The US and China are always playing political chess. Every time there is a major announcement, touching on rare earth metals from China, or tariffs from the US, expect them to move asset prices, creating top trending crypto and Bitcoin news.

A trigger to the crypto collapse on October 10 and 11 was partly due to tariff announcements from the United States, a retaliation to new rare earth export rules. The good news is that everything has been relatively calm in the past few days, a net positive for Bitcoin and some of the .

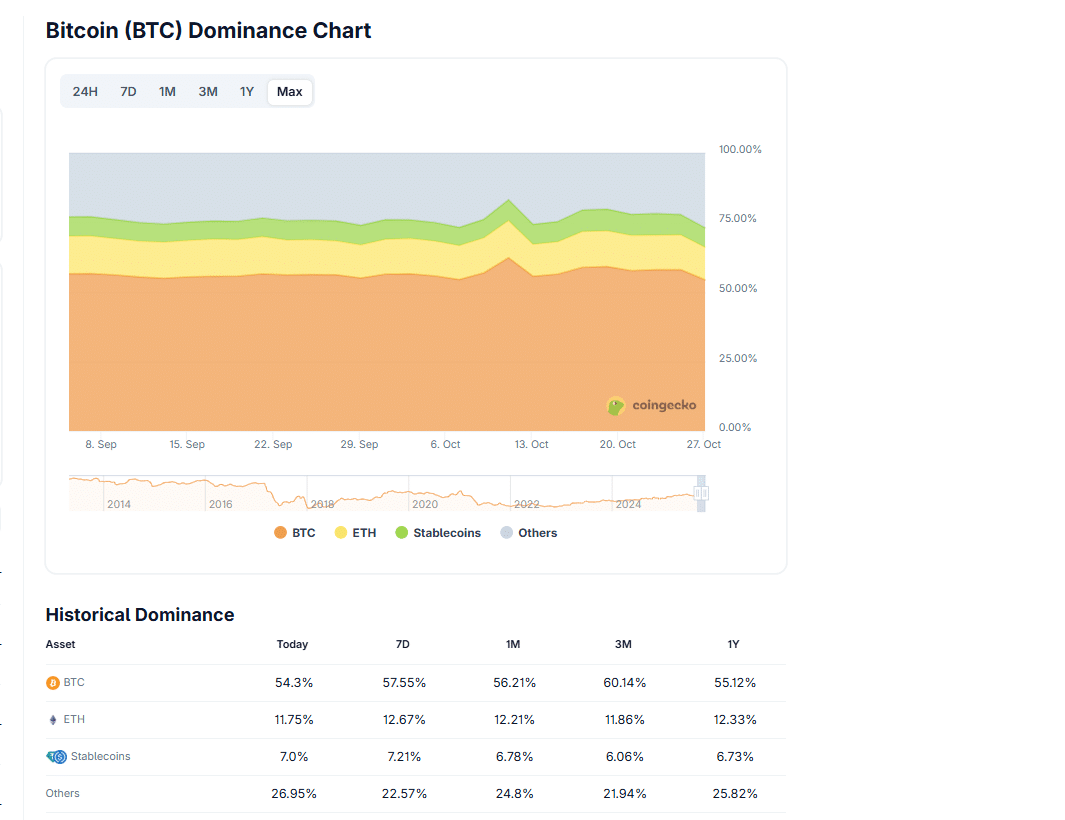

At spot rates, the total crypto market cap is up +3% to over $3.9Tn at press time. Meanwhile, the Bitcoin price is up +3% in 24 hours, pushing weekly gains to over +3.5% at press time. Impressively, the digital gold is changing hands above $115,000, pushing its dominance to over +54%.

(Source: )

DISCOVER:

Part of this recovery stems from positive news from Asia, where Donald Trump is currently on tour. Following discussions that concluded yesterday, October 26, in Kuala Lumpur, Malaysia, there are indications that a major addressing contentious issues will be finalized when Trump meets with Xi Jinping this Thursday.

Most importantly, it is reported that China agreed to freeze its production of rare earth metals for one year. The new export rules, which forced Trump to announce tariffs of over 100% on Chinese goods earlier this month, were, and still are, the major source of friction, a top priority as resolutions are needed.

In exchange for the one-year delay, the United States will hold off its threats to impose new +100% tariffs on Chinese goods, a move that, if implemented, would likely cause major disruptions across industries in China.

Additionally, China, which has been shifting to Latin America, specifically Brazil, will increase its soybean imports from the United States. In return, the United States will reportedly relax specific export controls and, crucially, adjust pot fees that have been imposed on China.

