A new Deutsche Bank study asks whether Bitcoin could sit alongside the surging gold price in central bank reserves by 2030. The comparison focused on liquidity, volatility, and credibility, and the outcome was blunt: both may end up coexisting.

The report calls gold and Bitcoin “” for central banks. But it also stresses that the US dollar isn’t losing its top spot anytime soon.

“We conclude there is room for both gold and bitcoin to coexist on central bank balance sheets by 2030,” the analysts wrote.

Meanwhile, gold is up +10.5% over the last week while BTC USD is down almost -4%. So, which is the better investment for Q4 2025?

Gold remains the bedrock of official reserves. In September, prices surged to an all-time high of $3,783 per ounce, fueled by central bank purchases and geopolitical risk.

According to FRED data, gold demand from has climbed for five consecutive quarters, the longest stretch since the 1970s.

The Gold Price is Wrong

Gold is actually cheap relative to the global currency fiat money supply.

And the setup for much higher prices is staring us in the face.

At $3,600, everyone knows that gold is at nominal all-time highs.

But relative to M2, it’s well below historical…

— Katusa Research (@KatusaResearch)

On one hand, we know it’s beaten to death, but going on the gold or any other is mind-blowingly vapid.

Hell, just the whole site is:

But with that said, gold can’t stop winning.

Henry Allen, strategist at Deutsche Bank, put it bluntly:

“Whilst gold prices have many drivers, one is the perception that it operates as a haven that investors buy in times of fear.”

The rally echoes the Volcker era of the 1980s, when tight money policy triggered demand for safe havens.

DISCOVER:

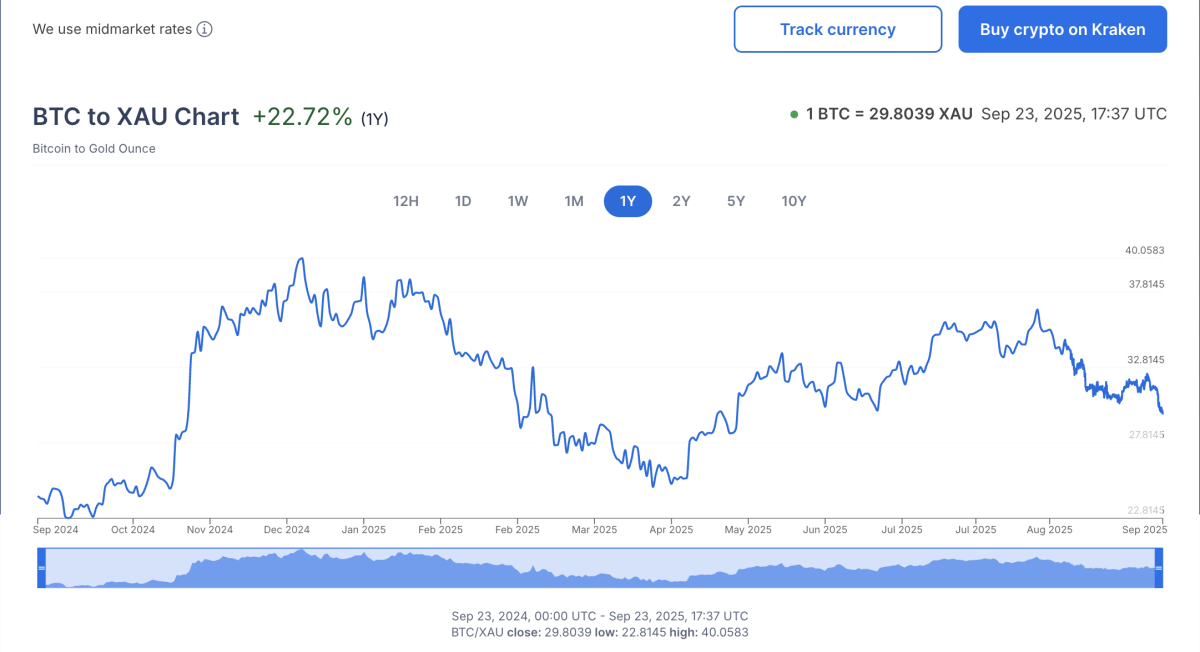

Bitcoin is still far more volatile than gold, but its momentum is undeniable. BTC USD prices touched $123,500 in August, and according to , BTC has gained +22.7% more than gold over the past 12 months.

Changpeng Zhao, Binance co-founder, argued the portability edge is decisive: “Gold is great if you can carry it everywhere… If only someone could invent digital gold.”

Bitcoin’s capped supply, independence from governments, and ease of verification will always give it an advantage. For private reserves and alternative funds, that’s an attractive package in a world still wrestling with inflation.

DISCOVER:

Central banks don’t just manage reserves but set the tone for global markets. Even modest on their balance sheets could trigger trillions in new institutional flows.

From a macro view, Bitcoin looks like a growth hedge, while gold is the fear hedge. Both may sit side by side in the decade ahead, but recent history still shows that Bitcoin is a stronger performer than gold.

EXPLORE:

The post appeared first on .