Why did Ethereum drop? Well the fundamentals haven’t changed for ETH but my net worth has. slid sharply this week, in 24 hours as a mix of structural and psychological pressures collided – but how is it impacting Ethereum price prediction.

A exploit triggered the initial wave of selling, but the cascade quickly spread across the market, sending BTC down 5% and pulling total crypto market cap below $3Tn.

$1M profit in just 1 hour!

Trader pension-usdt.eth opened a 2x short on 6,358 ($18M) an hour ago — right before the market dropped — now sitting on an unrealized profit of $1M.

— Lookonchain (@lookonchain)

Meanwhile, crypto whales are selling their bags, and short sellers sense an opportunity. Here’s what you need to know for the ETH price:

DISCOVER:

One of the day’s biggest headlines came from an on-chain alert showing a , that has been dormant for ten years, moving 40,000 ETH, originally purchased for $12,400 at $0.31. That stash is now worth roughly $120 million, a 9,677x return by today’s pricing.

Despite fears of a selloff, no exchange deposits were detected.

: “The transfer appears to be an internal move, not a liquidation event.”

A whale transferred $120,000,000 in after 10 years of dormancy.

He bought them for just $12,400 and is now sitting on a 9,633x return.

Life-changing wealth with Ethereum.

— Ted (@TedPillows)

Historically, early-era ETH whales have caused more social-media panic than real market damage. Dormant wallet activations are narrative events, not typically liquidity events.

DISCOVER:

The real trigger came from a Yearn Finance exploit reported by CoinDesk, which blindsided markets already stretched by leverage. As the exploit circulated, ETH futures unwound aggressively, and more than $600M in crypto liquidations hit the tape, per CoinGlass.

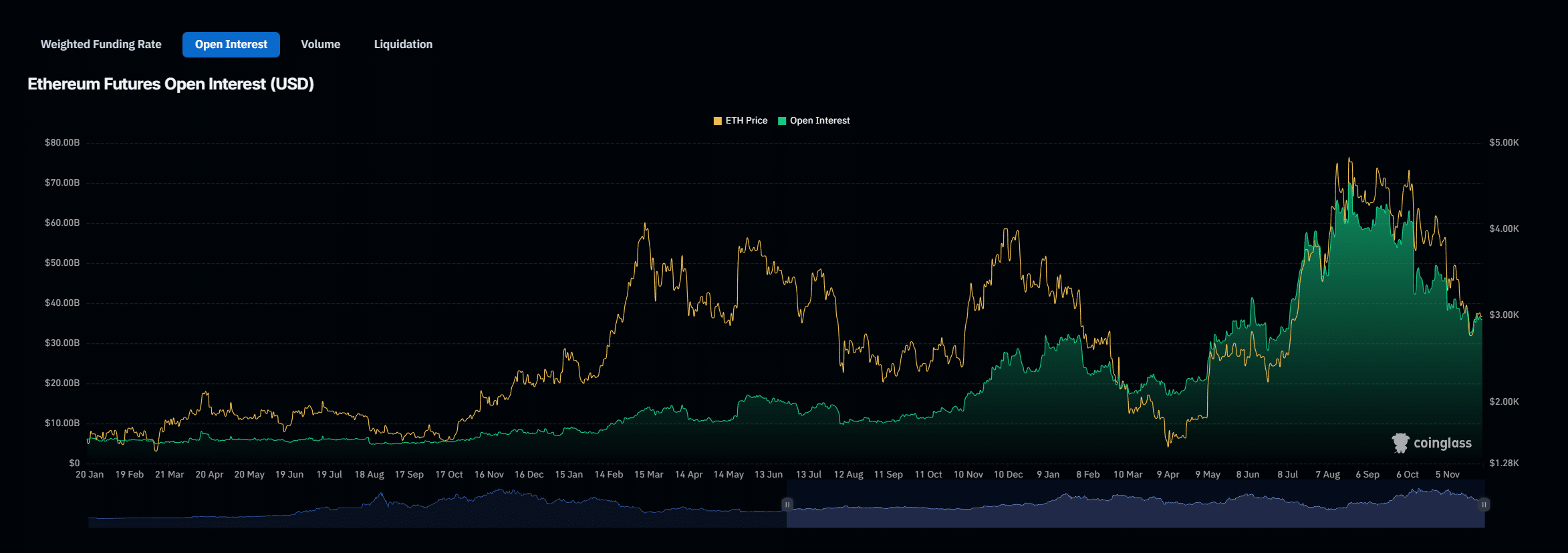

shows a sharp increase in ETH futures open interest through late November, followed by a violent flush as traders were forced out. Retail investors accused insiders of front-running the exploit, though no evidence supports the claim.

Meanwhile, Taiwanese whale Machi Big Brother once again found himself on the wrong side of volatility. His partial liquidation left him holding 3,300 ETH at 25x leverage, with a liquidation price of $2,831.58.

Screenshots of his HYPE and ETH perpetual positions show another $1.7M in forced closes and a -108% ROE. Analyst Wukong: “This is what happens when you treat ETH like a casino chip instead of collateral.”

Machi() just got partially liquidated again as the market dropped!

He still has a 3,300 ($9.4M) long position left, with a new liquidation price of $2,831.58.

— Lookonchain (@lookonchain)

From a data perspective, Ethereum remains in a fragile spot.

shows ETH trading on fading spot volume, while Glassnode’s funding rate metrics indicate an unhealthy tilt toward high leverage even after this washout. FRED data on global liquidity continues to trend downward as Japan signals tightening and US real yields remain elevated.

EXPLORE:

The post appeared first on .