Bitcoin and the general crypto market have witnessed another , with prices falling by double digits in the late hours of Friday, October 10. This bearish pressure started when rumors of a trade war between the United States and China emerged in the early hours of Friday.

The downward pressure intensified after US President Donald Trump declared that the US would impose a 100% tariff on Chinese goods. As a result of this announcement, over $5.5 billion was liquidated from the crypto market in less than an hour, with the Bitcoin price briefly falling to as low as $101,500.

In a recent post on X, on-chain analyst Maartunn a specific Satoshi-era Bitcoin investor who might have expected this downturn way before it happened. A look at the trader’s market moves suggests that the large BTC holder almost always knows something the market doesn’t.

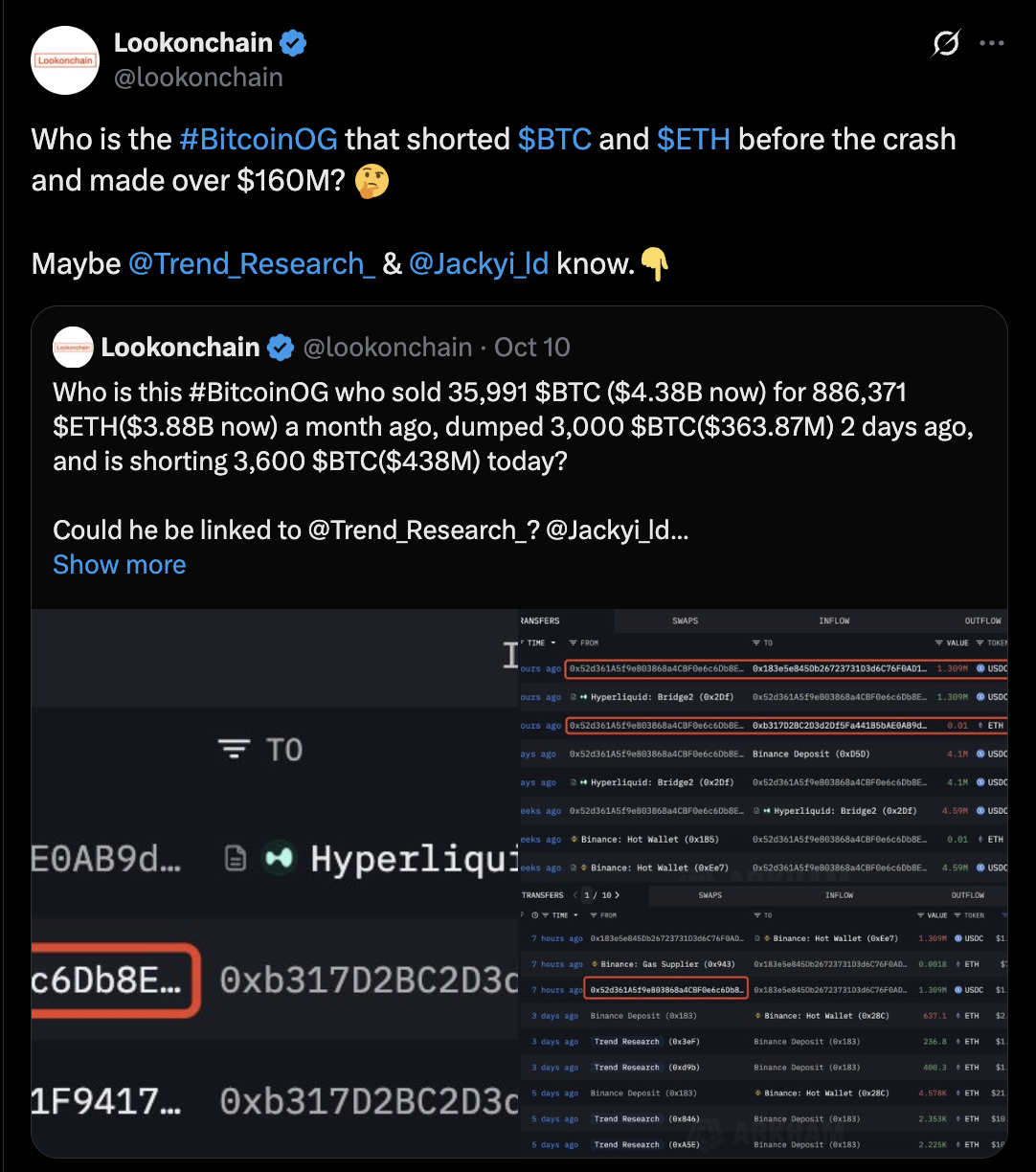

While the price of Bitcoin steadily dropped towards $117,00 during the day, blockchain analytics platform Lookonchain revealed that this Bitcoin OG kept piling up their short positions up to $1.1 billion. Following the BTC crash below $110,000, this large investor made a profit of over $160 million, leading to speculations about them having insider information.

Maartunn went further to highlight the large holder’s activities in the past few months. According to the analyst’s post on the social media platform X, this Bitcoin OG started selling part of their 86,000 Satoshi-era BTC stash when prices peaked around August 2025.

Similarly, the BTC whale took to shaving off their holdings again when the Bitcoin price ran up to new highs in early October. What’s more interesting is that the Satoshi-era investor soon opened leveraged short positions on both Bitcoin and Ethereum on the Hyperliquid platform.

Maartunn thought that the timing of these trades might be interesting, especially as the general crypto market due to President Trump’s tariff announcement. The on-chain analyst then concluded that the “Satoshi-era OG have insider ties to the US government.”

As of this writing, the price of BTC stands at around $113,250, recovering swiftly from the plunge to around $101,500. However, the premier cryptocurrency is still down by nearly 7% in the past 24 hours.