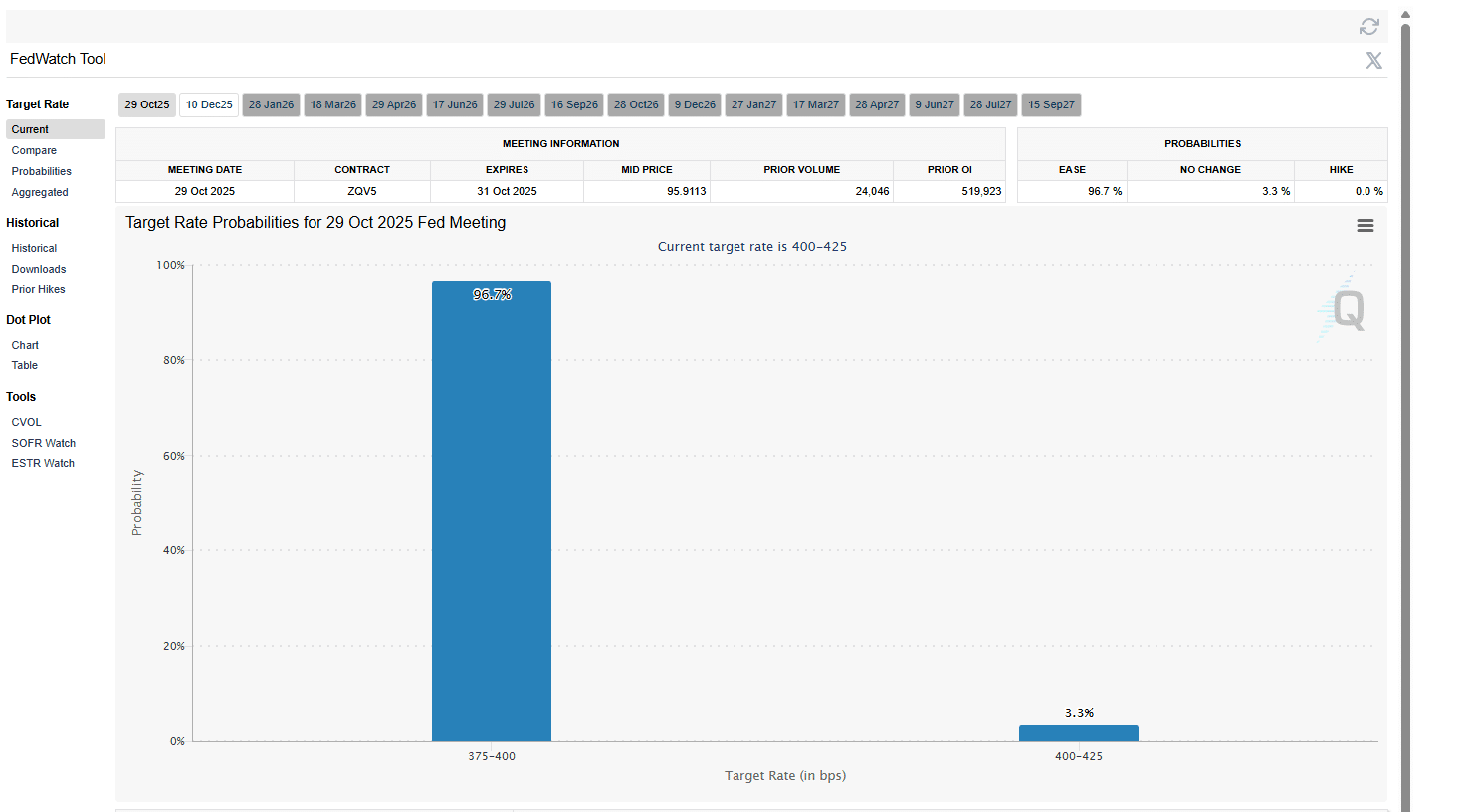

These key deals come as the crypto world expects the Federal Reserve to slash rates later this month. According to the FedWatch Tool, there is a 97% probability that the central bank will reduce its funds rate by 25 basis points at the next meeting.

(Source: )

If the FOMC and Jerome Powell also end up being dovish in their press conference, not only will BTC USDT tick higher, but there is also a likelihood that some of the will rally.

DISCOVER:

Technically, the path of least resistance is southwards.

BTC USD prices remain within the bearish bar of October 10.

For this to shift, there must be a sharp close above $116,000, accompanied by expanding trading volume.

Market Cap

The Bitcoin price must also stay above the psychological round number at $100,000 and October 2025 lows. If this prints out, buyers will likely breach $126,000, soaring to fresh all-time highs in Q4 2025.

A lax monetary policy will provide the much-needed tailwinds. In the short to medium term, one trader on X thinks the Bitcoin price is headed to nearly $122,000, the 1.38 Fibonacci extension level. For this to happen, BTC USDT must first close above $114,000.

: The price has broken above $114,026, so I’ve removed the orange scenario from the chart. The price may now target the 1.38 Fib extension level at $121,846.

— Man of Bitcoin (@Manofbitcoin)

Amid this bullish price action, BTC holders are moving coins away from centralized exchanges at the “fastest rate in history.” By the time the analyst shared this data, there were only 2.4M BTC held across all centralized exchanges.

HISTORIC SIGNAL:

BITCOIN RESERVES ON EXCHANGES JUST COLLAPSED TO 2.4M BTC.

COINS ARE LEAVING EXCHANGES AT THE FASTEST RATE IN HISTORY.

WHEN SUPPLY DRIES UP, PRICE DOESN’T STAY LOW FOR LONG.

— Merlijn The Trader (@MerlijnTrader)

Typically, it is a positive signal when coins are moved from custodial ramps. With coins under the control of holders, it becomes incredibly hard to swap for fiat.

DISCOVER:

The post appeared first on .