Bitcoin (BTC USD) price closed September near $113,400, slipping from an intraday high of $114,842 as trading wrapped up on September 30. The late-month pause came as gold pushed to fresh all-time highs, renewing debate over whether Bitcoin might follow bullion’s lead into Q4.

Gold’s surge set the tone for the close. As per Reuters Spot XAU/USD touched roughly $3,871 per ounce on Sept. 30, lifted by US government shutdown concerns and expectations that the Federal Reserve may lean toward policy easing.

Market watchers say a softer yield backdrop could support risk assets, including Bitcoin, in the weeks ahead.

DISCOVER:

For Bitcoin, $115,000 now stands out as the first upside trigger, while a Chicago Mercantile Exchange “gap” near $110,000 remains a near-term downside magnet.

Traders described the latest action as consolidation, noting parallels between BTC’s setup and gold’s breakout pattern.

“The breakout is coded. Next stop: price discovery mode,” one analyst .

BITCOIN IS FOLLOWING GOLD’S SCRIPT.

Gold: shakeout into ATH.

Bitcoin: same consolidation, same trap.The breakout is coded.

Next stop: price discovery mode.— Merlijn The Trader (@MerlijnTrader)

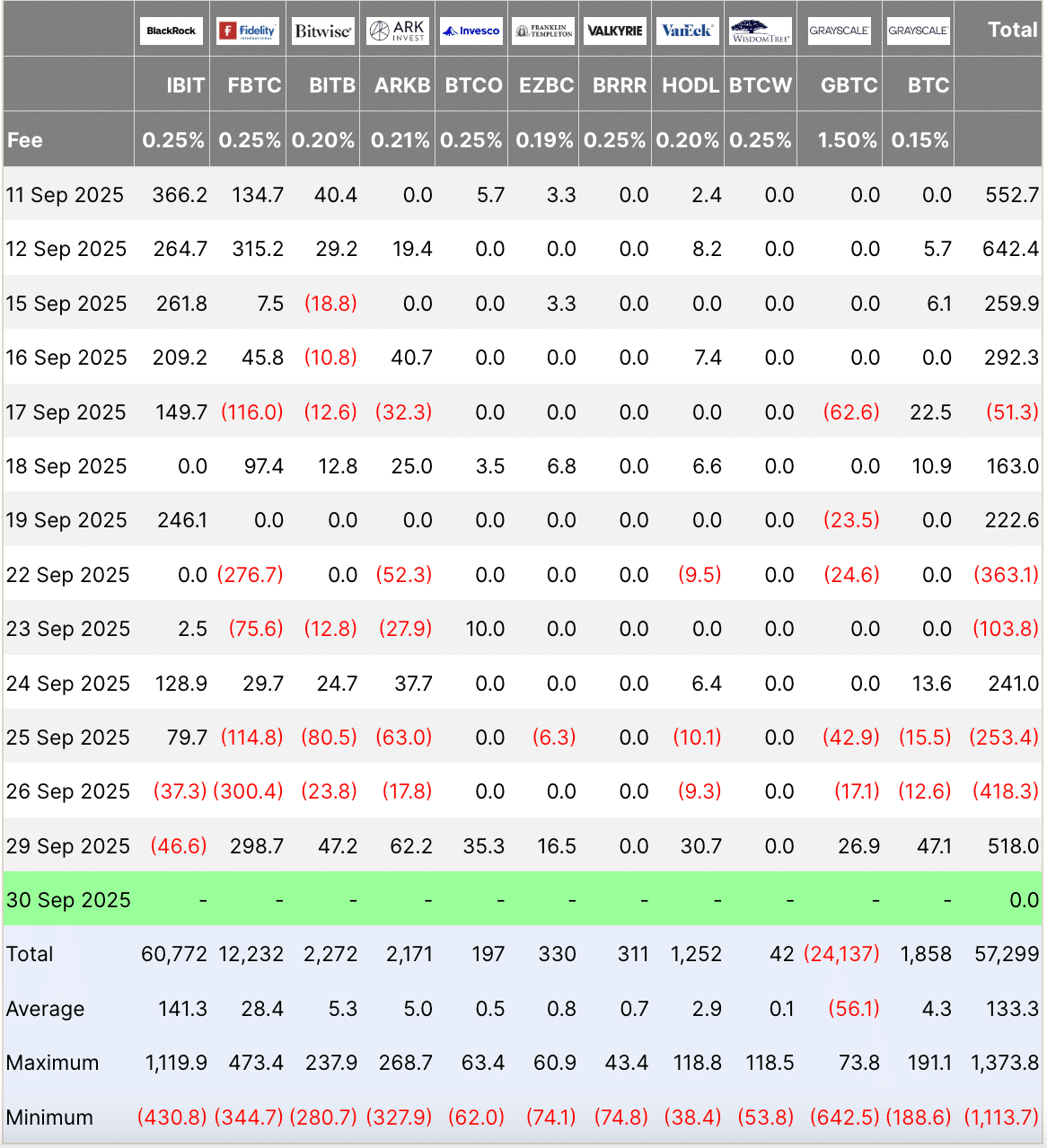

According to Farside investors’ US spot Bitcoin funds recorded a net +$518M inflow on Sept. 29, the strongest daily intake of the week, partly offsetting earlier outflows.

Data for September 30 was not finalized by press time.

()

