Dogecoin could be approaching a structural breakout that carries it to the long-discussed $1 threshold, according to crypto analyst Stephan Burns, who in a July 24 described a “perfect storm” of monetary design, market structure and what he characterizes as rare astrological alignments. Burns framed the move as an “inevitability,” while acknowledging timing uncertainty, arguing that the next parabolic advance could emerge within months.

Burns built his case first on tokenomics. Dogecoin’s fixed issuance of 10,000 DOGE per one-minute block—approximately 5.2 billion DOGE annually—translates today into an inflation rate of roughly 3.3% against a circulating supply he placed at 150 billion. With that supply base, he said, the network simultaneously sustains miner incentives, gradually replaces lost coins and avoids the periodic “” embedded in Bitcoin’s quadrennial halving schedule.

“It’s beautiful because of this inflation rate,” he said, calling Dogecoin “better as a currency than Bitcoin” precisely because of its predictability. By contrast, he argued, Bitcoin’s declining issuance—on track to fall below half a percent after the 2028 —forces a future reliance on transaction fees. “Eventually Bitcoin will be completely mined… the network has to be maintained by transaction fees. That’s probably not enough to incentivize miners at the end of the day,” Burns claims.

He also asserted that Dogecoin’s governance surface is harder to co-opt than Bitcoin’s as large institutional and governmental actors accumulate BTC exposure. In his view, Dogecoin remains “the people’s currency,” with economic dilution limited by social and technical difficulty of altering code. The flat nominal issuance, he added, produces a declining percentage inflation rate over time without rendering the asset strictly deflationary or, in his words, vulnerable to miner attrition.

Beyond economics, Burns devoted extensive time to what he calls “crypto astrology,” arguing that Dogecoin’s natal chart—anchored to its genesis block—now sits under exceptionally favorable transits. He highlighted Pluto’s conjunction with Dogecoin’s natal Moon, describing it as “a once in a roughly 250-year transit,” and an impending Jupiter return with the planet “exalted” near the project’s midheaven point.

These, he claimed, historically correspond to phases of visibility, capital inflow and wealth symbolism. “Dogecoin is being activated… more than any other cryptocurrency this year,” he said, labeling the configuration a catalyst for renewed global attention.

Burns linked those internal transits to a broader macro cycle, citing the approaching Saturn–Neptune conjunction at the first degrees of Aries in early 2026, which he associated—through earlier historical recurrences—with milestones such as the emergence of coinage and trade networks.

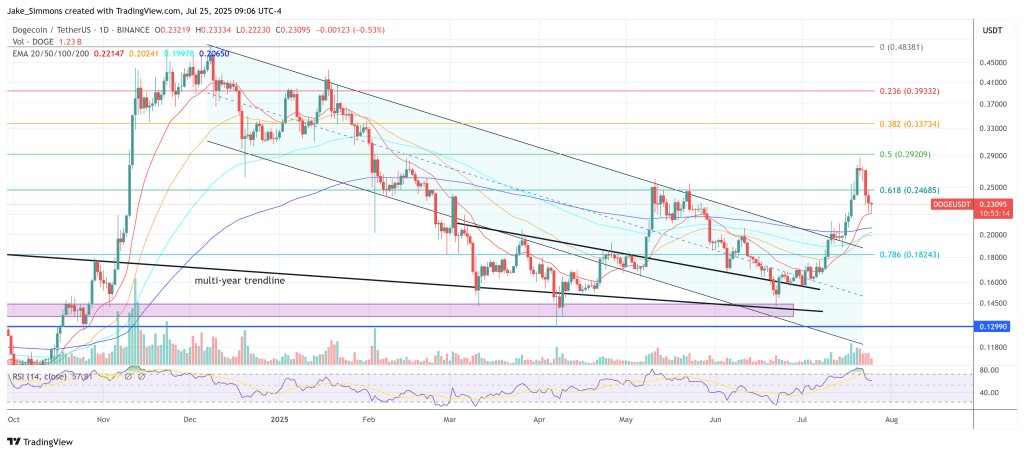

In his view, that backdrop reinforces the plausibility of another speculative wave. A logarithmic review of Dogecoin’s price history, he said, shows three prior “parabolic” expansions separated by lengthening consolidation phases; the current basing structure, including what he described as an ascending W-pattern supported by long-term moving averages, could precede a fourth. “Just based off of that it looks like we may be due for another one of these parabolic moves up in the next few months,” he said, while conceding that “just because I think it doesn’t mean it’s going to happen.”

He further projected that a Dogecoin exchange-traded fund “will get approved” and place the asset “in the spotlight,” though he did not provide documentation beyond his expectation. Burns also contrasted Dogecoin’s relative resilience on its Bitcoin ratio with altcoins that have reverted to prior ranges, arguing that structural holding above pre-2020 levels supports his thesis.

Summarizing his outlook, Burns reiterated what he called the “inevitability of Dogecoin ,” framing that level as the maximal target in his public analysis for the forthcoming cycle. The timing, he implied, hinges on the interplay between tokenomics-driven accumulation and the unfolding of the transits he tracks. “I do think it’s going to moon,” he concluded.

At press time, DOGE traded at $0.23.