Bitcoin ETF outflows, bank contagion, and more! Here’s your weekly roundup. It took America 9 months to become a third-world country … or maybe America has been a third world country since 2008?

Seems like the US is steamrolling its way into doing all the actual bad things that the Russia and China did.

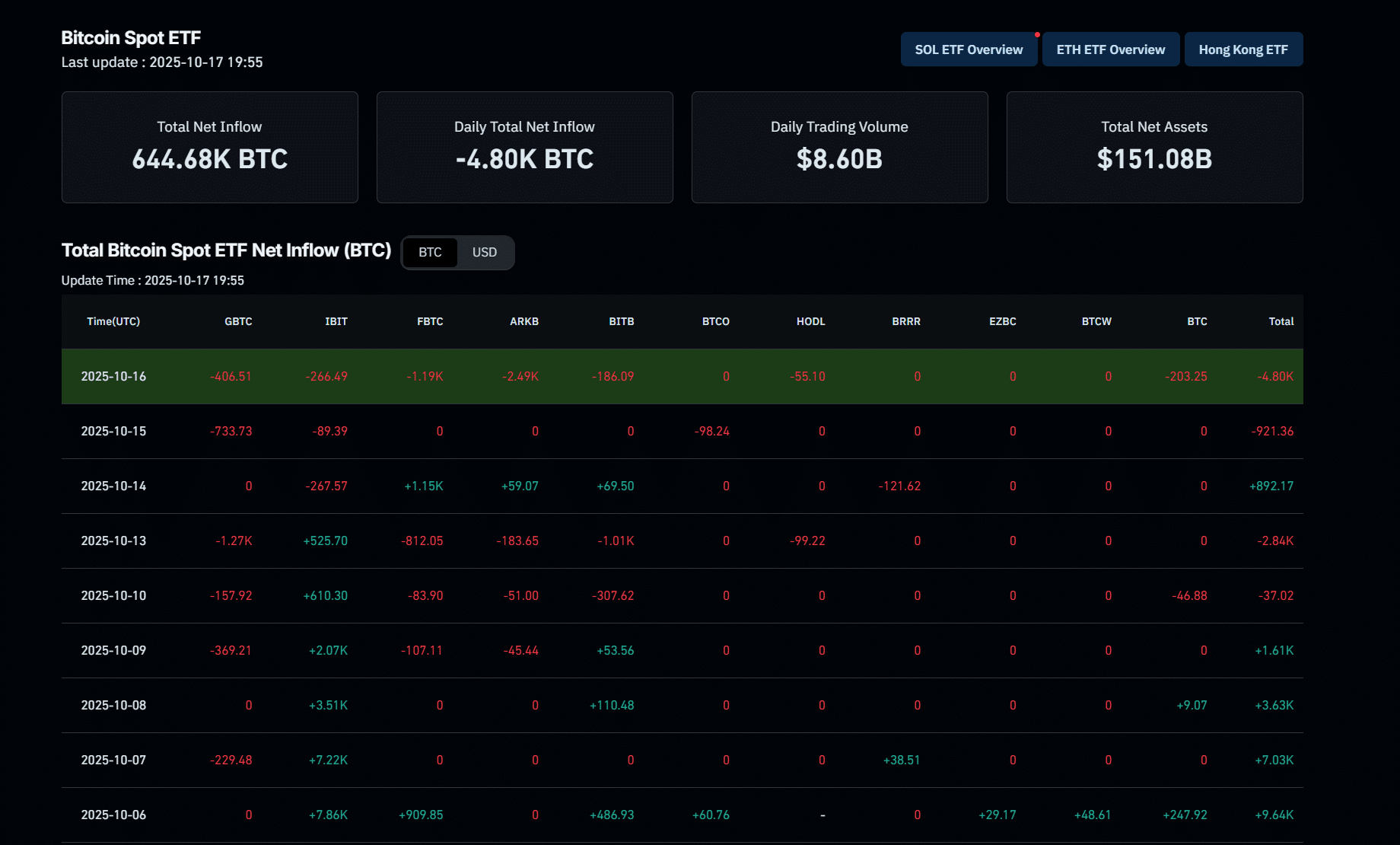

Meanwhile, recorded $536M in daily net outflows on Thursday, their largest since August 1, according to SoSoValue. Outflows hit eight of the twelve funds, led by ARKB with $275M and Fidelity’s FBTC with $132M, as investors moved to the sidelines amid macroeconomic and geopolitical uncertainty.

Here are three news stories from the week you need to know:

The outflows in mirror rising investor caution following one of crypto’s biggest liquidation events this year: more than $20Bn in leveraged positions erased after Trump’s announcement of on Chinese imports.

Moreover, bank contagion risks have flared up, adding further pressure:

Turns out we were all right and banks have been lending against dog shit private credit for the last 5 years

H/t for the chart

— Daniel A. Saedi (DataManDan) (@TheRealDanSaedi)

Ethereum ETFs saw $56.9 Mn in withdrawals the same day, reversing a brief two-day inflow streak.

“The $536 million in net outflows primarily reflects a sharp surge in investor risk aversion,” said Nick Ruck, Director at LVRG Research.

EXPLORE:

CoinGecko data shows Bitcoin trading near $$104,747, down -6.1% over the week, while total crypto market capitalization has fallen to $4.1Tn.

Trading volume remains muted as investors wait for next week’s Core CPI, , and jobs data trifecta, all of which could steer risk appetite heading into November.

EXPLORE:

And let’s end things with one spark og good news! With capital fleeing overseas and crypto innovation shifting to Asia, SEC Chair Paul Atkins admitted the US is “a decade behind.” Speaking on October 16, he outlined plans to transform the SEC into an innovation hub and offer startups limited exemptions to test blockchain products without facing immediate enforcement.

Moments ago: Paul Atkins (Chair of SEC) says crypto's time has come.

— MartyParty (@martypartymusic)

Atkins also praised Asia’s superapps that blend payments, trading, and banking, arguing the US needs similar integration and coordination between the SEC and CFTC. The message was clear: bring capital home.

EXPLORE:

The post appeared first on .