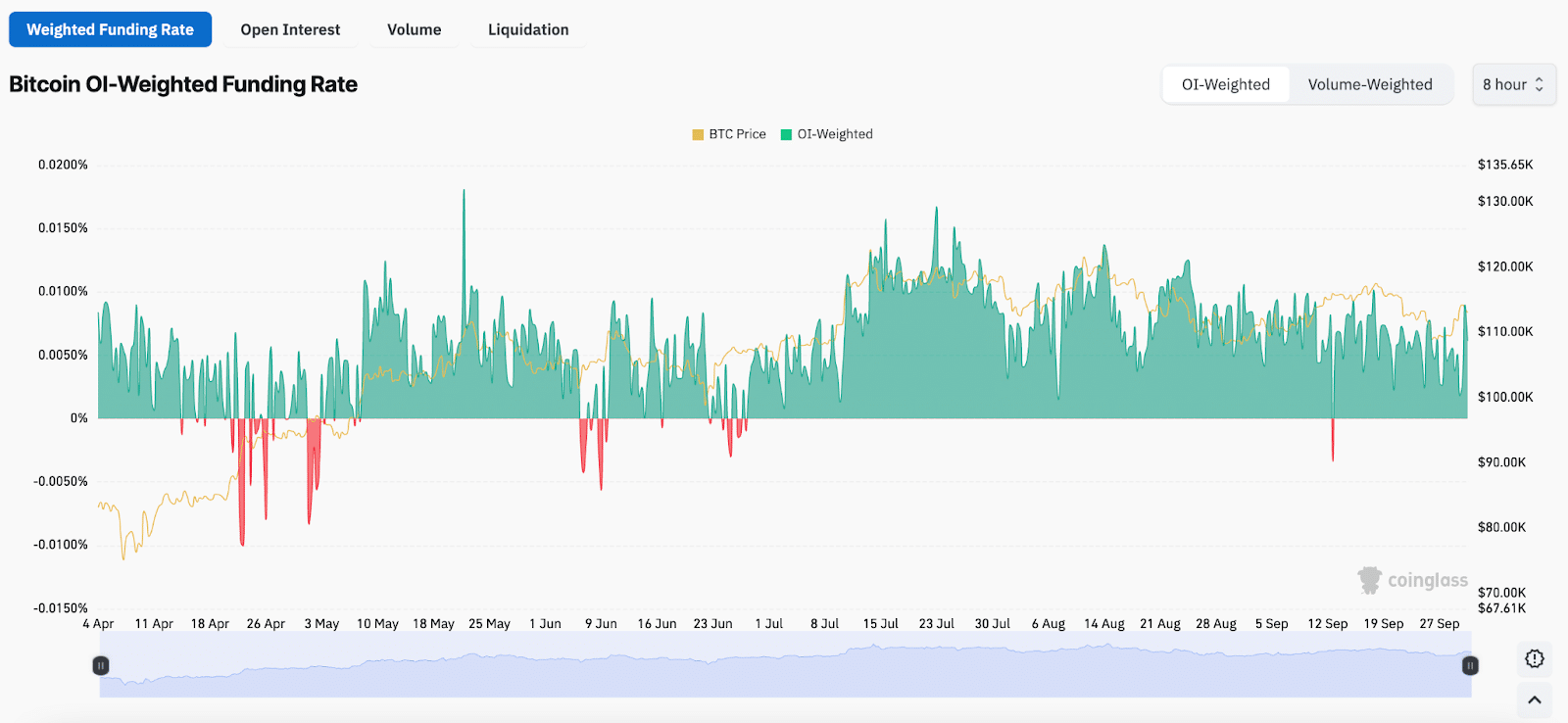

Perpetual futures funding stayed modestly positive across exchanges, suggesting a mild long bias without the overheated positioning that often marks local tops.

()

With Q4 underway, Bitcoin bulls are watching to see if gold’s record rally proves a leading signal or if downside risks tied to the $110K gap pull prices lower before any sustained push above $115K.

DISCOVER:

Bitcoin (BTC) is finding fresh support after blockchain intelligence firm Arkham that Tether purchased $1Bn worth of the asset.

TETHER JUST BOUGHT $1 BILLION USD OF BITCOIN

TETHER IS BULLISH ON

— Arkham (@arkham)

The move signals strong institutional demand and adds weight to bullish expectations heading into the final quarter of the year.

Market analysts say Bitcoin’s price action is shaping up for another attempt at higher levels, despite a brief dip on Tuesday.

Crypto trader Michaël van de Poppe the recent retreat as a “slight pullback,” noting that BTC has already cleared an important resistance area.

As you can see, broke through a crucial resistance zone and has a ton of upwards potential.

I would assume that we'll have a slight pullback and start running upwards from there.

It's buy the dip season and I think we'll see a new ATH in October.

— Michaël van de Poppe (@CryptoMichNL)

“Bitcoin broke through a crucial resistance zone and still has significant room to run higher,” he said in a market update.

