A crypto hedge fund manager has uncovered a concerning metric for the market that could signal potentially worrying times ahead for Bitcoin predictions in November and beyond.

Charles Edwards, founder of Capriole Investments, took to X yesterday (November 3), posting a chart showing that net institutional buying has dropped below the daily mined BTC for the first time in seven months.

Bitcoin is down 2.5% today as the market continues to struggle, with any pump quickly being sold off. The combined crypto market cap has slid -3.9% in the past 24 hours, dropping to $3.5T as a result.

For the first time in 7 months, net institutional buying has DROPPED below daily mined supply. Not Good.

— Charles Edwards (@caprioleio)

When daily mined Bitcoin begins to outpace the institutional capital flowing into it, the signal is clear and worrying; the entire market could be struggling, and for Bitcoin, this could mark the start of high-timeframe structural strain.

This sentiment has been echoed by Charles Edwards, founder of Capriole Investments, who on November 3, posted a chart overlaying the daily mined BTC amount, with buying from ETFs and corporate treasury firms.

Worryingly, the chart shows that institutional buying has failed to keep up with the amount of BTC being mined daily, for the first time in seven months. It is a scary data point that will test any bullish Bitcoin prediction theories.

This could indicate that the market is exhausted and/or facing broader economic issues, suggesting that firms are running out of cash to continue purchasing risk-on assets, such as Bitcoin.

Responding to his original post with the chart, Edwards expanded on his thoughts regarding this situation. He said, “Won’t lie, this was the main metric keeping me bullish the last months while every other asset outperformed Bitcoin. The trend could flip tomorrow, next week, or in 2 years. But right now we have 188 treasury companies carrying heavy bags with no business model and a lot less interested institutional buyers than before.”

This is a concerning message from the founder of a prominent crypto investment firm, aligning with the theory held by many market participants that the growing number of crypto treasury firms could signal the top of this bull cycle.

Since October 11, spot Bitcoin ETFs have recorded net outflows of approximately $1.67Bn. Bitcoin mining output remains steady, but with demand via institutional vehicles lagging, new supply may no longer be absorbed as smoothly.

DISCOVER:

Leading Bitcoin treasury Strategy announced yesterday (November 3), that it had added BTC worth around $45.6M through last week amid continued sell pressure in the crypto market. Bitcoin plummeted from around $110,000 to under $105,000 in the past 24 hours.

According to Strategy’s 8-K filing with the SEC, Strategy acquired 397 BTC at an average price of $114,771 per coin. This raises the firm’s average buy price for Bitcoin to $74,057.

Strategy co-founder and Executive Chairman Michael Saylor once again teased Monday’s purchase announcement, posting the firm’s acquisition tracker on Sunday with the caption, “Orange is the color of November.”

The Virginia-based firm now owns roughly 641,205 Bitcoin worth $68.6Bn. For perspective, Strategy’s BTC stack represents over 3% of Bitcoin’s total 21M supply. Since Strategy acquired the total stash for $47.49 billion, the Nasdaq-traded company is sitting on around $21.1Bn in unrealized gains.

Saylor’s firm remains the world’s largest corporate holder of Bitcoin, focusing primarily on securitizing the asset. Investors can purchase its shares to gain exposure to BTC without the hassle of buying and storing digital coins.

During the last week of October, Strategy spent $43.3M on Bitcoin, lifting its total for the month to 778 BTC, marking one of the smallest buying sprees by the leading Bitcoin treasury firm in recent years. By comparison, Strategy purchased 3,526 BTC in September alone, roughly 78% more than October’s haul.

()

November has historically been Bitcoin’s best month, with an average return of 42.5%. Last November, Donald Trump’s re-election triggered a massive bull run, which saw BTC surge by over 60% to $108k.

If Bitcoin can attract buyers to purchase the mined supply, whether from retail investors or institutional investors, we could be set for another bullish November this year. BTC could be poised to reclaim $120k and potentially reach a new all-time high.

