The crypto bull 2025 might get overshadowed by stablecoin regulation. While dominates headlines with its , it was stablecoins that had policymakers and institutional investors talking during a recent series of U.S. meetings hosted by Standard Chartered Bank.

According to Geoffrey Kendrick, the bank’s global head of digital assets research, dominated 90% of his conversations with lawmakers and clients in Washington, D.C., New York, and Boston. So… is this bullish or nah?

“The discussions were almost entirely focused on stablecoins rather than bitcoin, despite BTC’s price surge,” Kendrick said.

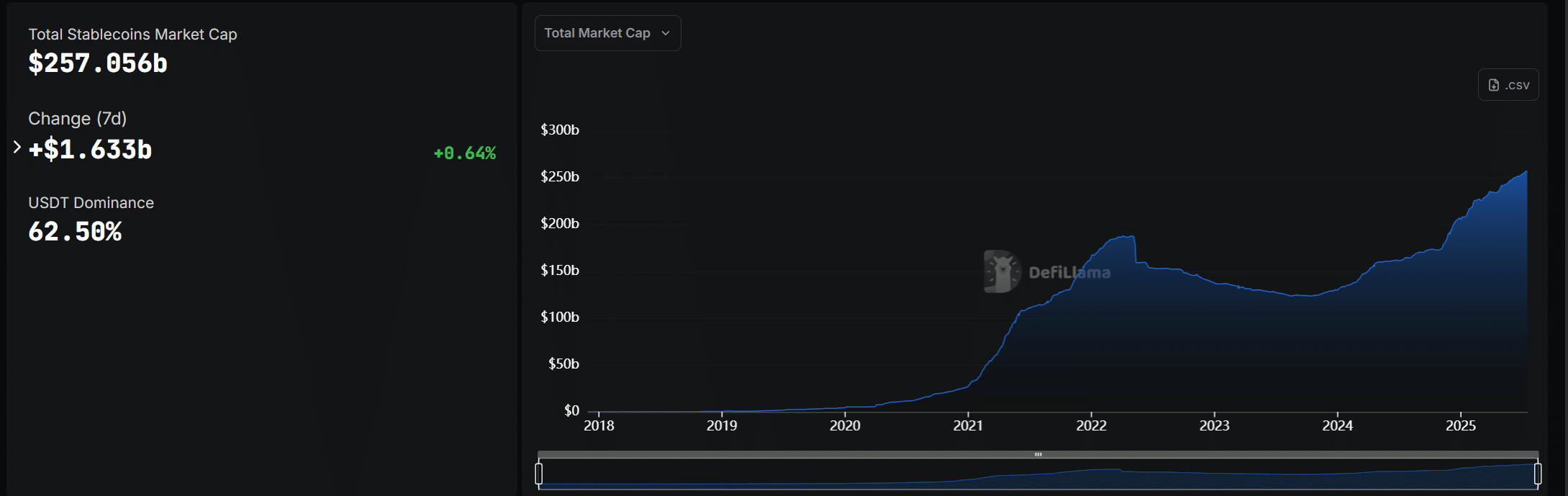

With stablecoins forecasted to balloon from $240 billion to $750 billion by 2026, the impact won’t just be felt in crypto but will ripple straight into the bond market.

Kendrick warns that the demand for T-bill backing could distort Treasury issuance, overloading the short end of the curve and dragging attention away from longer-term debt.

A major factor in the rising interest is the GENIUS Act, which aims to regulate fiat-backed stablecoins. The bill is expected to pass as soon as this week, potentially clearing the way for broader adoption by corporations, fintech firms, and even local governments.

Momentum is building behind the Digital Asset Market Clarity Act, which could now hit the House floor by September, months ahead of schedule. The bill aims to demystify the rules around crypto tokens and, in doing so, pave the way for things like stock-token hybrids to flow into DeFi protocols.

Just imagine being able to invest in SpaceX, OpenAI or X (Twitter) by year-end? That’s what this bill could open up.

Speaker Mike Johnson has signaled the House will go bill-by-bill instead of bundling crypto legislation to keep fragile Senate talks alive.

“It’s a priority of the White House, the Senate and the House to do all of these crypto bills,” Johnson said.

In a year dominated by Bitcoin, stablecoins may quietly be the most disruptive force in digital finance. And not because of price action, but because of their deepening ties in governance.

EXPLORE:

The post appeared first on .