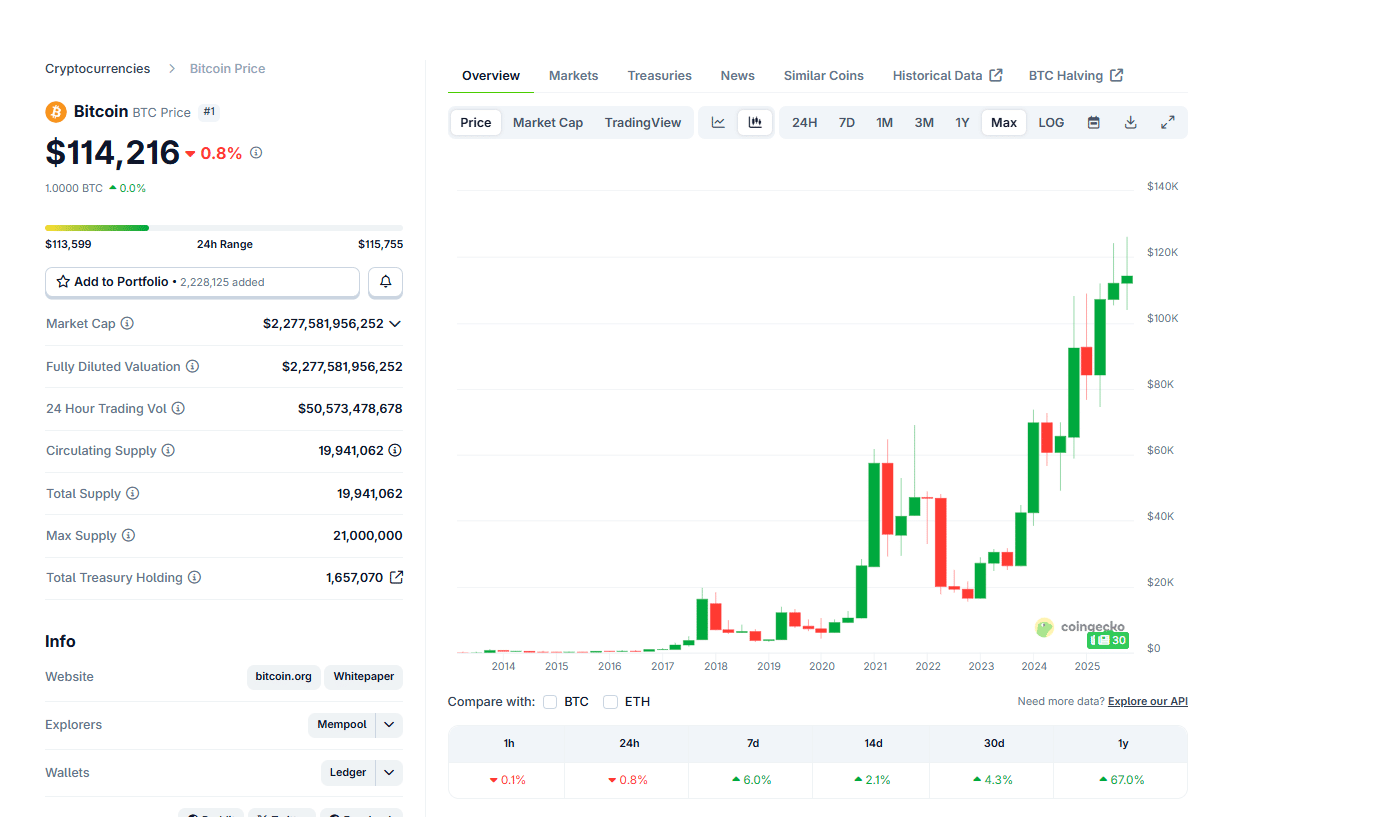

The crypto market is slightly lower today as investors wait for the U.S. Federal Reserve’s interest rate decision this Wednesday. The total market cap has fallen 1.5% to $3.86 trillion, while touched $113,800 (–1.4%) and $4,090 (–3.7%). slipped 1% to $2.64, and is down 1.6% at $1,132. The Fear & Greed Index remains neutral at 50, showing that traders are cautious before the FOMC announcement.Could this dip be the perfect buying opportunity for traders looking for the best crypto to buy?

Market Cap

The Fed is widely expected to , bringing the target range to 3.75%–4.00%. According to futures data, there’s a 96% chance of a rate cut. Markets will closely watch Jerome Powell’s comments for clues about the Fed’s direction for 2026.

Institutional activity remains steady despite the pullback. Spot Bitcoin ETFs saw $149.3 million in net inflows on October 27, while Ethereum ETFs recorded $133.9 million, showing ongoing confidence in long-term growth even as prices cool.

On October 27, Bitcoin spot ETFs recorded a total net inflow of $149 million, marking their third consecutive day of inflows. Ethereum spot ETFs saw a total net inflow of $134 million, with no net outflows among the nine funds.

— Wu Blockchain (@WuBlockchain)

EXPLORE:

While large-cap assets move sideways, several smaller tokens are performing strongly. Official Melania Meme jumped 26.8% to $0.125, and River (RIVER) climbed 25% to $8.64. Tokenbot rose 16%, now up more than 350% over the past week.

Over the weekend, World Liberty Finance (WLFI) burned 175 million WLFI tokens worth about $26.7 million, aiming to reduce supply and strengthen its ecosystem. Meanwhile, American Bitcoin, , acquired 1,414 BTC valued at $163 million, increasing total holdings to 3,865 BTC (around $445 million). These moves appear to have reignited speculative interest in Trump-related tokens.

