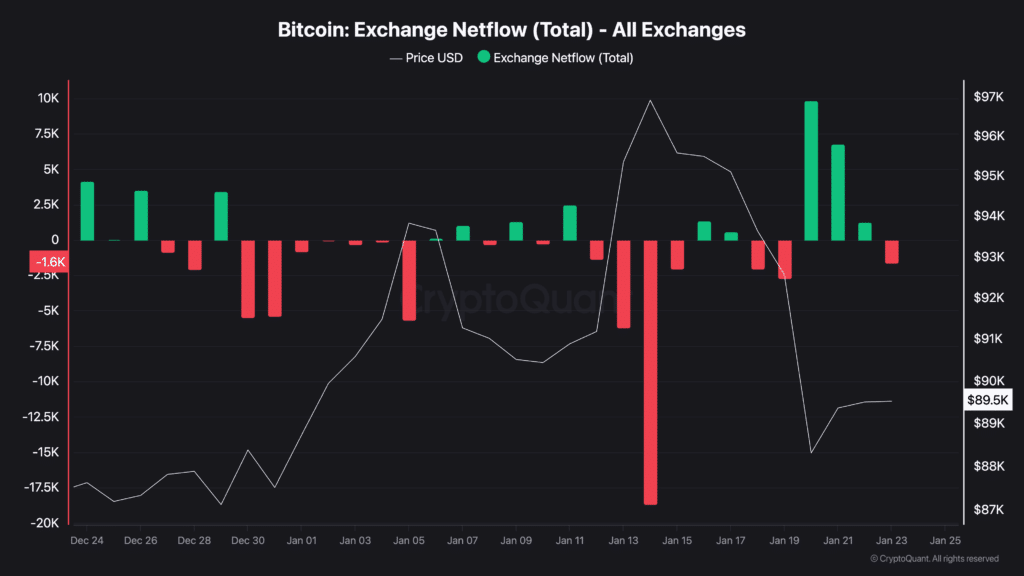

Roughly 17,000 Bitcoin reportedly moved onto crypto exchanges this week, a pattern traders watch closely for sell pressure. Bitcoin slipped as the inflow appeared, struggling to hold recent highs as short-term sellers woke up. This move lands in a market shaped by massive Bitcoin ETF demand and a growing tug-of-war between long-term holders and fast money.

DISCOVER:

When Bitcoin moves onto exchanges, it often signals intent to sell. Think of it like taking cash out of a savings account and placing it on the counter. You might spend it. You might not. But the chance jumps.

(Source: Last week Bitcoin exchanges netflow / )

On-chain trackers spotted about 17,000 BTC hitting exchanges in a short window. For beginners, this matters because heavy inflows often precede pullbacks, especially when prices already sit near recent highs.

This behavior stands out because long-term holders recently slowed selling and even resumed accumulation, according to . That split tells us short-term traders are active, while patient investors still show confidence.

DISCOVER:

Bitcoin ETFs now play a huge role in price action. In 2025 alone, spot Bitcoin ETFs absorbed over 617,800 BTC, supply off the open market and tightening liquidity.

(Source: Lastest Bitcoin ETFs flow data / )

That demand explains why sell-offs look sharper but shorter. When Bitcoin dips, ETF buyers often step in. According to , ETF flows now act like a sentiment engine, amplifying both fear and confidence.

So while exchange inflows raise eyebrows, they no longer guarantee a long crash. The market has a new buyer class with deep pockets and longer time horizons.

If you are new to Bitcoin, this data is not a sell signal on its own. It is a volatility warning. When most holders sit in profit, selling pressure rises because people feel comfortable locking in gains.

During past rallies, on-chain profitability above 95%, a zone where pullbacks become common. That does not kill the bull trend. It resets it.

For beginners, the smart move is simple. Avoid chasing green candles. Spread buys over time. Never use money you need for rent, food, or emergencies.

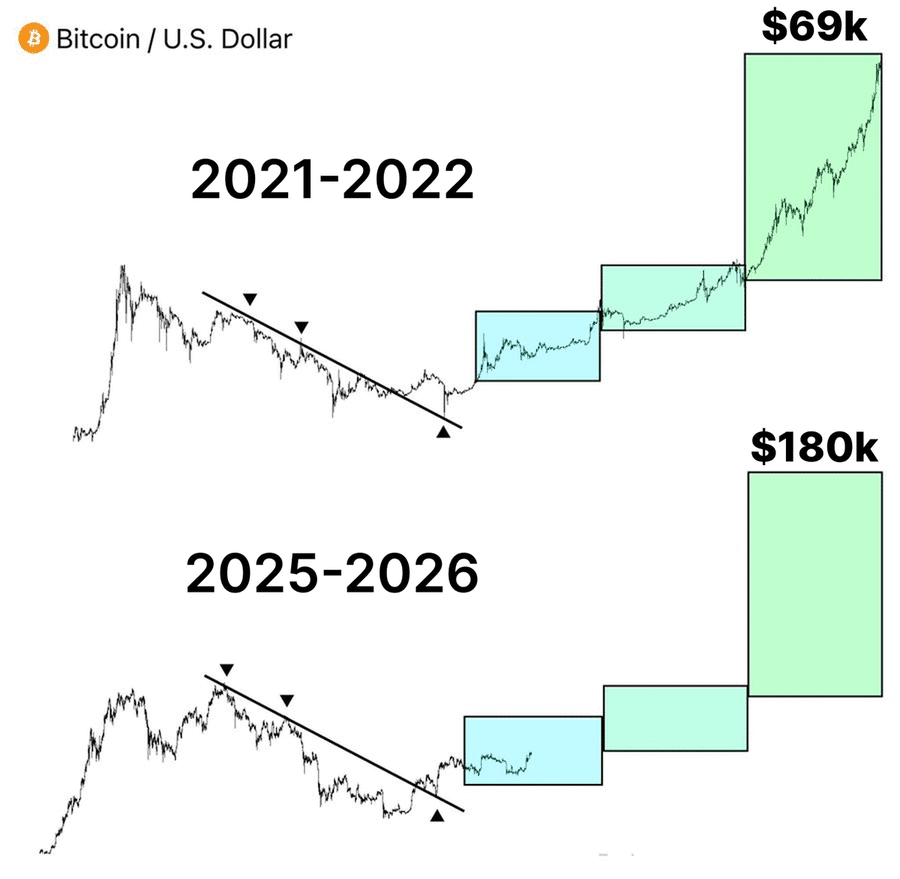

(Source: Possible scenario for bitcoin / )

DISCOVER:

Follow For the Latest Market Updates and For Daily Expert Market Analysis

The post appeared first on .