Why is Bitcoin down today? Moreover, how do I profit from the inevitable US financial crash that will occur when the AI bubble pops? I have $73 in my bank account. I need help here.

We don’t know what…

Or when…

But something financial, , will happen…

For this week’s crypto weekly roundup, Bitcoin’s midweek rally evaporated as the world’s largest cryptocurrency slipped back to $100,000, erasing the previous day’s gains and dragging the down 1.7% to $3.37 trillion, according to CoinGecko data. also followed suit, dropping 3.8% to around $3,330.

Employment at US small businesses is falling:

US small businesses shed -10,000 jobs in October, according to the ADP Employment Report.

This marks the 5th monthly decline over the last 6 months.

As a result, the 3-month average of job losses fell to -29,333, the highest since…

— The Kobeissi Letter (@KobeissiLetter)

US stocks also sank over 1% across the Nasdaq, S&P 500, and Dow after new data showed the steepest wave of corporate layoffs in two decades. Amazon, Target, and UPS all announced major cuts, stoking fears that the labor market’s finally cracking and the recession is here. Buckle up! Things could get ugly.

Here’s what’s next for Bitcoin and if we’re about to crash into the Earth’s crust.

DISCOVER:

Crypto Fear and Greed Chart

All time

1y

1m

1w

24h

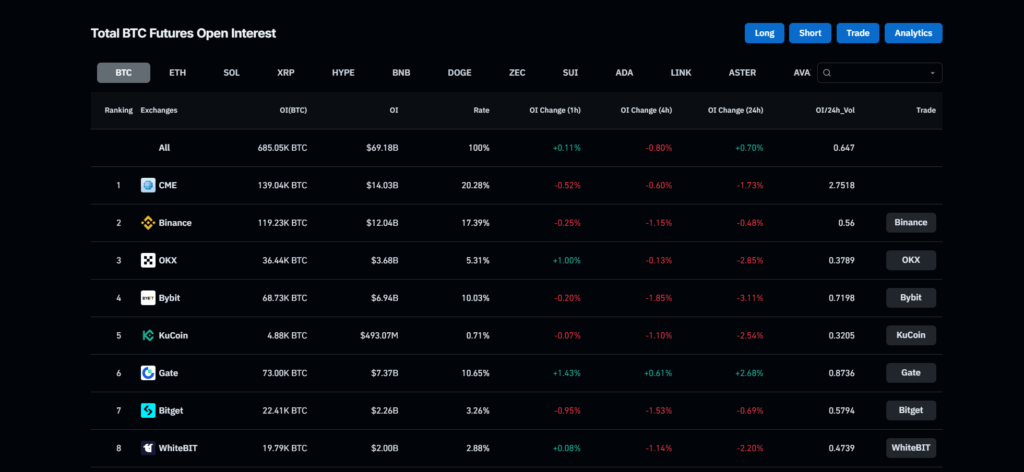

Market anxiety is surging across crypto… with the exception of Zcash! Go read here. The Crypto Fear and Greed Index dropped to 24, firmly in the “fear” zone, while data shows total open interest falling 3.45% to $140 Bn, down from over $300 Bn a month ago.

This cooling sentiment here is reflecting a broader “dead-cat bounce” dynamic, as 99Bitcoins analysts warn the Wednesday rally was likely short-lived. We could be heading into a recession, folks.

Despite panic selling, exchange reserves continue to decline, signaling that investors are moving coins to cold storage rather than selling. This’s a sanguine historical pattern often seen before market recoveries.

For now, Bitcoin’s key support lies between $99,000 and $101,000, where 99BTC analysts expect new accumulation to begin.

DISCOVER:

While analysts like Arthur Hayes, , and Raoul Pal keep saying “relax, bro. The bull run ain’t over,” there is a building case a crash is due:

Just as in 2021, when the Federal Reserve claimed inflation was transitory, the Fed acted too late in reversing its monetary policy in 2025. We’re on red alert over here at 99Bitcoins. Keep your ear to the ground, people, you and me both might be panhandling in 2026.

EXPLORE:

The post appeared first on .