At the time of writing, BTC trades near $112,800, down about 1.2% on the day.

The daily chart shows the coin consolidating below the $115,000–$118,000 band, where it has faced repeated rejection over the past three months.

Still, buyers have held the $109,000 level, framing the current move as a correction within a broader uptrend rather than a reversal.

Analyst Ted, who tracks the correlation between Bitcoin and gold, that BTC tends to lag behind gold’s movements by an average of eight weeks.

has been highly correlated to Gold with an 8-week lag.

Right now, Gold is hitting new highs, which means Bitcoin will do this next.

Maybe we could see another correction, but overall Q4 will be big for Bitcoin.

— Ted (@TedPillows)

Gold recently climbed above $3,800 per ounce, marking a new high. If Bitcoin follows the same path, it could target resistance near $125,000 and potentially higher, echoing past late-year rallies.

Traders remain cautious about the near term. Another correction toward the $109,000–$110,000 zone remains possible before momentum picks up again.

A decisive close above $118,000 would confirm a bullish continuation.

()

With Tether’s billion-dollar buy and gold’s record run forming the backdrop, sentiment is tilting positive. Q4 has historically been one of Bitcoin’s strongest periods, and many see the stage set for another attempt at fresh highs before the end of the year.

DISCOVER:

The post appeared first on .