When crypto prices are unusually volatile and falling, two things can happen: Either you cave in and lose, or you HODL and win. The choices are binary. Being a weak hand may sometimes look safe, but crypto has its lessons. When Ethereum prices, for instance, flash crash, the drawdown tends to flush out speculators, and the diamond hands scoop up ETH crypto at low prices.

It has happened before, and happened last week, and, as long as long ETH USDT is a tradable asset, it sure will print out in the future. In 2017, ETH crypto ballooned to $1,400 before collapsing below $80. A few years later, in 2021, it rallied to over $4,900 before dipping below $1,000 in 2022. Last week, there was a deleveraging event that wiped out gains from mid-September. ETH USDT flash-crashed from $4,400 to as low as $3,500, in minutes, before recovering.

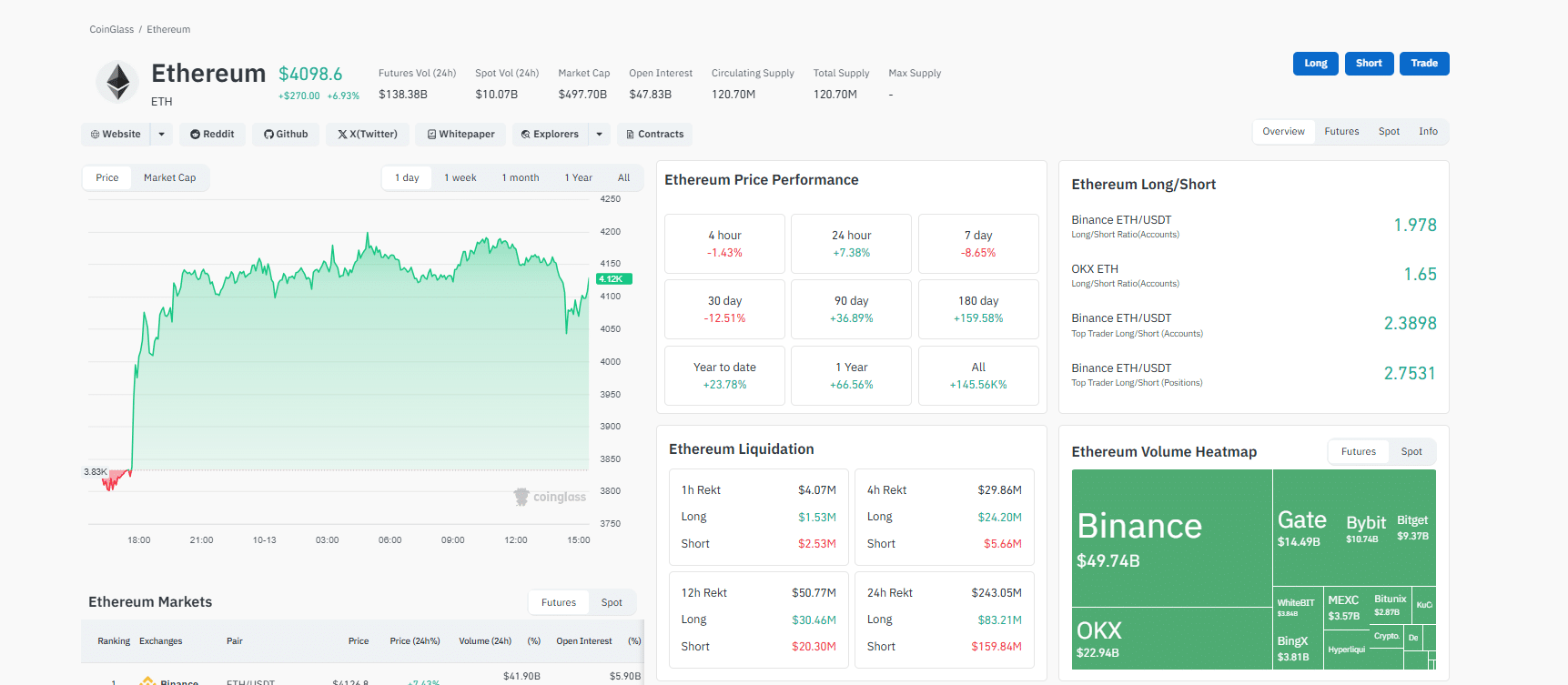

On Coinglass, ETH USDT is pushing higher, quite impressively. It is trading above $4,000, and the long/short ratio stands above two in Binance. Tables are also quickly shifting: shorts, not longs, are getting liquidated. In the past 24 hours, over $159M of ETH USDT shorts were forcefully closed across major perpetual exchanges, mostly Binance and OKX.

(Source: )

DISCOVER:

The rapid shift is unexpected. If the sellers of October 9 were genuine, there could have been a spillover over the weekend, forcing ETH USDT towards $3,000. Instead, ETH crypto is funding support above September lows and firm above $4,000.

Notably, ETH crypto bulls have reversed over +60% of October 9 losses and are . A complete reversal may be the solid foundation for a close above $4,800 and $5,000 in a refreshing buy trend continuation formation.

On X, the recovery of Ethereum over the weekend is why investors are confident. In a post, one said that if ETH USDT reclaims $4,250, buyers will be back in control.

has reclaimed the $4,060 support level.

Right now, Ethereum is having a V-shaped recovery, which is a good sign.

The next level to reclaim is $4,250 and then bulls will be in control.

