Ark Invest CEO Cathie Wood has trimmed her ultra-bullish Bitcoin price prediction, cutting her 2030 target from $1.5 Mn to $1.2 Mn per coin. Her reason is that stablecoins are eating Bitcoin’s lunch as the preferred currency for payments and remittances.

Speaking with CNBC, said her team had underestimated how quickly would dominate the crypto economy.

“Stablecoins are usurping part of the role we thought Bitcoin would play,” she said. “They’re serving emerging markets in the way we thought Bitcoin would.”

DISCOVER:

Market Cap

According to , stablecoin market capitalization has grown over 40% in 2025, reaching $305 Bn, while Bitcoin’s dominance has slipped to 48%, its lowest level since early 2024.

data shows trading near $100,775, down nearly 19% from October’s record high of $126,080.

JUST IN:

Cathie Wood says Ark Invest is trimming its bullish forecast by $300K, citing stablecoins’ rapid growth in emerging markets, bringing the new top target to $1.2M by 2030.

— Bitcoin.com News (@BTCTN)

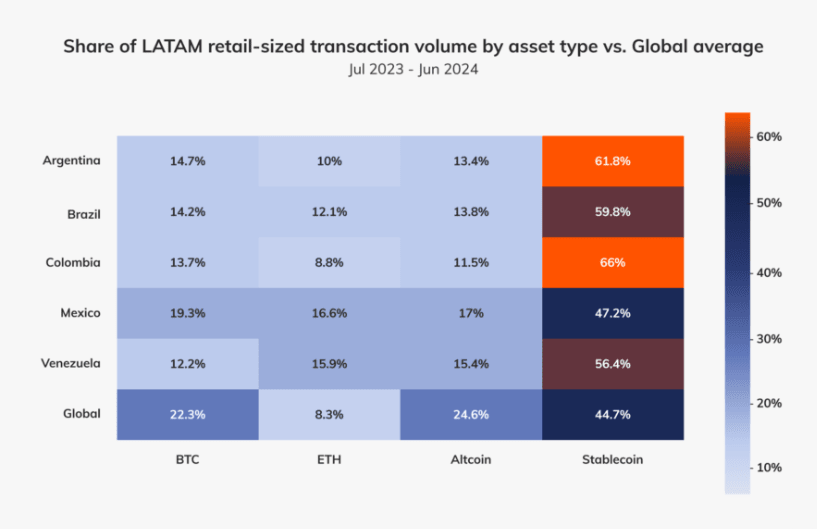

In parts of Latin America, stablecoins have become survival tools that are much more reliable than Bitcoin. In Venezuela and Argentina, where inflation eats wages by the hour, USDT and USDC have become more ubiquitous than Messi jerseys – and that’s saying something!

Chainalysis data shows the region leading global adoption, pushing more than $180 billion in stablecoin transactions last year alone.

DISCOVER:

Institutional research firm Galaxy also cut its year-end target for Bitcoin from $185,000 to $120,000, describing the current cycle as a “maturity era” characterized by lower volatility and passive institutional flows.

Despite the cut, Wood remains bullish.

“I think the whole crypto space gets bigger,” she said. “Bitcoin will still capture half the gold market but stablecoins are the real disruptors.”

Her recalibration reflects a broader market shift that while BTC is maturing into digital gold, its gains are going to be much more stable.

EXPLORE:

The post appeared first on .