World Liberty Fi just burned 175M ($26.72M)

— Emmett Gallic (@emmettgallic)

Analysts expect Bitcoin to stay between $113,000 and $115,000 before the Fed announcement. If the Fed confirms a rate cut, BTC could rise toward $120,000 in early November. If the central bank signals caution, a temporary dip toward $107,000 is possible.

The next two days may define the market’s short-term direction and highlight the best opportunities to buy ahead of the FOMC decision.

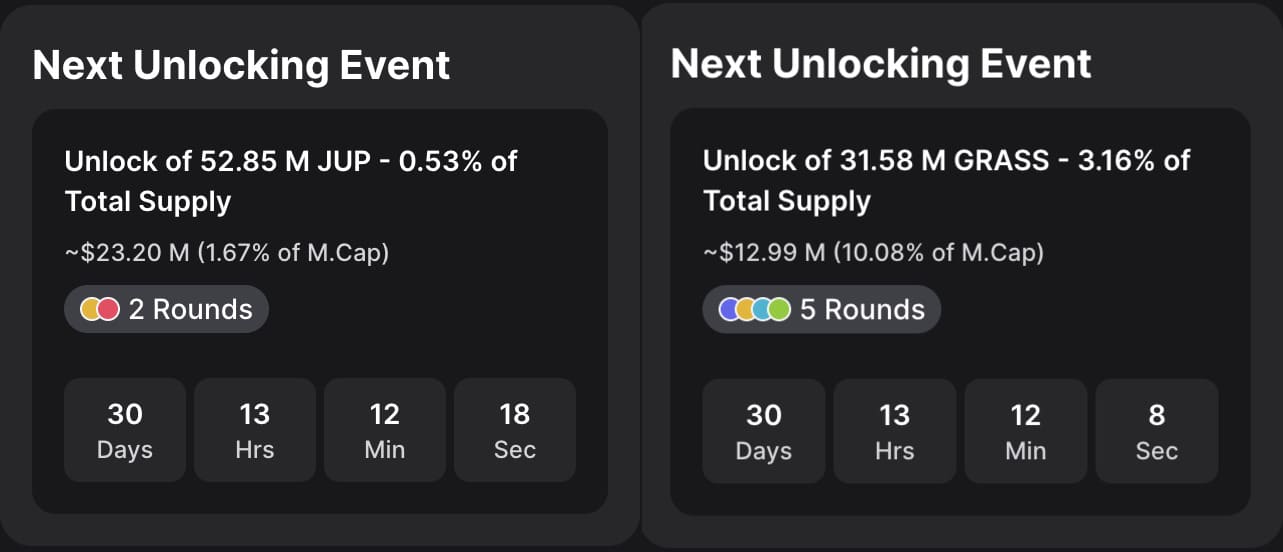

Token unlocks are coming for some significant projects, leaving investors seeking a flight to safety away from the volatility that tends to accompany substantial portions of a project’s token supply flooding the market. Bitcoin Hyper (HYPER) is a new BTC Layer-2 that is tipped to be the next crypto to explode. JUP and GRASS

are three prominent tokens with large token unlocks happening today, which will see 0.53% and 3.16% of their respective supplies flooding the market. This equates to $23.2m worth of JUP and $12.99m in GRASS being unlocked. () In the next 48 hours or so, there will be two major market-moving events. The Federal Reserve and Jerome Powell will announce new interest rates tomorrow, and US President Donald Trump will meet with Premier Xi Jinping the day after. Regardless of the outcome, the BTC USD price will move. So far, there are hints of strength. Even though Bitcoin bulls should build on the series of higher highs posted over the weekend, what’s crucial for structure traders is whether the digital gold will float above $110,000. Presently, the BTC USD price is hovering around $114,000 and $115,000, up +6% in the past week. Although stable, the sharp recovery from October 23 could be the foundation for even more gains. (Source: ) DISCOVER: The community hype has grown around the Official TRUMP memecoin in the last 24 hours, with the price action giving its best performance in months. The

memecoin surged to $8 from $6.19 or thereabouts where it was trading all day when US President Donald Trump announced that he expected a trade deal to be on the cards with Chinese President Xi Jinping. Since hitting $7.96, its price has come down and it is currently trading at

. For the longest time, the memecoin has been trading between $8 and $10. But earlier this month, the price dropped to $5.40 after Trump announced retaliatory tariffs on China, which saw $19 billion liquidated from the broader crypto market. Yesterday, after Trump announced that he expected a trade deal with China, trading activity surged. The Trump memecoin saw a surge of over $1 billion in trading volume, with Binance handling nearly 13% of all trades. “I have a lot of respect for President Xi, and we are going to come away with the deal,” he said. The memecoin’s total market cap now stands at $1.5 billion. Also, the pump has come just days after Trump Changpeng Zhao, the former CEO of Binance. JUST IN: — BlockNews (@blocknewsdotcom) Trump official has pumped 22% in the last 24 hours and is up by 18% on the weekly charts.

JUP and GRASS Face Major Token Unlocks: Whales Bid New BTC L2 – Next Crypto to Explode?

BTC USD Price Braces For FOMC: Polymarket Says Cut, Will Powell Deliver?

Official TRUMP Memecoin Sweeps Degen Attention: Is Undervalued Official MELANIA Best Memecoin to Buy?

Market Cap

Donald Trump's memecoin is up 30% today, its biggest gain in 190 days

Donald Trump's memecoin is up 30% today, its biggest gain in 190 days

The post appeared first on .