The Bitcoin experiment is over. Thank you, Mr. President. You’re all holding Beanie Babies now. Buy silver. Buy gold.

At least this is how and Reddit are reacting. The real fear – and for some, hope – is that will be affordable again within your lifetime.

the scammers won. and crypto, (along with the rest of the markets), have become financialized beyond belief

total reset is needed

both of trust,

and of wealth distribution— lucas (@lucasdimos)

screens worldwide lit up red as Bitcoin knifed down to $81,000, and the market broke in seconds. More than $1.68 Bn in leveraged positions vanished in a single day, a rapid unwind that caught traders flat-footed and overexposed.

Around 267,000 accounts were liquidated, with longs making up roughly 93% of the damage. This was not but leverage snapping under its own weight. Bitcoin absorbed about $780 Mn of the losses and Ethereum another $414 Mn.

The big worry now is that the next big group of buyers can’t afford Bitcoin anymore. We don’t mean unit bias. We literally mean they have zero income. Gen Alpha sees holding one Bitcoin as a symbol of success. Is BTC priced too high?

DISCOVER:

The liquidation data shows how concentrated risk had become across venues. Hyperliquid led the event with approximately $598 Mn in forced closures, more than 94% of them long positions.

Bybit followed with $339 Mn, while saw $181 Mn liquidated. This wasn’t panic selling from spot holders but margin math doing its job.

Liquidations cascade because falling prices trigger margin calls, which force sales, which push prices lower again. Once momentum flips, the exits get crowded fast.

According to CoinGlass, total crypto open interest fell sharply alongside the selloff, confirming that leverage was flushed rather than rotated. Glassnode data shows funding rates had been persistently positive heading into the drop, a classic sign of one-sided positioning.

DISCOVER:

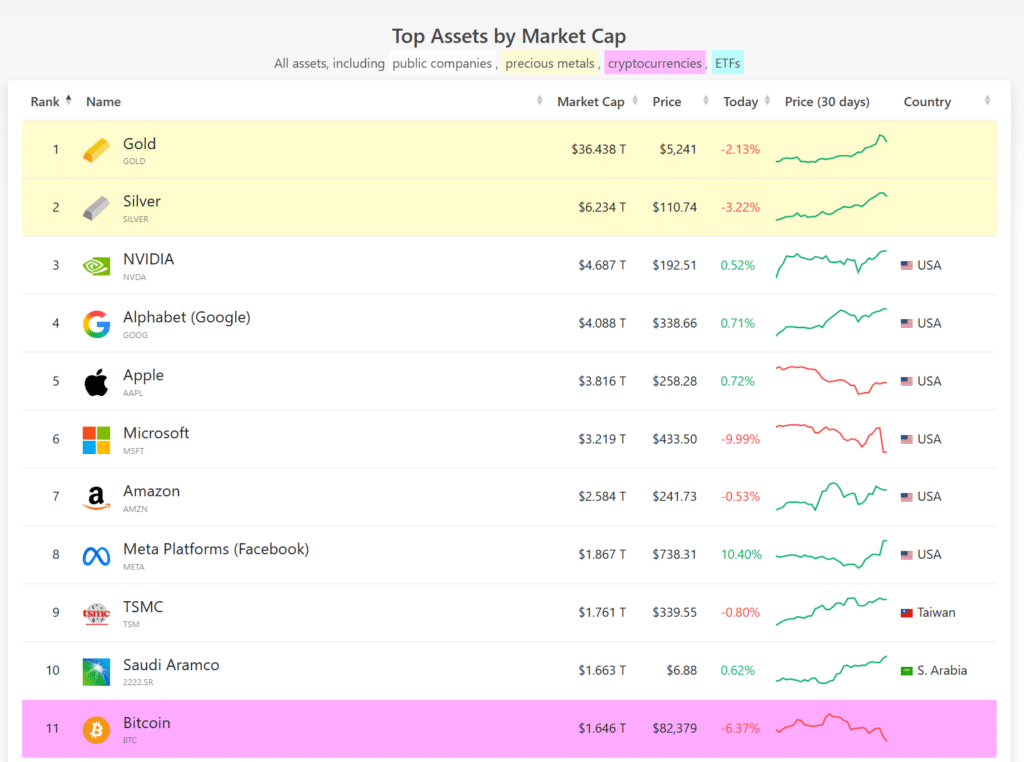

The spillover for the BTC crash was immediate. Strategy, Bitmine Immersion Technologies, and Gemini-linked equities each dropped close to 10% in regular trading.

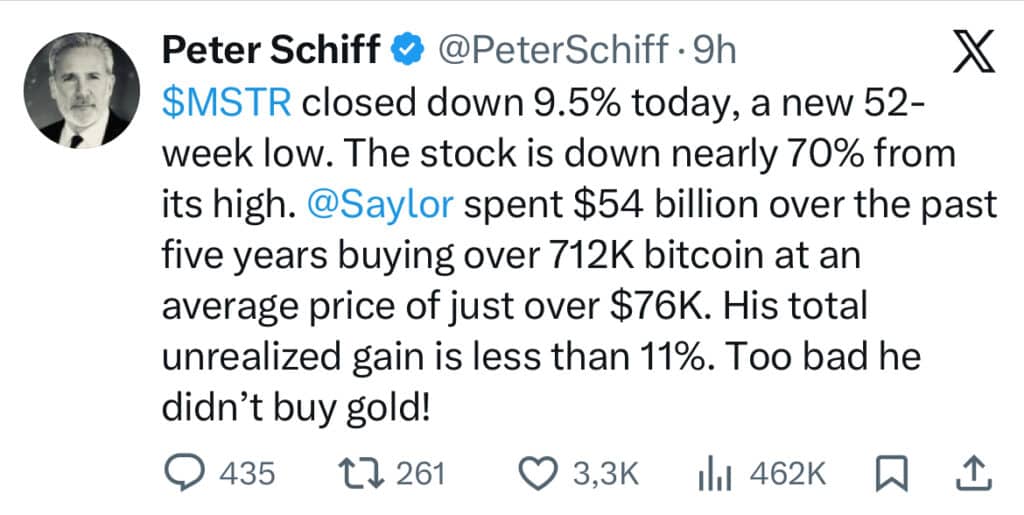

As it stands, many are egging on the collapse of Strategy and Michael Saylor, someone who has been the most vocal and flamboyant in the crypto markets.

The silver lining is that Strategy is currently priced lower than its net asset value, which nears $73.62 Bn in total assets. The stock has basically been treated like a 2x BTC downside and 0.5 BTC upside for over a year now. It will go up if Saylor doesn’t get liquidated.

Investors of Strategy argue if you are even slightly bullish on BTC, this will 2x again if Bitcoin goes up 20% this summer.

DISCOVER:

What’s the next Bitcoin, retail investors are wondering. The new Bitcoin will just be Bitcoin. We do this every 4 years and people still don’t get it.

However, this recent slaughter in crypto was about positioning and policy. Retail is afraid of the uncertainty in markets and the next chaotic moves President Donald Trump makes. The lesson here is that when everyone crowds into the same trade, the unwind is brutal.

EXPLORE:

Follow 99Bitcoins on For the Latest Market Updates and Subscribe on For Daily Expert Market Analysis

The post appeared first on .