The crypto market on November 12, 2025, shows signs of steady recovery after a turbulent session. Following brief pumps in MELANIA and TRUMP tokens, other meme coins are now surging: are traders looking for the best memecoin to buy? has climbed back to $104,524.74, marking a 0.52% gain over the past 24 hours and 2.54% over the week after a brief dip around $103K.

Expecting 102K to hold and start reversal

— Giant Bull (@Giant_Bull12)

This rebound comes after over $336 million in long positions were liquidated in the prior 24 hours, with derivatives open interest falling 15% as traders dialed back leverage.

A potential breach of $103K could still unleash another $500 million-plus liquidation wave, so traders remain cautious. Broader trends reflect mixed signals: has introduced stablecoin regulations requiring issuers to hold 40% reserves in non-interest-bearing accounts by 2026, enhancing stability but possibly curbing yields and institutional uptake in pound-pegged assets.

Spot ETF flows offer a brighter note. Bitcoin ETFs drew $524 million in net inflows, led by BlackRock’s IBIT at $224 million and Fidelity’s FBTC at $166 million, pushing total assets under management to $137.83 billion—6.67% of BTC’s market cap.

ETFs, however, faced $107.1 million in outflows, mainly from Grayscale’s ETHE (-$75.7M), underscoring softer sentiment for ETH at $3,485.40 (up 2.29%).

Top performers include Solana (SOL) at $158.16 (+3.57%) and XRP at $2.41 (+1.55%), while Dogecoin (DOGE) edges up 1.66% to $0.1748.

EXPLORE:

on Solana leads at $0.1675, up 15.37% daily and 31.28% weekly, driven by its status as a cat-themed benchmark since its 2024 all-time high of $2.07. Strong holder growth, projected at 25-40% for 2025, and listings on platforms like Coinbase and Robinhood have sustained demand, positioning POPCAT as a retail favorite cat meme coins. Could this momentum help POPCAT reclaim its old ATH?

Ribbita by Virtuals follows closely at $0.3841 (+12.93% daily, 27.88% weekly), surging 33% to a $400 million market cap after Robinhood CEO Vlad Tenev replied “bring it on” to an eight-month-old project post.

This interaction, alongside digital artist Beeple’s repeated inclusion of TIBBIR motifs and ties to Ribbit Capital founder Micky Malka, has sparked a feedback loop of accumulation.