— Ted (@TedPillows)

Another noted that the V-shaped recovery is shaking off sellers. Looking at the candlestick formation, he is convinced buyers are accumulating and preparing for the .

is shaking off the sellers. This setup looks like a continuation pattern before the next leg up. HODL tight.

— 𝐊𝐚𝐦𝐫𝐚𝐧 𝐀𝐬𝐠𝐡𝐚𝐫 (@Karman_1s)

DISCOVER:

Should ETH crypto tick higher, clearing $4,250 and $4,800, that price action will translate to tidy profits for one whale.

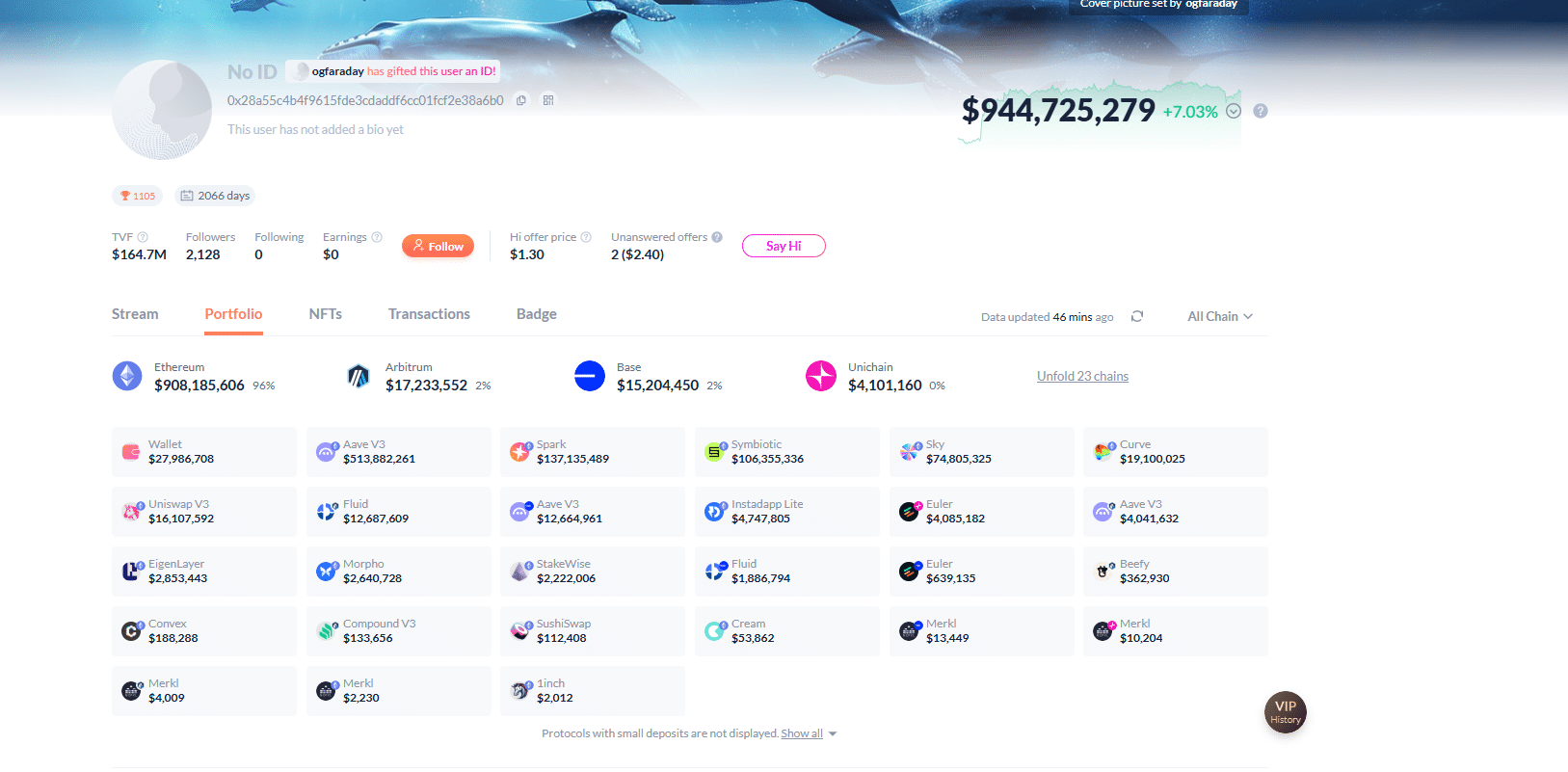

Records showed that though the sell-off on October 9 forced investors to de-risk, Seven Sisters, who are known ETH DeFi whales, aggressively bought the dip.

On Aave, they borrowed $40M USDC and bought more ETH. Their purchase is noteworthy.

The Seven Sisters are known for buying ETH, especially when there are sharp market downturns. What’s more? Analysts have noted that this group of whales often time market bottoms. Over the years, they have repeatedly bought the bottom, using Aave to amplify their positions.

While most are derisking today, the defi megawhale Seven Sisters borrowed 40m USDC on AAVE and kept buying more ETH.

— Cryptoyieldinfo (@Cryptoyieldinfo)

From late February to March 2025, this entity bought over 12,000 ETH when ETH USDT slid to as low as $2,382. Later, in April 2025, they added another $24,817 ETH when ETH USDT slid to $1,700. On October 9, when ETH dumped again, they bought some more.

When writing, Seven Sisters currently holds over $944M of various Ethereum tokens, cumulatively up +7% in the past 24 hours.

(Source: )

DISCOVER:

The post appeared first on .