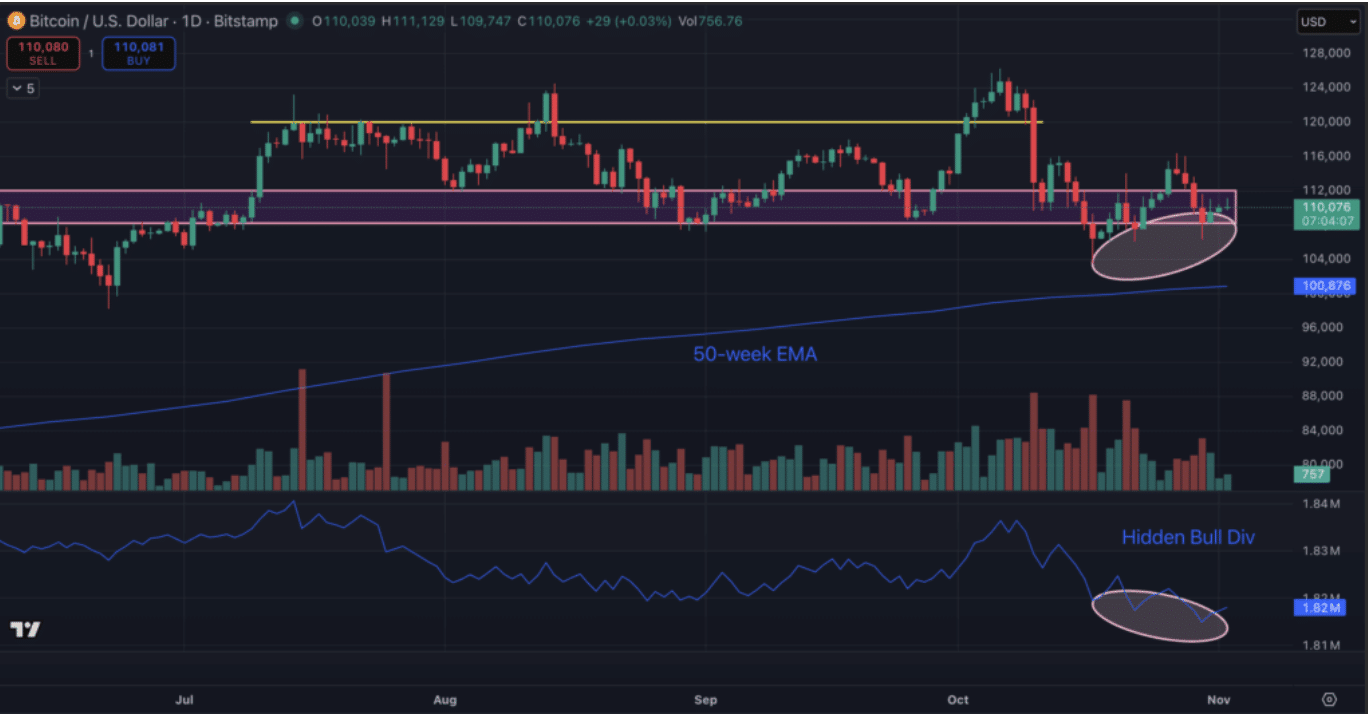

Notably, investors should be open to the possibility of a correction to its 50-week Simple Moving Average, which is currently at $100k. A successful retest here would be an excellent buying opportunity for sidelined investors.

However, with market sentiment currently leaning bearish, the leading digital asset must hold above $100k; otherwise, a Bitcoin prediction of $92,000, which also doubles as the next support zone, becomes a real possibility.

On a positive note, BTC has formed a hidden bullish divergence with its on-balance volume (OBV), indicating growing buying pressure. A weekly close above $112k could invalidate all bearish scenarios and pave the way for a rally to new highs in November.

EXPLORE:

The post appeared first on .