Tom Lee and his Ethereum bet is back in the headlines this time on reports of a fresh $281 million buy that has crypto traders asking what he sees next for ETH.

Tom Lee’s BitMine Immersion bought 72,898 ether, worth about $281 million, within the last 24 hours.

BREAKING:

Tom Lee's Bitmine Immersion just bought $281 million worth of Ethereum.

— Ash Crypto (@Ashcryptoreal)

BitMine’s Ethereum holdings have risen to 3.03 million ETH, about 2.5% of the total circulating supply, after adding roughly 202,000 tokens since Oct. 6.

BitMine provided its latest holdings update for Oct 13, 2025:

$12.9 billion in total crypto + "moonshots":

– 3,032,188 ETH at $4,154 per ETH (Bloomberg)

– 192 Bitcoin (BTC)

– $135 million stake in Eightco Holdings (NASDAQ: ORBS) (“moonshots”) and

– unencumbered…— Bitmine (NYSE-BMNR) $ETH (@BitMNR)

Analysts noted there are no visible transaction hashes, wallet addresses, or regulatory filings to verify the purchase. BitMine has not commented publicly on the claim.

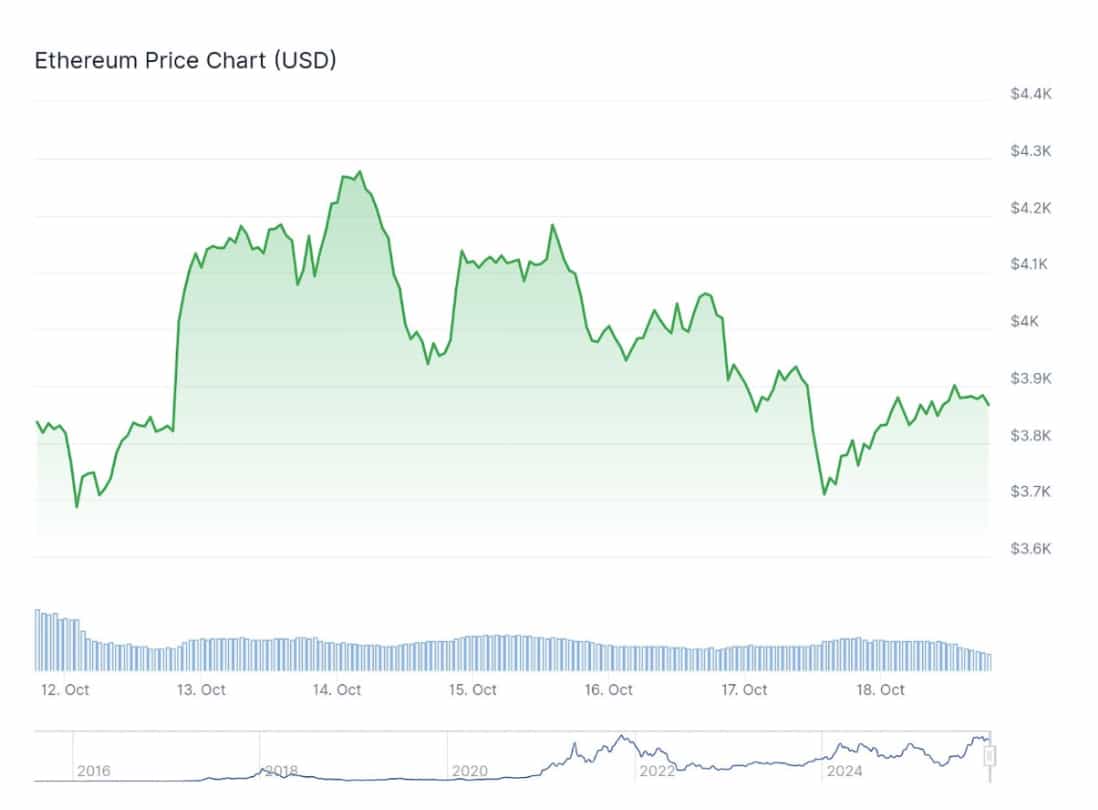

According to Ether traded around $3,830 to $3,870 on Friday, posting slight daily gains of +0.8% yet still below its early-October highs.

(Source: )

The token remains under pressure after last week’s sharp correction, when the Oct. 10–11 liquidation wave, the largest in crypto’s history, briefly pushed prices into the mid-$3,400s.

Market observers say investors such as Lee appear to be accumulating during weakness, wagering that Ethereum’s long-term fundamentals will outweigh short-term swings.

DISCOVER:

