Arthur Hayes, BitMEX co-founder, thinks Bitcoin will hit $250,000 and Ethereum will break $10,000 in 2025. Global credit growth and institutional demand will lift valuation.

The crypto rally of 2025 has been unprecedented. By August 2024, many thought Bitcoin and some of the were teetering on the brink. It could have been a different story if Kamala Harris had won.

Instead, Donald Trump emerged victorious, and his crypto-friendly policies lifted Bitcoin above $75,000, an all-time high, to over $100,000 by December 2024. Although prices cooled in Q1 2025, the comeback saw spike from $110,000 to $112,000, then to $113,000, before surging to as high as $123,000 in July.

BitcoinPriceMarket CapBTC$2.35T24h7d30d1yAll time

Explore:

Buyers are in good shape, and traders expect Bitcoin to reach $150,000 in the coming sessions. While bullish, this outlook pales in comparison to Arthur Hayes’ predictions.

Hayes, the co-founder of the crypto perpetual exchange BitMEX, in a post titled “,” said Bitcoin will surge to as high as $250,000 by the end of the year, while Ethereum will also skyrocket, reaching $10,000 in the next five months.

Last year, Hayes’ prediction came true when Bitcoin crossed $100,000. Will his forecast this year also materialize? The BitMEX co-founder is strongly convinced that Bitcoin, which serves as digital gold due to its deflationary nature, is the ultimate leverage play in an era of USD and fiat debasement worldwide. He believes global credit will only grow, and governments will continue to print money, driving inflation and debasing fiat currencies.

As this happens, Bitcoin and some of the top Solana meme coins will also shine. In his post, Hayes said the current Bitcoin price reflects credit growth, and prices are highly leveraged to this growth.

He notes that credit growth has doubled since 2020, and during this time, Bitcoin has surged by 15X in response. He added that the United States relies heavily on investors and nations purchasing Treasuries through short-term debt issuance and, recently, stablecoins. This position and increasing debt issuance will catalyze the next leg up, pushing Bitcoin above $200,000 to $250,000 by year-end.

Although Bitcoin will rally, Hayes believes will “melt faces.” From his analysis, he’s convinced Ethereum is undervalued and will rip higher as institutional investors pour in.

EthereumPriceMarket CapETH$437.65B24h7d30d1yAll time

In the post, he notes, “The Western institutional investor class, whose chief cheerleader is Tom Lee, loves ETH.” Moreover, while Ethereum is growing in popularity, he notes that roughly 53% of all ETH in circulation is liquid. The rest is tied up in staking or used as collateral in DeFi protocols.

