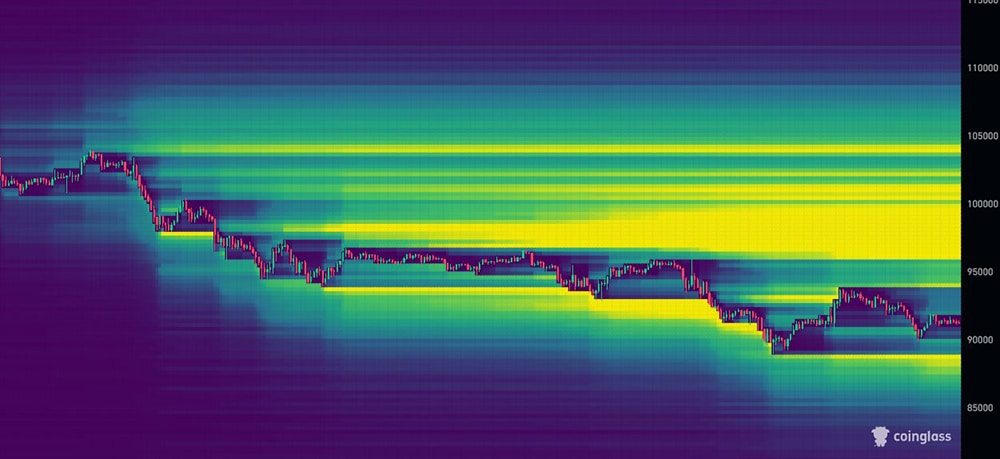

A big talking point in crypto market news today revolves around liquidation clusters. People pointed out that north of $10 billion in shorts would get vaporized if the Bitcoin price surges toward 105k. Historically, if we see this level of stacked open interest, like that of the May 2025 squeeze, the market hasn’t hesitated to run straight at it. Technically, the setup is primed for another cascade of forced buybacks once the good vibes kick.

(source – )

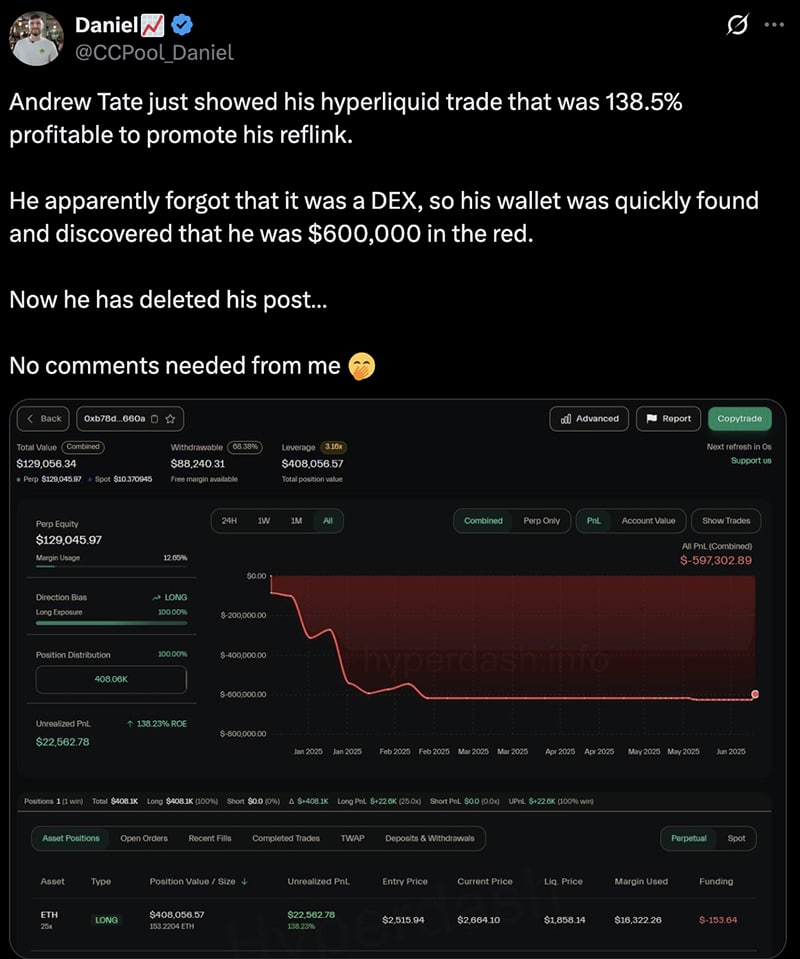

Even the Andrew Tate alleged liquidation saga on Hyperliquid fits the bull picture as overleveraged positions can’t survive these whipsaws. His wipeout referrals and all are a reminder that the market is ruthless when volatility spikes.

