The crypto market is on edge as investors await the U.S. Federal Reserve’s interest rate decision later today. A 25 basis point (bps) rate cut is widely expected, but fears of a more aggressive tone or a delayed 2026 rate path have unsettled traders. However, this uncertainty is not stopping investors from looking for the next 1000x crypto, especially if the market reacts positively to rate cuts.

Exchange order-book liquidity has fallen to just 40% of pre-drop levels, amplifying slippage risks and fueling sharper price swings. briefly dipped below $113,000, while is holding near $4,000. sits at $2.63 (+0.78%), at $1,114.62 (+1.62%), and at $194.07 (+3.84%).

The Bitwise Solana Staking ETF (BSOL), the first U.S. spot Solana ETF, launched on October 28 with $69.45 million in net inflows on its opening day. The fund now holds $289 million in total net assets, representing 0.27% of Solana’s market cap, according to Farside Investors. In contrast, the and Canary Litecoin ETFs saw no inflows or outflows in their first session.

For now, all eyes are on Fed Chair Jerome Powell’s commentary at 2:30 PM UTC. Any dovish signal could swiftly reverse today’s dip and re-ignite market momentum.

We almost always dump after the FOMC…

Will this time be different?

— Mister Crypto (@misterrcrypto)

EXPLORE:

Bitcoin’s recent $240 million futures liquidation wiped out over-leveraged long positions as prices swung between $111,000 and $117,000. While this “stop hunt” cleared excess leverage, it also left spot markets thinner and more sensitive to volatility. Derivatives funding rates have plunged nearly 95% in 24 hours, reflecting traders’ more cautious stance.

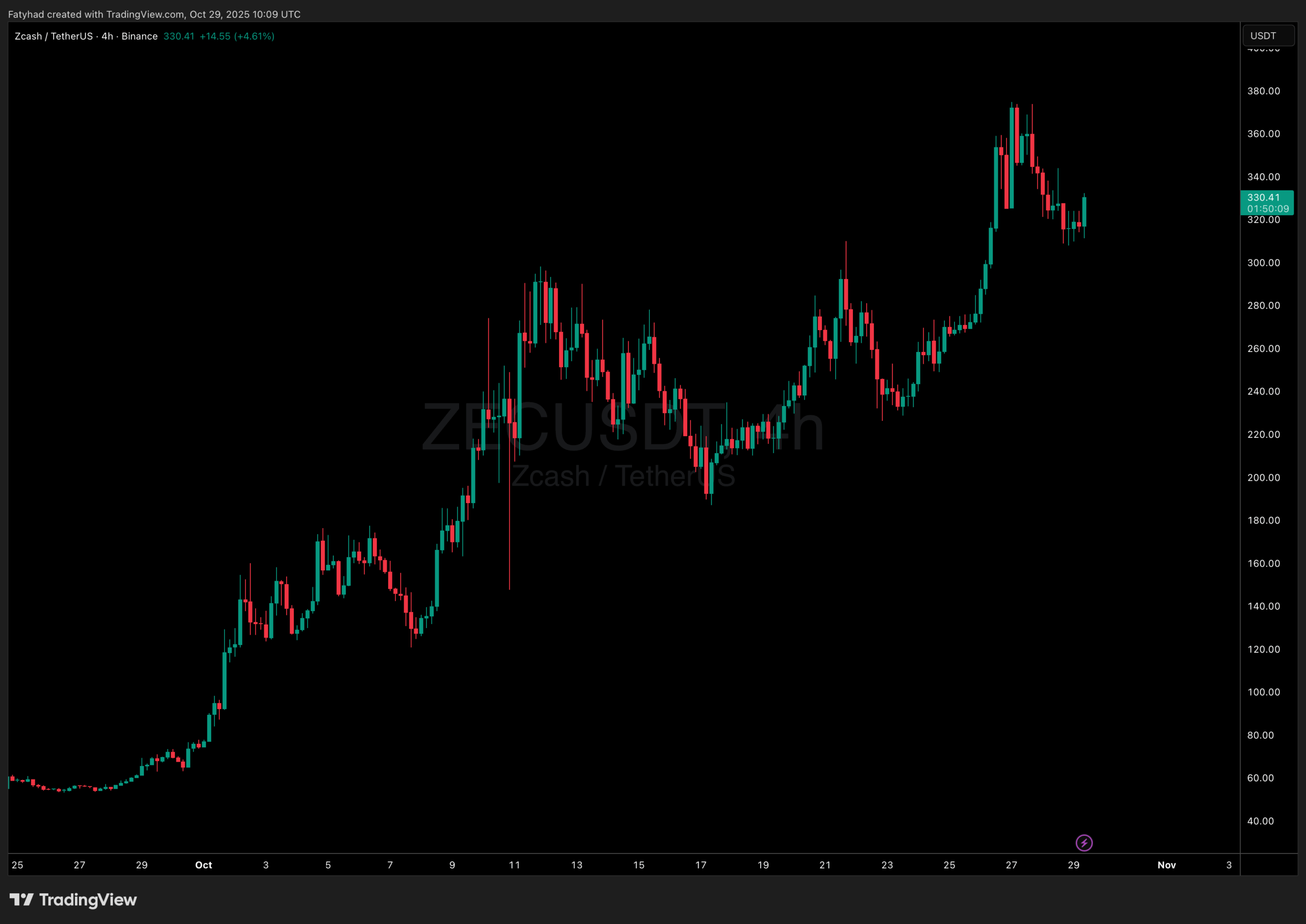

Among altcoins, is gaining traction, up 20.97% over the past week to around $329. The price action shows ZEC retesting support near $315, hinting at possible accumulation before another leg higher. With renewed interest and a cleaner market setup, ZCash could attempt to reach new highs. At the same time, if the Fed confirms the rate cuts, following an initial wave of high volatility, the market could be ready to deliver the next 1000x crypto.

(Source: )

Today’s dip appears to be more of a leveraged flush than a sign of structural weakness. Bitcoin remains above its 200-day EMA ($108K), ETF inflows are steady, and sentiment could turn quickly if Powell’s tone leans dovish. A BTC reclaim of $115K may confirm that the next market leg higher is already taking shape.

Grayscale has officially launched the Solana Trust ETF (ticker: GSOL), giving investors direct exposure to Solana (SOL) and its staking rewards. This marks one of the first mainstream U.S. ETFs to combine both spot holdings and staking features for a major cryptocurrency. The product allows traditional investors to gain access to Solana’s performance and passive income potential through regulated markets. The launch highlights growing institutional interest in Solana’s ecosystem and follows a wave of new crypto ETF products entering the U.S. market amid increasing regulatory clarity. Hedera Hashgraph has been selected to join the Bank of England’s DLT (Distributed Ledger Technology) challenge, which is focused on testing how DLT can be used in finance. HBAR crypto is up +15% on the week following this announcement, alongside yesterday’s (October 28) Hedera ETF launch. The Bank of England is officially committing to exploring DLT innovation, and the inclusion of Hedera is a big deal. It could play out really well for HBAR

crypto, with institutional interest in crypto heating up lately and the UK finally trying to emerge from its dark ages stance on crypto.

Grayscale Launches Solana Trust ETF With Staking Rewards (GSOL)

Is Bank of England Quietly Tapping HBAR Crypto For Stablecoin Push?

The post appeared first on .