Ahead of the Federal Reserve FOMC meeting today, economists expect interest rates to remain unchanged between the 4.25% and 4.5% range. What will be the FOMC Bitcoin impact? Will BTCUSDT break $110,000?

Bitcoin, Solana, and some of the in the top 20 are trading inside tight ranges. is down, capped below $105,500, while is yet to break above $3,000. Meanwhile, is struggling to close above $170, down 11% in 24 hours, making it one of the top losers in the top 10, trailing .

Clearly, the crypto market and its participants are proceeding cautiously. Ahead of the highly anticipated Federal Open Market Committee (FOMC) meeting in the United States, Bitcoin traders are focused on one key question: Will today’s Federal Reserve decision shift the tide for crypto assets, triggering a wave of demand that lifts prices above critical liquidation levels?

This question is relevant: Inflation, tariffs, and an unusually shaky macroeconomic backdrop, worsened by conflict in the Middle East, dominate headlines, requiring the central bank to move with tact.

DISCOVER:

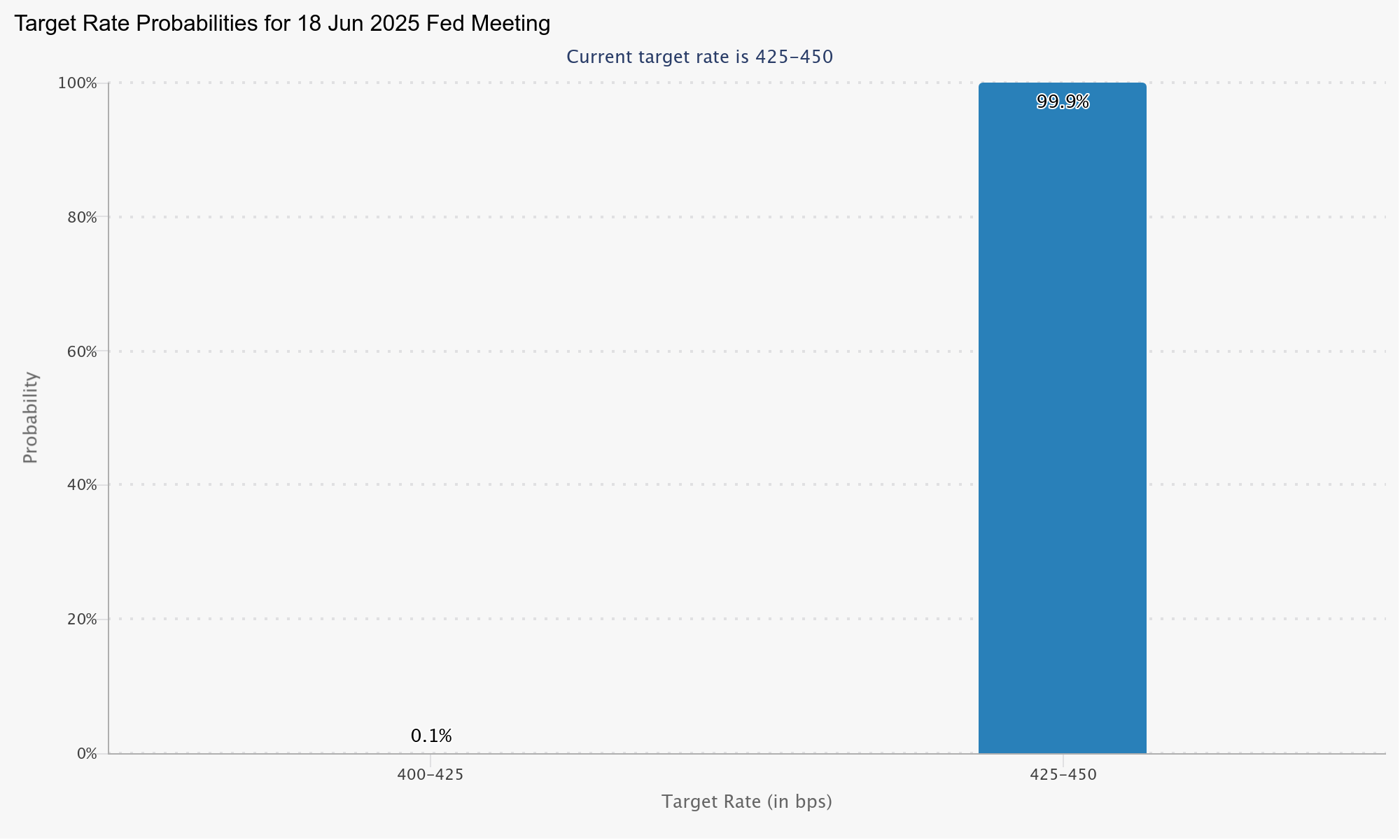

Most economists and analysts expect rates to remain unchanged between 4.25% and 4.5%.

According to the CME FedWatch tool, the probability of the central bank holding rates steady is a staggering 99.9%.

()

Although the consensus is for rates to remain unchanged, Bitcoin traders will closely monitor what the Federal Reserve Chair, Jerome Powell, says during the press conference.

This is because, while interest rates are the focus, the central bank’s thoughts and forward guidance are equally critical.

As in the May 7 press conference, little change is expected.

Powell will likely adopt a data-dependent stance, especially given President Trump’s aggressive tariff agenda and mixed economic data, particularly on inflation.

Moreover, the Federal Reserve is navigating a delicate balancing act between keeping rates low, around the benchmark 2%, while ensuring economic growth despite rising debt levels.

DISCOVER:

As seen during the 2021 crypto boom, crypto and Bitcoin prices thrive during periods of low interest rates.

When the central bank eases monetary policy, more money circulates, some of which is invested in Bitcoin and other “risky” crypto assets, including some of the .

During such times, inflation also tends to rise.

However, unlike 2021, the macroeconomic environment in 2025 is different.

The global economy is grappling with tariff wars, labor market uncertainty, and stagflation due to persistent inflation and slow economic growth.

Although core inflation slowed in May 2025, it remains elevated, and tariffs could reignite price pressures, especially if no deal is reached with the European Union and China.

For this reason, if the Federal Reserve unexpectedly slashes rates against economists’ forecasts, the Bitcoin price could spike. There is a chance that it may break above $110,000 by the end of the week.

BitcoinPriceMarket CapBTC$2.08T24h7d30d1yAll time

Still, even if rates are cut, the timing could be problematic. This view is considering the inflationary risks posed by tariffs and a slowing economy.

Consequently, a surprise rate cut could trigger capital flight to the USD and treasuries. Subsequently, there could be an unexpected sell-offs in cryptos as the greenback strengthens.

DISCOVER:

The post appeared first on .