Bitcoin price pushed through resistance and blasted to the roof above its previous all-time high, putting the king back to the top. Most crypto news today reports this records that BTC USD reached above $126,000, while ETH and BNB both delivered double‑digit gains over the past week. Bitcoin’s dominance remains above 58%, which is not bad, as it means that altcoins still have

(source – )

Massive flows into Bitcoin are responsible for this price run. Nearly 985 million USD was funneled into BTC ETFs last week alone. Data reveals BTC USD futures open interest surged about 15% as institutional players stepped back in. Yet, even with Bitcoin USD price leading, the momentum behind ETH and BNB deserves close attention.

Market Cap

DISCOVER:

Though many had predicted would run toward 7,000 USD before this bull phase, it hasn’t quite broken free yet. It currently sits at around $4,700 with 12% gains over the past seven days. Behind the scenes, Ethereum’s DeFi ecosystem shows signs of life. It reports a healthy 4% rise in protocol TVL, with $40.22 billion locked via Lido and an additional $19.7 billion in EigenLayer. Numbers that show patience.

(source – )

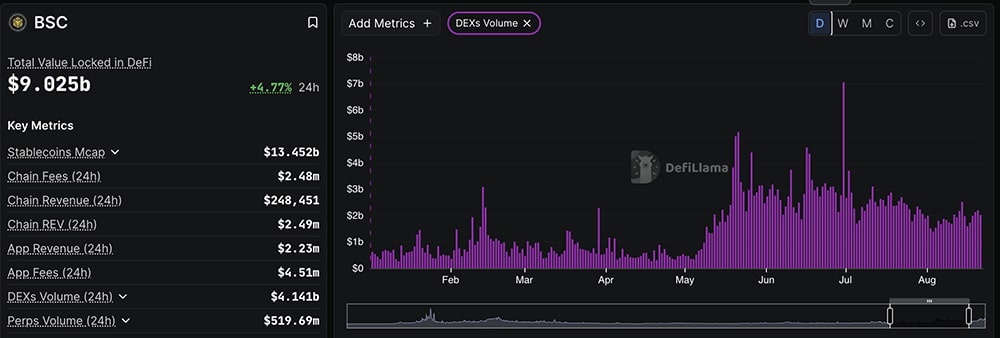

On the flip side, is the surprise standout. Up about 22% in the last week, BNB eyed a new ATH at 1,260 USD. What makes this even more interesting is how activity on BNB Chain exploded. PancakeSwap’s weekly volume hit $30.8 billion, and total DEX volume spiked a dramatic 85%, per DeFiLlama. These all show that USD stablecoins and capital are rotating to BNB ecosystem, leaving some who refuse to enter behind.

(source – )

With Bitcoin or BTC price resting above 124,000 USD, the market finds stability to explore altcoin ecosystems. price rally anchors sentiment, but crypto, today, increasingly spotlights the outperformance potential in ETH and BNB USD pairs. While Ethereum gathers strength quietly, BNB has already delivered its surprise punch.

Total crypto market cap now nears $4.33 trillion, mostly because of aggressive inflows across the space. Once Bitcoin USD price moves sideways, attention may shift from BTC dominance toward the layer‑1 ecosystems. BNB has already done some huge moves against USD, but will ETH follow?

(source – )

DISCOVER:

The crypto market is heating up again, and this time, data suggests a significant rotation may already be underway. Stablecoin dominance is dropping sharply, with USDT’s market share tumbling 11.8% in the last week to 4.22%, signaling a shift away from safe-haven liquidity into higher-risk plays.

Meanwhile, the TOTAL3 chart, which tracks the market cap of all cryptocurrencies excluding Bitcoin and Ethereum, hit an all-time high of $1.18 trillion, a clear sign that capital is flooding back into altcoins.

For traders looking to catch this wave, the best crypto presales are becoming the early hunting ground for smart money, especially as altcoin season indicators start flashing green.

(Source – )

Read the full story .

Could CAKE crypto be gearing up for its next big rally? Following the official CakePad launch on October 6, 2025, PancakeSwap’s native token CAKE surged nearly 14%, reclaiming the spotlight in the DeFi and crypto market.

The update is part of the project’s Tokenomics 3.0 push, a plan centered on deflation, accessibility, and utility expansion. Traders now wonder: could this finally be the breakout that sends the CAKE price toward the long-awaited $10 mark?

With PancakeSwap leading the DEX landscape, this could mark the start of a new era for CAKE holders.

Market Cap

Read the full story .

The post appeared first on .