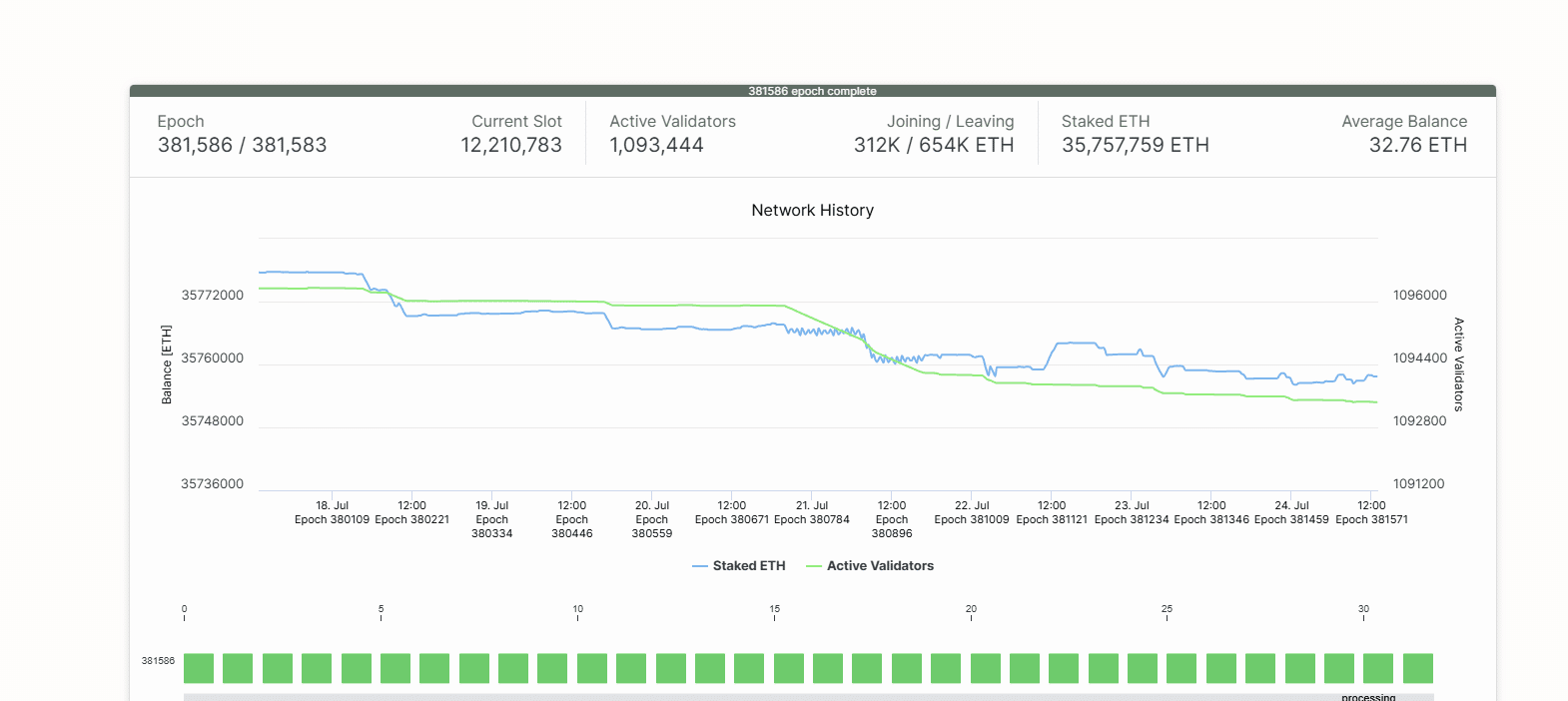

According to Beaconcha.in, more than 1 million validators have staked over 35.7 million ETH. This supply constraint will catalyze demand, lifting prices above $10,000 in the coming months.

()

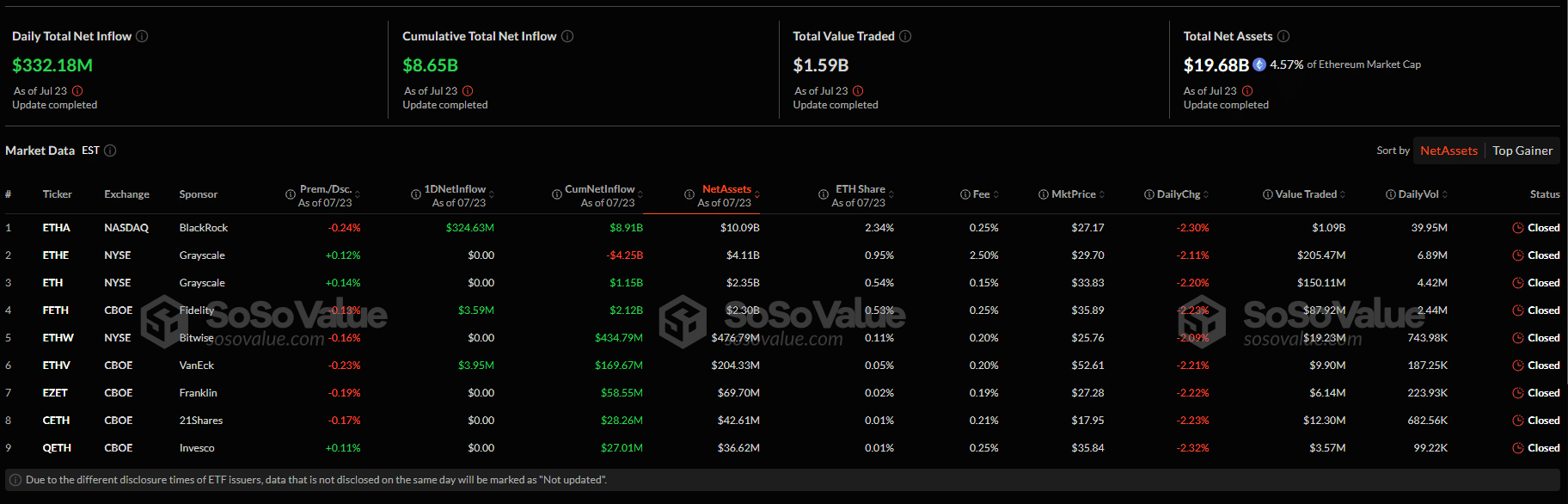

As DeFi makes a comeback, Hayes added that he’s fully exposed to ETH through his fund, Maelstrom, and is focusing on DeFi tokens on Ethereum and other “ERC-20 shitcoins.” By the close of July 23, institutions bought over $332 million of ETH-backed spot Ethereum ETFs, primarily through BlackRock and Fidelity.

()

Hayes is no stranger to making headlines with bold predictions. During the TOKEN2049 Dubai event in 2024, he said Bitcoin could reach $1 million by 2028. He explained that Bitcoin’s fixed supply makes it a hedge against fiat debasement. Accordingly, more nation-states, including Iran, have been mining BTC to avoid printing money.

In May, at an event in Las Vegas, Hayes ETH would hit $5,000 in 2025. He said the coin was undervalued and poised for a comeback. A month later, he raised his prediction to $10,000, pointing to increased inflows via spot Ethereum ETFs and growing institutional adoption. As Ethereum rallied, Hayes said the coin would outperform Solana thanks to its robust developer ecosystem and continuous network improvements.

DISCOVER:

The post appeared first on .