Why is Bitcoin dropping so sharply this week? Bitcoin price has slipped back toward the $90,000 zone, and the altcoins’ bear market has intensified as Ethereum, Solana, and mid-caps continue bleeding double digits.

The question of has dominated discussions, forums, and X. However, current anxiety suggests we may be nearing one of those emotional tipping points where despair tests everyone’s conviction.

Can’t sell because down bad

Can’t buy because no money

— Ash Crypto (@AshCrypto)

DISCOVER:

Just today, Bitcoin price cracked through $90,000 after more than a billion dollars in liquidations, around $800 million of that hitting overleveraged longs. This imbalance alone explains part of why Bitcoin is dropping. As more longs unwind, downside momentum feeds on itself.

Adding to the current pain, outflows from major ETFs are also adding fuel to desperation. We saw nearly a billion dollars pulled in a single day, deepening the altcoins’ bear market as liquidity drained everywhere in the market.

Technically, the chart pattern is not helping either. A fresh death cross formed on Bitcoin’s daily chart, while the RSI slipped into the low 30s, an exhaustion, even if it’s not confirming a reversal.

(source – )

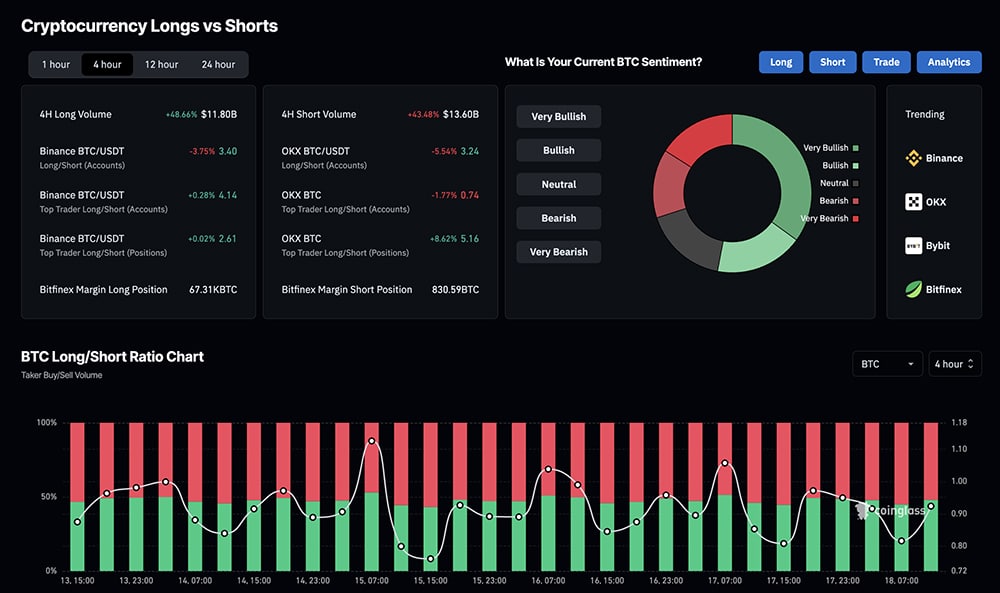

Long-to-short ratios recently dipped below 0.9 for the first time in months, indicating that shorters have finally overwhelmed longs. Historically, this combination of heavy shorts, plunging sentiment, and forced selling resembles the structure of 2022’s capitulation phases, which eventually produced major bottoms.

(source – )

Seasonally, November tends to be strong, delivering a median gain near 9% across the past decade. But 2025 is an outlier. Inflation surprises and fading odds of a December Fed cut have dragged risk assets like crypto lower, especially with the current tech slump.

Adding to why Bitcoin is dropping, large holders reportedly unloaded hundreds of thousands of BTC across the last few weeks, pushing nearly a third of the supply into unrealized loss territory.

crypto down so bad even the chart is scared to show its face

— Shibetoshi Nakamoto (@BillyM2k)

DISCOVER:

The Bitcoin price weakness looks like capitulation rather than the start of a deeper structural failure. Fear and Greed readings plunged into extreme fear, touching levels not seen since late 2022.

Typically, when forums turn hopeless, shorts pile in aggressively, and volatility drains liquidity from altcoins, the ingredients for a reversal quietly assemble. Even in 2018, the brutal November crash reset positioning before a multi-month recovery began.

Despite the chaos, some accumulation signals emerged. Several large wallets absorbed tens of thousands of BTC this week, offering a counterweight to selling pressure. If the Bitcoin price defends the mid-80Ks, it could recreate the stair step bottoming patterns seen in prior cycles.

I find it astonishing that sentiment is so down despite Altcoins looking SO good in macro terms.

Honestly, I can't understand it.

It's going to go so much higher.

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖

(@el_crypto_prof)

The altcoin bear market will likely lag any recovery, but clearing excessive leverage often sets the stage for healthier upside.

This feels like the pain month. Why is Bitcoin dropping? Because every weak hand is being wrung out. And historically, that’s when bottoms form, right as everyone believes the bull run has already failed.

DISCOVER:

Why crypto is down has become the most significant question across the market today, as Bitcoin, Ethereum, and major altcoins extend their November losses. The total crypto market cap has slipped toward $3.1Tr trillion, with Bitcoin dropping from its recent all-time highs near $126K to the $90K range.

Fear is building rapidly, with liquidations climbing above $800M in a single day, while the Crypto Fear & Greed Index plunges into extreme fear. What caused the mayhem, and did the “no data November” help for the FUD?

Market Cap

Read the full story .

The post appeared first on .