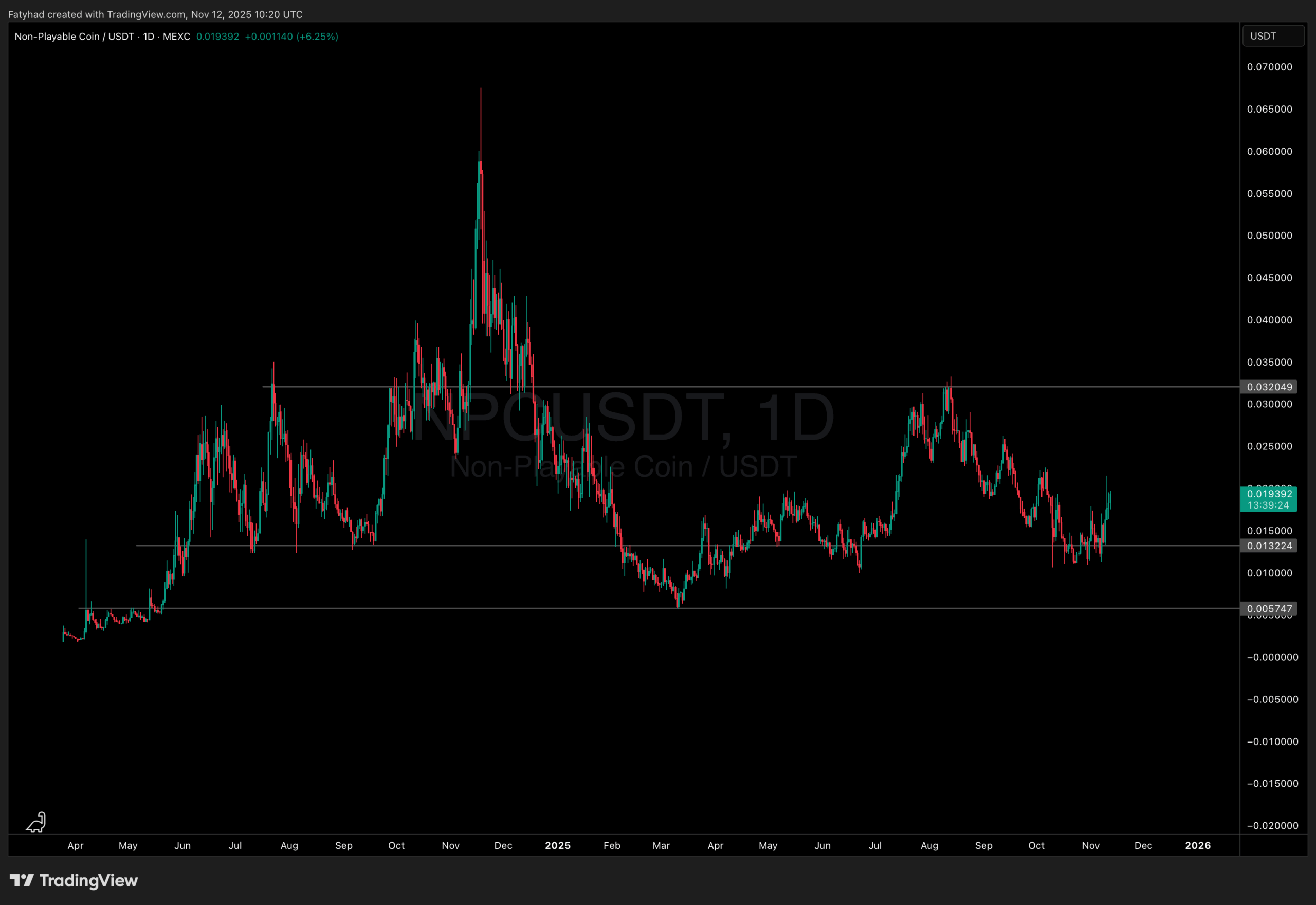

Non-Playable Coin rounds out the trio at $0.01926 (+10.43% daily, 42.56% weekly), blending meme fungible tokens with NFT utility on Ethereum and Base. Its supply mirrors the global population (8+ billion), enabling 1:1 NFT conversions, which has driven a 36% 24-hour spike amid rising trading volume over $14 million. It recently flipped POPCAT and MOG in rankings.

(Source: )

With BTC stabilizing, these movers signal altcoin potential, but volatility persists—research thoroughly before diving in.

Coinbase has unveiled Coinbase Business in Singapore, marking its first international expansion beyond the U.S. The platform enables local startups and SMEs to trade crypto and process payments, backed by a partnership with Standard Chartered for real-time SGD transfers. Businesses can instantly settle in stablecoins like USDC and XSGD, cutting transaction costs and chargebacks. Early access is open to Singapore-based firms. The launch follows Coinbase’s participation in Singapore’s MAS BLOOM Initiative for digital asset settlement. Could Nano be the next 1000x crypto investors are searching for? The question has resurfaced as XNO Crypto rallies 23% in 24 hours, outperforming most of the market and reigniting the classic “dino-coin comeback” narrative. With XNO price breaking significant resistance and social media booming about its potential as “AI-powered robot money”. Many traders are wondering if the long-forgotten Nano Crypto can pull off one of the most significant revivals of the year, mainly because projects like Metis and Fasttoken are gaining momentum. More and more traditional finance (TradFi) institutions are integrating blockchain in their operations. Chief among them is JPMorgan, which has launched its own digital token, the JPM Coin, on Base (a public blockchain developed by Coinbase). According to a Bloomberg published on 12 November 2025, JPM Coin’s launch on Base marks the first major instance where traditional banks have begun to use public blockchains in earnest for real-world money transfers. With this launch, institutional clients can send and receive USD payments instantly, any time of the day, and without having to wait for regular banking hours to start. JPMORGAN just launched its on-chain deposit token ( Coin) for institutional clients, marking a major shift from trad-fi to real blockchain rails. When the biggest bank goes on-chain… you know what's next! — Wise Advice (@wiseadvicesumit) The coin itself is backed by actual deposits at JPMorgan, making it a secure and regulated way to settle transactions on-chain. Right now, only verified institutions can use JPM Coin on Base. But the banking giant hopes to eventually offer access to its clients, depending on regulatory approval. The token can also be used as collateral on Coinbase. This launch builds on JPMorgan’s earlier pilot programs with Mastercard, Coinbase, and B2C2 and follows a it shared earlier in June 2025. EXPLORE:

Coinbase Launches Coinbase Business in Singapore

Is XNO the Next 1000X Crypto? NANO Crypto Pumps +29% as MET and FTN Price Chase

Market Cap

JPMorgan Launches JPM Coin On Base For Scalable Institutional Payments

BREAKING:

BREAKING:

The post appeared first on .