American Bitcoin Corp, co‑founded by Eric Trump and Donald Trump Jr., just made one of the boldest plays in corporate bitcoin accumulation this year. The firm bought about 1,414 bitcoins, adding more than $160 million worth of crypto to its balance sheet. That purchase alone was enough to push it into the top 25 public bitcoin treasuries worldwide.

Combined with its mining output, American Bitcoin now holds around 3,865 BTC. Altogether, the stash is valued at nearly $450 million. Some of that bitcoin is pledged as collateral as part of a deal to get its hands on new mining equipment.

Unlike traditional mining companies, American Bitcoin is playing a dual role. It mines bitcoin, but also buys it directly from the market. Chairman Asher Genoot said this setup allows them to reduce the average cost of acquiring bitcoin compared to firms that only buy.

Eric Trump said the company is just getting started, hinting at even more aggressive accumulation in the future. As part of its effort to be more transparent with shareholders, American Bitcoin introduced a new metric called “Satoshis per Share.” This shows exactly how much bitcoin backs each share, helping investors track value more clearly.

DISCOVER:

Climbing into the top 25 public holders of bitcoin puts American Bitcoin in serious company. It now sits alongside other big players who’ve made bitcoin part of their long‑term strategy.

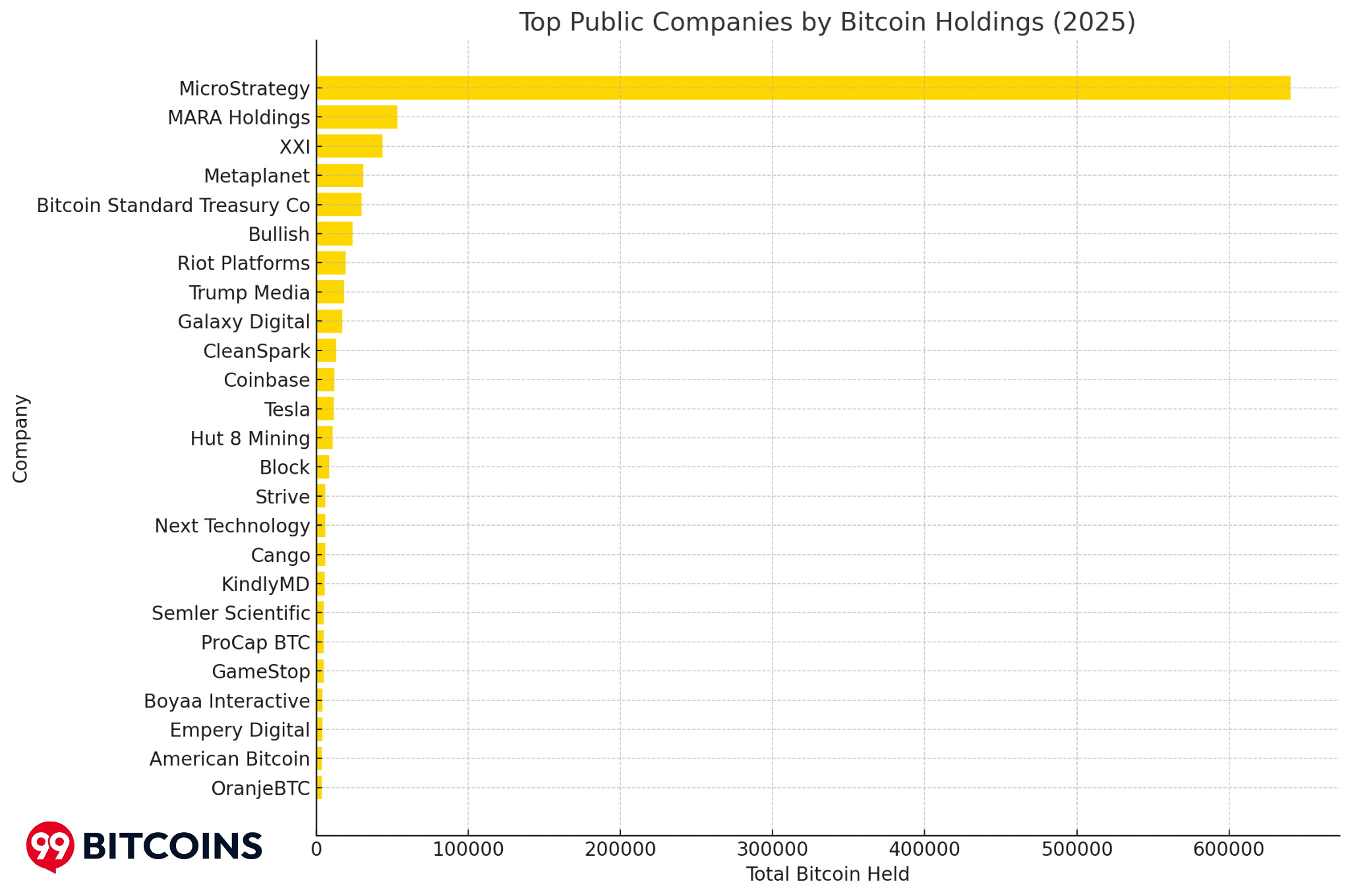

Using data from , this chart shows how much Bitcoin the largest public companies are holding right now.

MicroStrategy is miles ahead with a huge stash, while others like MARA Holdings, XXI, Metaplanet, and now American Bitcoin also hold sizable amounts. Together, they show how more companies are stacking Bitcoin as part of their long-term strategy.

This is not just about speculation. The company is treating its bitcoin reserves as a core part of its treasury, much like some businesses hold gold or bonds. That makes it more than a miner and puts it squarely in the middle of conversations about how companies manage digital assets.

The Trump connection naturally brings added attention. This is not a quiet play by unknown executives. The Trump brothers are front and center, and their involvement raises questions around how this firm will be perceived in markets, media, and political circles.

Earlier this year, American Bitcoin went public, and the IPO valued the brothers’ stake at about $1.5 billion. That valuation gave them a powerful foothold, and it also makes every move the company makes a headline event.

Markets responded quickly to the latest purchase. Shares jumped nearly 12 percent to reach $6.28. That is still below the IPO peak, but the rally shows investors are paying close attention to every step.

DISCOVER:

The company’s next moves will be key. Will it keep buying bitcoin, or start offloading some of its mining output? Will it scale up mining or stick to treasury growth? The newly introduced “Satoshis per Share” metric could become a go‑to tool for investors tracking performance.

However, there are some real risks. Bitcoin’s price can swing wildly, and any regulatory shifts could affect mining or treasury holdings. Still, American Bitcoin is clearly aiming to lead this hybrid model of mining and long‑term holding.

Bitcoin is slowly becoming a fixture in corporate finance. Companies like American Bitcoin are no longer just dabbling. They’re making Bitcoin a foundation of their business.

By stepping into the top 25, the Trump‑backed company is sending a signal. This is not just about mining coins. It is about building a serious, publicly traded bitcoin powerhouse with real skin in the game.

DISCOVER:

The post appeared first on .