The global financial system is about to melt down and you’re laughing? tumbled to a 15-week low of $105,000 Friday as renewed stress in US regional banks rattled markets and reignited fears of a broader credit crunch.

Here’s a brief snapshot:

An industry-wide with added shark cannibalization frenzy, anyone? Well, the important thing is that we all had fun.

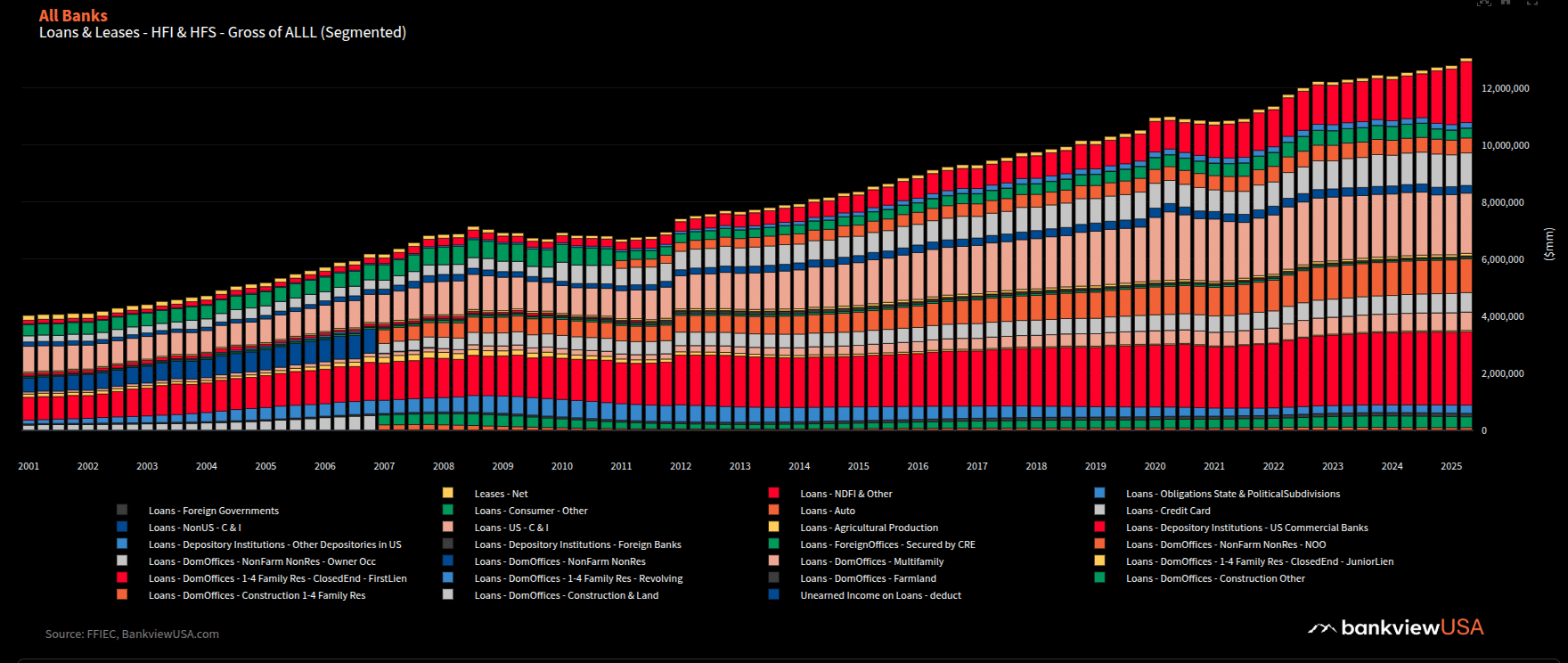

Turns out we were all right and banks have been lending against dog shit private credit for the last 5 years

H/t for the chart

— Daniel A. Saedi (DataManDan) (@TheRealDanSaedi)

The slide followed news that Zions Bancorporation wrote off $50 Mn in fraudulent commercial loans, which wiped more than 6% off its stock and sparked a broader rout in regional banks.

So what’s coming next? Is the Bitcoin USD price screwed?

DISCOVER:

99Bitcoins analysts warn BTC may “go straight to $98,000” if key supports fail. BTC has lost the $108,000 level, leaving limited support until $101,000-$102,000, according to investor Ted Pillows. Moreover, Bitcoin has now touched its for the first time in six months, a huge sign of waning momentum.

“If further disclosures reveal more losses, weaker names could get re-rated aggressively downward,” warned Brian Mulberry of Zacks Investment Management.

The concern was rare, ripping crypto apart, where leveraged positions were flushed again. data shows that Bitcoin is trading around $105,006, down nearly 6% on the day, while Ethereum has fallen 5% to $3,720.

DISCOVER:

While crypto bled, gold reached new all-time highs near $2,650 per ounce, extending its rally amid the flight from risk. The divergence between Bitcoin and gold revived an old debate over which asset is the better hedge against systemic stress.

“It’s not just a de-dollarization trade but a de-bitcoinization trade,” argued Peter Schiff, predicting gold could “reach $1 million before Bitcoin.”

Still, some analysts see potential for rotation. Crypto trader Jelle noted that profits may soon “” as markets seek risk-on exposure if volatility subsides.

DISCOVER:

The parallels to last year’s SVB bank rout are hard to ignore. Jamie Dimon warned earlier this week that “when you see one cockroach, there are probably more.” For now, Bitcoin remains vulnerable, and we don’t know how far this downward trend will continue.

reports that long-term holders haven’t flinched, continuing to pull BTC from exchanges. That steady conviction may form the base of the next leg higher, but for now, nobody knows the extent of the bank contagion.

EXPLORE:

The post appeared first on .