Two Bitcoin (BTC) whales have been unloading massive amounts of BTC to exchanges and causing a ruckus in the market. Traders are now walking on eggshells as they expect another BTC dip incoming.

Blockchain data from Lookonchain reveals that a well known trader in the crypto space, BitcoinOG (also known as 1011short) has sent around 13000 worth $1.48 billion to Kraken since 1 October 2025.

Bitcoin OGs are dumping !

BitcoinOG(1011short) has deposited ~13K ($1.48B) to Kraken, Binance, Coinbase, and Hyperliquid since Oct 1.

Owen Gunden has deposited 3,265 ($364.5M) to Kraken since Oct 21.

— Lookonchain (@lookonchain)

Another BTC whale, Owen Gunden, moved 3,265 BTC valued at around $364.5 million to the same exchange starting 21 October.

These transfers happened when BTC was trading near $108,000, that have many wondering if these whales were cashing out or preparing to bet against the market. Just moving coins to exchanges does not guarantee a sale, but it does mean an increase in trading activity and possible price swings in the short term.

BitcoinOG is known for raking in massive profits by shorting BTC. During the 10 October market crash, he earned nearly $197 million by predicting the impending crash.

Since then, wallets linked to him have continued sending BTC to exchanges like Kraken, Binance, Coinbase and Hyperliquid, hinting at plans for leveraged trades or further selling.

On 2 November alone, he moved 500 BTC worth $55 million to Kraken along with smaller batches of 70 to 150 BTC to Hyperliquid.

EXPLORE:

Moving on to the next whale who is causing a pandemonium in the market, Owen Gunden has swung back into action after a long hiatus. Gunden is a legend who accumulated more than 15,000 BTC during its early years and has held firm through multiple market cycles that earned him the reputation of being a true OG.

Gunden, between 21 October and 3 November, moved 3,265 BTC worth $364.5 million to Kraken in large batches. These batches included 364 BTC on 22 October, 1448 BTC on 29 October and 483 BTC on November 3.

This marks the latest move that he has made in years, suggesting that the whale must either be adjusting his portfolio or cashing in some profits.

Owen Gunden has further deposited 193.77 , worth $21.49M, into .

Owen still holds 8,922 , worth $990.85M.

— Onchain Lens (@OnchainLens)

Furthermore, several of his old wallets that were left untouched for decades have recently become active again. This comes in as BTC has been hovering between $110k and $115k after the great liquidation on 10 October.

Large batch transfers of BTC to exchanges free up these BTC for selling. This often leads to sudden price changes, more so if there aren’t many buyers in the market.

In the past, when BTC whales have moved their coins, it has often caused prices to drop by 5% to 10% in the short term.

EXPLORE:

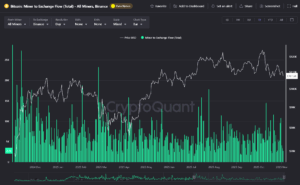

In parallel to the whales unloading BTC to exchanges, miners have been shedding BTC as well, adding selling pressure to the market. In October, miners moved 210,000 BTC to exchanges, with a majority of the activity taking place in the last two weeks.

Binance became the main platform for these transfers. Since 16 October, Binance’s BTC balance grew by 108,000 coins.

(Source: )

Altogether, the market is now absorbing BTC worth $10 billion, with some days seeing massive +10,000 BTC deposits to exchanges in a single shot. These deposits lined up with BTC falling from its ATH at $126,000.

CryptoQuant reveals that miners currently hold about $1.80 million BTC, down from over 1.81 million in October. This decline might be linked to a shift in their focus as many are now investing in AI data centers instead of only relying on BTC mining.

EXPLORE:

The post appeared first on .