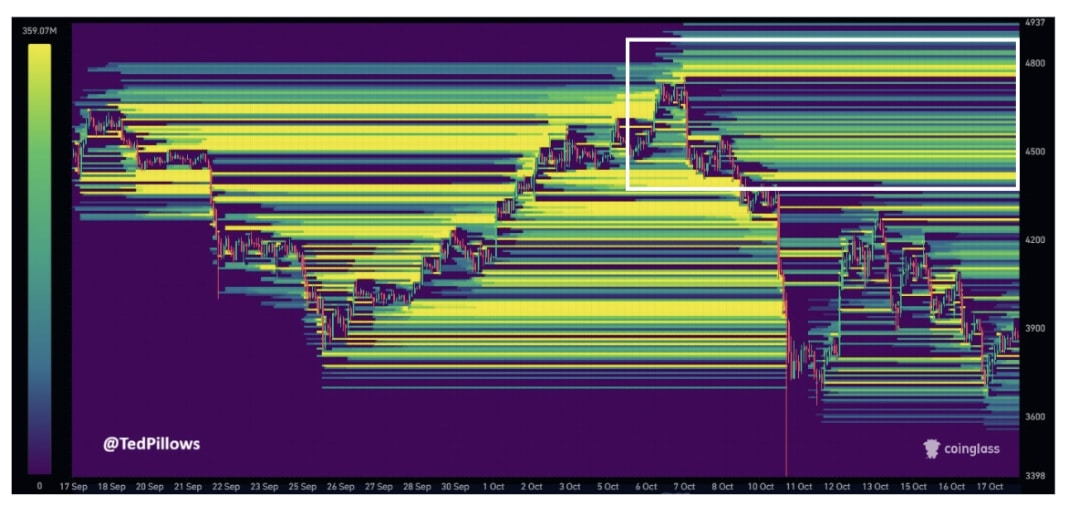

Crypto analyst Ted Ethereum’s next move depends on how it reacts to a large liquidity cluster between $4,400 and $4,800.

There is a massive liquidity cluster for around the $4,400-$4,800 level.

If the US-China trade deal happens, Ethereum could tap this liquidity reason.

Otherwise, it'll drop towards the $3,200-$3,400 level before reversal.

— Ted (@TedPillows)

The chart shows heavy sell orders stacked in that range, a sign that many traders are preparing to exit or short near those levels.

(Source)

Ethereum’s rebound from below $3,600 lost strength around the mid-$4,000 zone. The chart shows a possible double top forming near $4,600, followed by a pullback.

On the downside, new liquidity has started to build around $3,200-$3,400, pointing to strong buying interest if prices fall again.

Ted said that if a US-China trade deal goes through, Ethereum could reach the upper band near $4,800 as shorts start closing.

But if market sentiment weakens, ETH may slip back toward lower support before finding a base.

Right now, Ethereum sits between two major liquidity zones, one above, one belo,w and whichever breaks first could set the tone for the next big move.

DISCOVER:

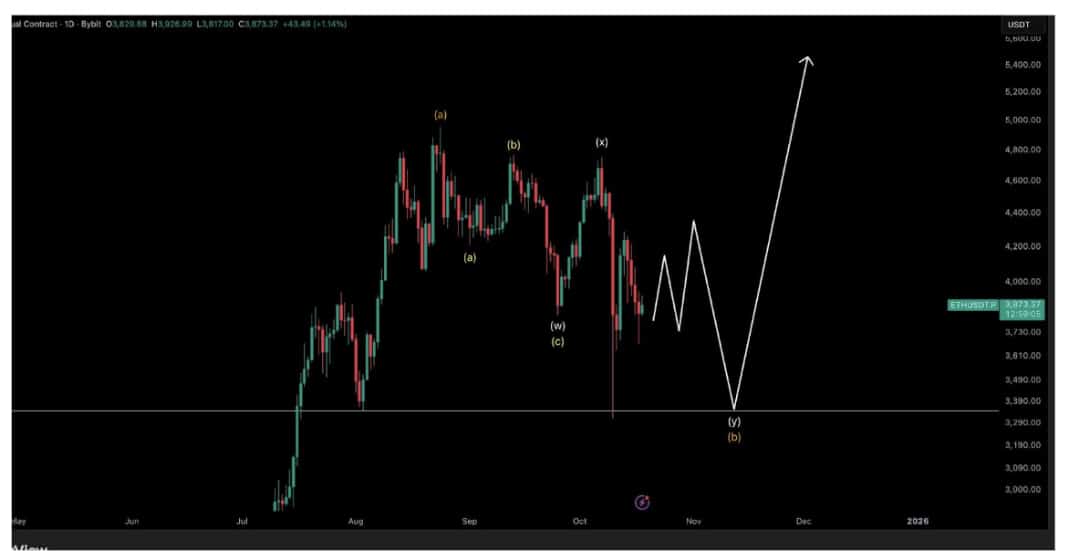

Crypto analyst Crypto Tony a cautious but hopeful view on Ethereum (ETH) in his latest market update on X.

/ – Update

This is what i am looking for on Ethereum as best case scenario. Another test of the lows and double bottom. From the highs we are seeing a corrective move instead

The macro outlook tells me we are in the middle of a corrective macro move.

— Crypto Tony (@CryptoTony__)

His chart shows that ETH is likely in a corrective phase, not a full trend reversal.

According to his Elliott Wave analysis, Ethereum is moving within a W–X–Y corrective structure, often seen before a recovery phase.

(Source)

The coin is currently trading near $3,870, and Tony expects another test of the $3,300–$3,400 range, a zone that could mark the formation of a double bottom, a classic signal of seller exhaustion and potential reversal.

He noted that this projected wave (b) low fits within the ongoing correction, hinting at one final dip before a rebound.

His chart outlines a potential move toward $5,000 by late Q4 2025 or early 2026 once Ethereum builds a base at lower levels.

The analyst added that the broader structure remains “corrective but stable,” suggesting that the recent weakness may be part of a larger bullish cycle still intact.

If buyers return around support, he believes ETH could soon shift back into recovery mode.

DISCOVER:

The post appeared first on .