(source –)

Then there’s the BlackRock angle. According to Arkham, last night marked the firm’s largest Bitcoin outflow ever, which conveniently lined up with the dump. Yet the speed of the rebound hints that someone, whether institutions or a deep-pocketed group, was more than happy to scoop up those coins.

(source – )

Past cycles show that once large players unload into weakness and the price barely budges afterward, it often marks a local bottom, not the start of a deeper drawdown.

However, there is some good news. Bitcoin dominance is slipping below 60% and forming a head and shoulder pattern, which is really good news. In previous cycles, like in 2017 and 2021, the same shift preceded altcoin runs by weeks. The market often needs a Bitcoin nuke for capital to rotate, and the pieces will start falling into place again.

(source – )

DISCOVER:

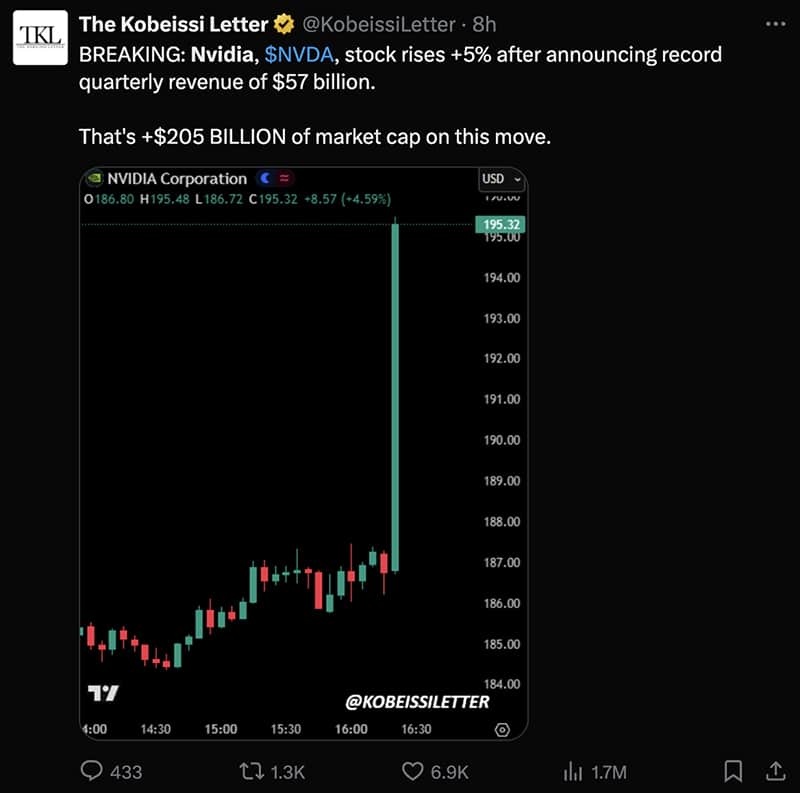

US stock futures ripping higher after NVIDIA’s blowout AI earnings are another underrated catalyst. Every time tech stocks have surged over the past two years, the Bitcoin price has followed with varying degrees of lag. Risk appetite rising in equities tends to spill directly into crypto.

(source – )

Putting everything together, crypto market news today paints a surprisingly e. The Bitcoin price defended key weekly levels, reversal strength remains intact, and liquidation data hints at explosive upside if the market pushes toward 105k.

With dominance falling, Solana outperforming, and tech stocks soaring, the conditions for another leg up are quietly but clearly forming. Bitcoin is once again reminding us that it is the revolutionary digital gold. A violent move upward is coming.

DISCOVER:

The race for the best Solana meme coins in November has taken a bizarre, pasta-covered, emperor-ruled turn, and honestly, crypto hasn’t been this unserious in months. When the rest of the market is drowning in FUD, two Italian-themed coins (ITALIANROT and ROME) have decided to march straight through the chaos like Julius Caesar with a cappuccino.

Fueled by TikTok brainrot culture, Roman Empire nostalgia, and the collective belief that memes are superior to fundamentals, these Solana projects are exploding in ways that can only be explained by pure degeneracy.

Read the full story .

The post appeared first on .