Crypto markets are shaking again and again. Despite the Powell rate cut, improving Trump-China relations, and a stable macro outlook, the Bitcoin price keeps sliding.

As of today, Bitcoin price is hovering barely over $110K, down about 2% in the past 24 hours. Many expected a rally after gold cooled off from its all-time high, but instead, crypto is facing what looks like a confidence vacuum.

Market Cap

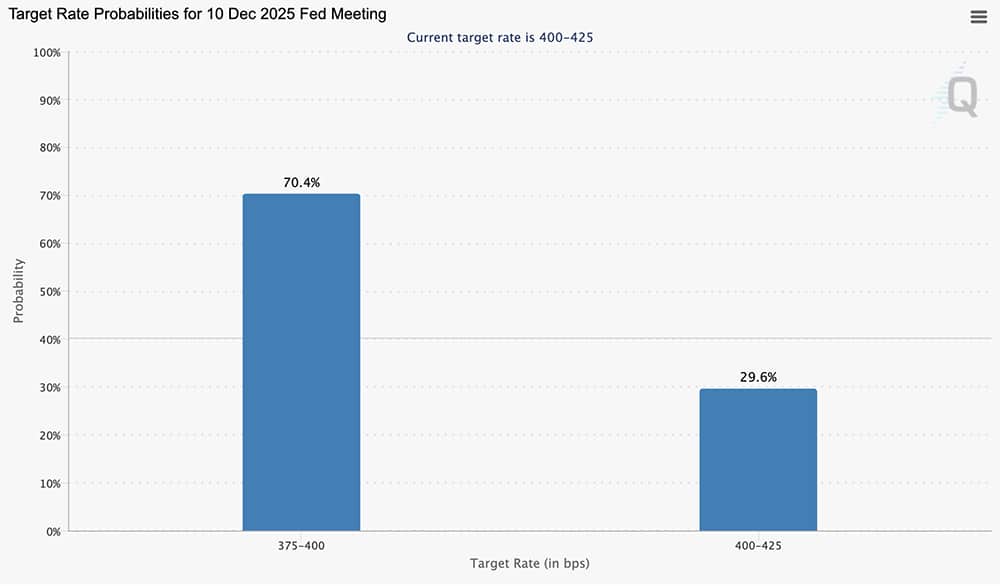

Normally, a Powell rate cut supports risky plays, giving traders room to take on more exposure with a lower rate. This time, it didn’t work that way. Jerome Powell’s 25 bps cut to the 3.75–4.00% range came with a firm “no more cuts this year” message. A dovish yet bearish tone that crushed expectations for a December easing.

According to FedWatch data, the probability of another cut fell from 98% to around 70%% right after Powell’s remarks.

(source –

DISCOVER:

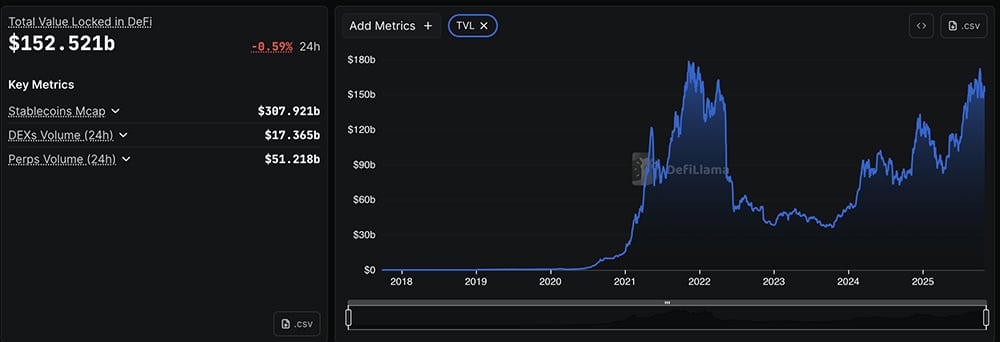

Bitcoin price, already soft before the announcement, slid from $115,000 to around $110,000, forming lower highs on the daily chart. Data also shows trading volume thinning out as investors rotate funds into equities. Liquidity indicators from DeFiLlama reflect the same, as the total value locked in DeFi dropped 0.6% overnight, with so many sidelining.

(source – )

Even with gold prices easing from record levels, crypto hasn’t caught the usual bid. Market participants blame Powell’s cautious tone, which signals that liquidity won’t flood the system anytime soon.

The Fed delivered as expected—a 25bps rate cut, but Powell's comments are leaving the market uneasy. The second consecutive cut was already priced in, but the bigger shift is that they’re ending QT.

Starting December, instead of letting MBS mature, the Fed will reinvest in…

— Marcos Crypto (@MarcosBTCreal)

DISCOVER:

At the same time, the Trump China trade developments should have offered relief. Tariffs have reportedly been cut from 57% to 47%, and China agreed to resume large-scale US agricultural imports. Historically, when Trump talks tough on China, markets drop, but this time, his deal with Xi Jinping was meant to be bullish. However, Bitcoin price nuked instead of rallying.

BREAKING:

TRUMP & XI MEETING RESULTS!

1. Reduced Fentanyl Tariffs to 10%.

2. Overall tariffs on China reduced from 57% to 47%.

3. China to "discuss" chip restrictions with Nvidia.

4. "No more obstacles on rare earths"

5. China and US to collaborate on Ukraine.

— Crypto Rover (@cryptorover)

Analysts point to excessive optimism before the deal and profit-taking afterward. Following it, outflows from Bitcoin liquidity pools show that institutional investors are rebalancing ahead of year-end, trimming crypto positions to secure cash flow.

Powell rate cut removed short-term momentum while Trump China progress couldn’t restore it. Bitcoin’s yearly gain still sits above 52%, but near-term weakness is still dominating.

Is it over for ? Nope, Bitcoin is still a million-dollar asset, and crypto is here to stay.

DISCOVER:

The MetaMask airdrop narrative is heating up again after fresh reports confirmed that JPMorgan and Goldman Sachs have been brought on to lead Consensys’ initial public offering (IPO). Consensys, the company behind the widely popular MetaMask wallet, is reportedly eyeing a late 2025 or early 2026 listing, potentially marking one of the biggest public offerings in crypto’s history.

With over 100 million MetaMask users worldwide and persistent chatter around a MetaMask ICO and MASK token, investors are now asking one burning question. Will the airdrop arrive before the IPO, or will both events coincide in a single massive rollout?

Market Cap

Read the original piece .

The debate over HBAR XRP crypto is heating up again, as both Hedera Hashgraph and Ripple crypto emerge as top utility contenders heading into 2026. With both tokens tied to real-world use cases. HBAR in tokenization and data integrity, and XRP in global payments.

Analysts say only one may be worth holding long-term. As altcoin season builds momentum and rate cuts loom, investors are closely watching these two networks that have outperformed most speculative assets this year.

Market Cap

Read the full story .

The post appeared first on .